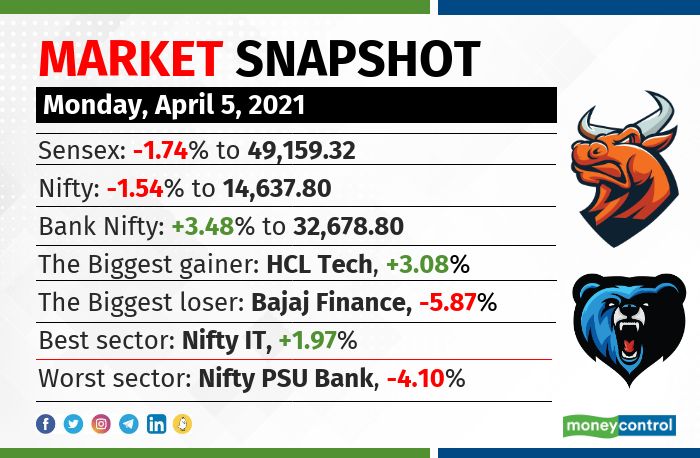

Benchmark indices started the week on a negative note dropping over 1 percent on April 5 amid concern over rising COVID-19 cases in the country. At close, the Sensex was down 870.51 points or 1.74% at 49,159.32, and the Nifty was down 229.60 points or 1.54% at 14,637.80.

“The market witnessed a huge sell-off today as India’s second wave of COVID-19 is getting bigger than anticipated and is expected to ruin the pace of economic recovery. High valuation further added concerns due to a possible downgrade in Q1FY22 earnings. Barring IT, metal and telecom, all sectors remained in the red,” said Vinod Nair, Head of Research at Geojit Financial Services.

“A policy decision in the upcoming MPC announcement and Q4 earnings will define the market volatility in the coming days,” said Nair.

The market capitalisation of BSE Sensex companies plunged by Rs 2,13,688.34 crore to Rs 2,05,12,713.45 crore on April 5 from Rs 2,07,26,401.79 crore on April 1.

On the sectoral front, Nifty PSU Bank index slipped 4 percent, Nifty Bank index shed over 3 percent and auto index declined more than 2 percent. However, IT index gained 2 percent.

Broader indices, BSE Midcap and Smallcap, shed over a percent each.

Bajaj Finance, IndusInd Bank, SBI, Eicher Motors and M&M were among major losers on the Nifty, while gainers were HCL Technologies, TCS, Britannia Industries, Wipro and Infosys.

Stocks & sectors

Except metal and healthcare, all other sectoral indices ended in the red. BSE Realty and Bank index shed 3 percent each and auto index slipped 2.6 percent.

Among individual stocks, a volume spike of more than 100 percent was seen in United Breweries, Marico and PVR.

Long buildup was seen in the Larsen & Toubro Infotech, Dr Lal PathLabs and Shree Cements while a short buildup was seen in Eicher Motor, PVR and Bajaj Finance.

More than 150 stocks, including JSPL, Infosys, Vedanta, Ambuja Cements, Birla Corporation, hit a fresh 52-week high on the BSE.

Technical View

The Nifty negated its higher lows formation of the last four trading sessions and formed a bearish candle with long lower shadow indicating overall weakness but some support based buying seen in sharp declines.

“Nifty has to cross and hold above 14,700 zones to witness an up move towards 14,850 and 15,000 zones, while on the downside support exists at 14,450 and 14,300 levels,” said Chandan Taparia of Motilal Oswal Financial Services.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.