Women are arguably pros at managing finances and budgets yet when it comes to personal finance or investing, there is a certain mounted hesitation. The trick to overcome this hurdle is to start slowly and bear a few things in mind as you go along.

As a beginner, you must start investing with an asset-allocation strategy. This means not putting all your eggs in one basket and thereby diversifying your portfolio as well as the risk.

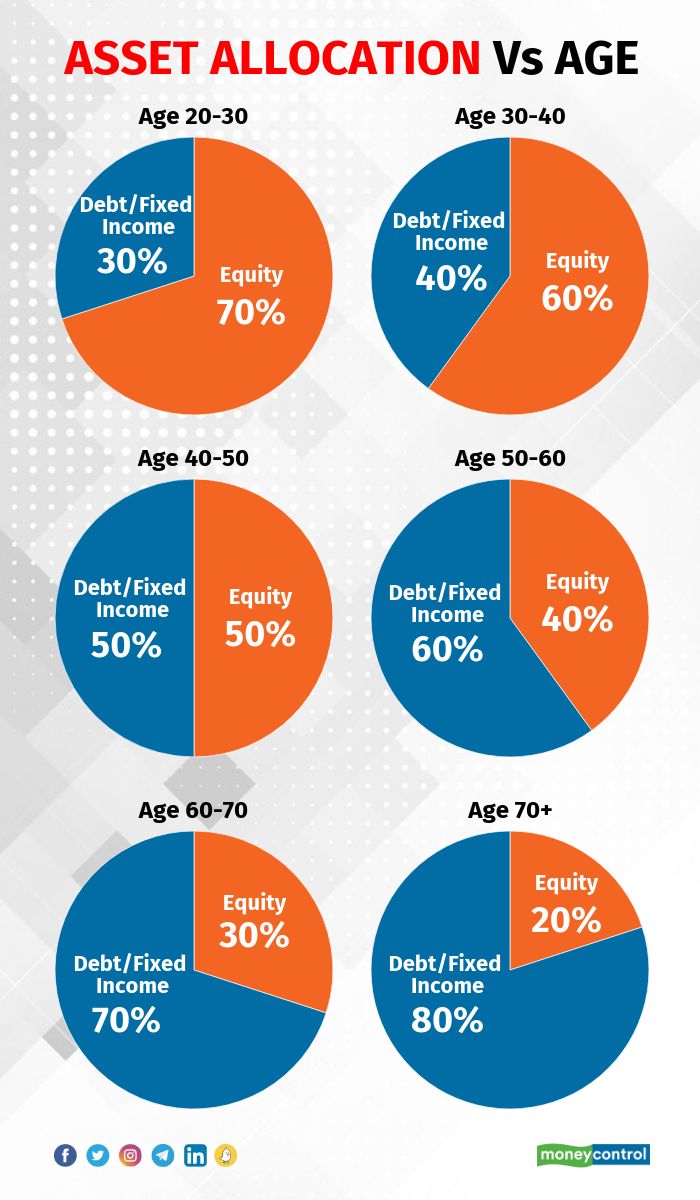

Age-wise asset allocation for portfolios is advisable. It means your allocation to debt funds must be equal to your age. To find your equity allocation, subtract your current age from 100.

As you grow older, your asset allocation needs to move from equity funds to debt funds. Your portfolio should consist of 10-15 percent of gold as well.

Another crucial factor that affects investment is inflation. Debt instruments provide an interest rate of 5-8 percent in today’s time, whereas the rate of inflation is at more than 7 percent.

With the rising rate of inflation and decreasing rate of interest, you will find it difficult to beat inflation through investment in debt securities. Hence, you need to switch to equity instruments where you can fetch a return of more than 16.

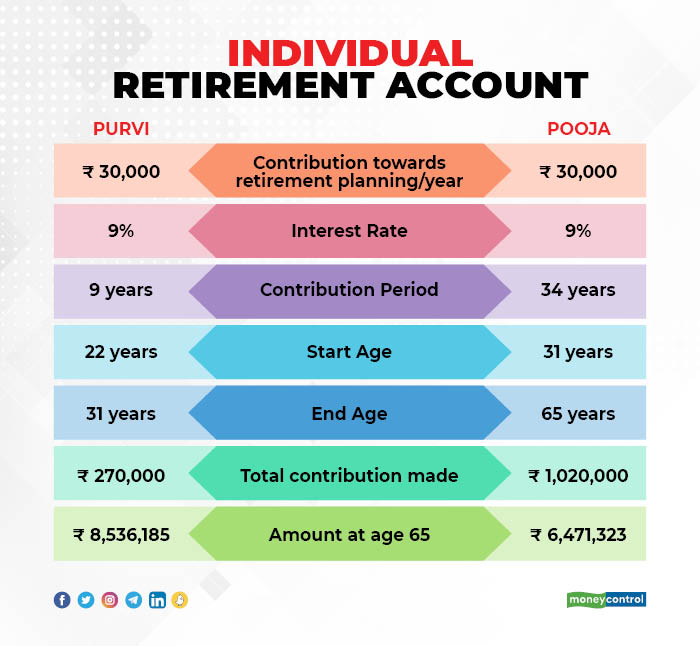

Next comes building an emergency fund and creating a retirement fund. The reason I say this in the same sentence is that these funds act as your financial backup.

An emergency fund is the total of your six months’ pay that you can fall back on in case of a financial crisis, whereas your retirement fund is something you build over a period of time.

The thing you can’t mess with is your taxes. In a lot of ways, tax planning and family planning are similar. If not accounted well, you’re in for a nasty surprise. Staying on top of your tax planning as per new guidelines is extremely important. Use the following pointers to plan your tax-saving for the year:

• Check the tax-saving expenses you already have—like insurance premiums, children’s tuition fees, EPF contribution, home loan repayment etc.

• Deduct this amount from Rs 1.5 lakh to figure out how much to invest. You needn’t invest the entire amount if expenses are covering the limit.

• Choose tax-saving investments based on your goals and risk profile. ELSS funds, PPF, NPS and fixed deposits are some of the popular options.

Payments made towards health insurance premiums receive tax benefits too. This means you must buy adequate health insurance for yourself. Women particularly are either not insured or are severely underinsured.

The oft-quoted figure for healthcare inflation in India is 15 percent a year compared to the overall inflation of 6-7 percent in the past few years. Don’t rely on insurance covers provided by your employer or policies that cover you as a dependent of your spouse.

Always get individual health insurance for yourself and your family members.

The world keeps changing every day and to stay on top of it, you have to constantly educate yourself with newer investment instruments and laws that apply to investing.

When it comes to investing. remember that you have multiple options and you can explore newer investment options like SGBs (sovereign gold bonds) or REITs (Real Estate Investment Trust). The possibilities are endless once you overcome the mental block that screams women can’t invest!

(The author is Founder of LXME, and MD & Promoter at Anand Rathi Share and Stock Brokers Ltd)

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.