With passage of the American Rescue Plan Act (ARPA), much of the $ 6 trillion in relief over the past year was directed to the unemployed in unemployment insurance (UI) benefits and to low- and moderate-income households in stimulus payments and child tax credits (CTC).

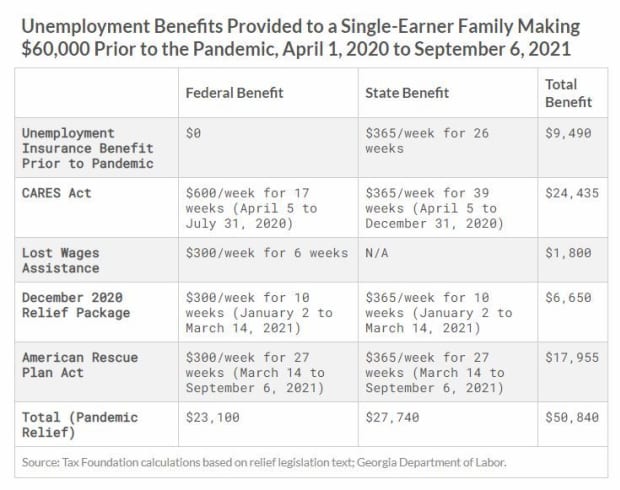

The unemployment insurance benefits paired existing state-level weekly aid with a federal payment ranging from $ 600 a week under the CARES Act to $ 300 per week under the American Rescue Plan Act. The aid was also extended to workers who usually do not qualify for unemployment benefits, including gig economy workers and independent contractors. Unemployed workers could continue to claim unemployment insurance benefits past the usual 26-week window during the pandemic.

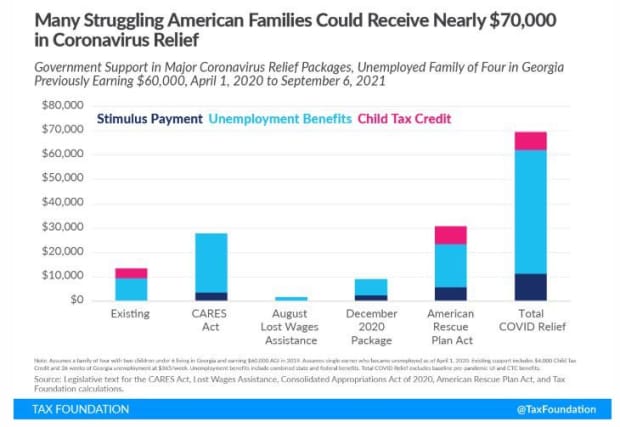

Take, for example, a married household with two young children living in Georgia with a single earner who made $ 60,000 in 2019. Imagine the single earner lost her job on April 1, 2020 due to the coronavirus pandemic.

Prior to the pandemic, the family would have been eligible for $ 365 per week from the state of Georgia in unemployment benefits up to 26 weeks and $ 4,000 in Child Tax Credit, for a total of $ 13,490.

During the pandemic, that family will have received $ 50,840 in federal and state unemployment benefits from April 1, 2020 to Sept. 6, 2021, plus $ 11,400 in stimulus payments, plus $ 7,200 in Child Tax Credit, totaling $ 69,440 in combined COVID-19 relief benefits.

The unemployment insurance benefits calculated include the combined state and federal benefits provided by the CARES Act; the six weeks of Lost Wages Assistance totaling $ 300 per week provided by the Federal Emergency Management Association (FEMA) in August 2020; state and federal benefits under the December relief deal; and additional unemployment insurance benefits provided under the American Rescue Plan Act, which expires on Sept. 6, 2021.

The American Rescue Plan Act provided an expanded Child Tax Credit, which, for this family, would be worth $ 3,600 for each child or $ 7,200 total in the 2021 tax year compared to $ 4,000 provided under current law.

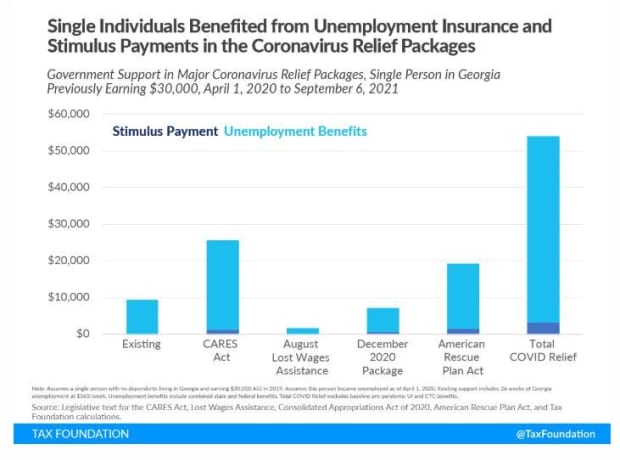

Some households may have received upward of $ 100,000 in combined benefits in states with more generous base unemployment insurance payments, such as Massachusetts. Single individuals also received generous benefits over the past year—an unemployed single person previously earning $ 30,000 in Georgia would be eligible for about $ 54,000 in relief from April 2020 to September 2021.

The two examples only examine three major sources of pandemic aid for households. The U.S. relief response went further by providing distressed businesses with forgivable loans to retain workers on payroll and cover fixed expenses, business tax relief for small businesses, and hundreds of billions of dollars in support for state and local governments.

The next task for policy makers is deciding how to phase out pandemic relief when the public health situation hopefully improves later this year and the economy reopens more fully.

The American Rescue Plan Act was a big bet that generous support will not slow the labor market recovery by disincentivizing work, and appropriate phaseouts for unemployment insurance must be kept to ensure that effective relief can be balanced with a successful rebound for the American economy.

Garrett Watson is a senior policy analyst at the Tax Foundation, a tax policy research organization in Washington, D.C. Follow him on Twitter @GS_Watson. This was first published by the Tax Foundation — “U.S. COVID-19 Relief Provided More Than $ 60,000 in Benefits to Many Unemployed Families“.