Anupam Rasayan, a specialty chemicals company, opens its initial public offering (IPO) for subscription on March 12. This will be the eleventh public offer of 2021 after Indian Railway Finance Corporation, Indigo Paints, Home First Finance Company, Stove Kraft, Brookfield India REIT, Nureca, RailTel Corporation, Heranba Industries, MTAR Technologies and Easy Trip Planners.

Axis Capital, Ambit, IIFL Securities and JM Financial are the lead managers to the issue. Equity shares will list on the BSE as well as NSE.

Here are 10 key things to know before subscribing public issue:

1) IPO Dates

The maiden public offer of Anupam Rasayan will open for bidding on March 12 and the closing date will be March 16.

2) Public offer

The Rs 760-crore public offer comprises a complete fresh issue of equity shares by the company. The company has already garnered Rs 225 crore from anchor investors on March 10.

Investors can bid for a minimum of 27 equity shares and in multiples of 27 thereafter, resulting in a minimum investment of Rs 14,985 at a higher price band.

3) Price Band

The price band for the offer has been fixed at Rs 553-555 per equity share.

4) Objective of the issue

The company will utilise net fresh issue proceeds for repayment of debt and for general corporate purposes.

5) Profile

Anupam Rasayan is one of the leading companies engaged in the custom synthesis and manufacturing of specialty chemicals in India, says the F&S report. Incorporated in 1984, it has two distinct business verticals—life sciences-related specialty chemicals used in agrochemicals, personal care and pharmaceuticals, and specialty pigment and dyes and polymer additives.

In FY20 and in the nine months ended December 2020, its life-sciences vertical accounted for 95.37 percent and 93.75 percent, respectively, of revenue from operations. Revenue from other specialty chemicals contributed 4.63 percent and 6.25 percent, respectively, during the periods.

The company has developed strong and long-term relationships with various multinational corporations, including, Syngenta Asia Pacific Pte Ltd, Sumitomo Chemical Company and UPL which helped the company expand product offerings and geographic reach across Europe, Japan, United States and India.

Also read: Kalyan Jewellers India IPO to open for bidding on March 16, price band fixed at Rs 86-87

As of December 2020, Anupam Rasayan operated six multi-purpose manufacturing facilities in Gujarat, India, having an installed capacity of 23,438 MT.

According to the F&S Report, India’s specialty chemicals industry is expected to grow at a CAGR of approximately 10-11 percent over the next five years on rising demand from end-user industries, along with tight global supply on account of stringent environmental norms in China.

6) Strengths

a) The company has strong and long-term relationships with diversified customers across geographies with significant entry barriers.

b) Its focus on process innovation through continuous R&D and value engineering has been instrumental in the growth of its business and improved its ability to customize products for customers as well as reduced cost of goods while maintaining margins.

c) It has a diversified and customised product portfolio with a strong supply chain.

d) Its manufacturing facilities are highly automated with a strong focus on the environment, sustainability, health and safety measures.

e) The company has shown consistent growth in revenue and profitability.

f) It has experienced promoters and a strong management team.

7) Strategies

a) The company intends to continue to focus on custom synthesis and manufacturing by developing innovative processes and value engineering.

b) The company plans to expand business by capitalising on industry opportunities and organic and inorganic growth.

c) It intends to continue to focus on the ability to customise products according to the specific requirements of customers and broaden portfolio through innovation, focus on sustainable solutions, undertake new chemistries and perform multi-step synthesis of niche products.

d) It intends to continue to focus on cost efficiency and improving productivity.

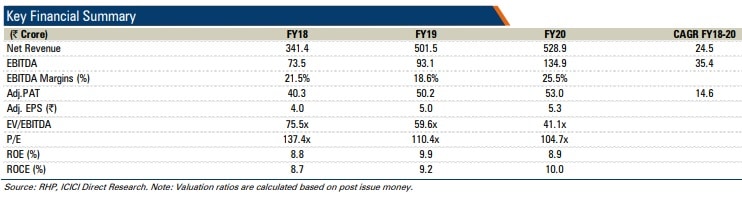

8) Financials

Anupam Rasayan’s revenue from operations has increased at a CAGR of 24.29 percent from Rs 349.18 crore in FY18 to Rs 539.4 crore in FY20. The value of exports has grown at a CAGR of 32.94 percent from Rs 203.66 crore in FY18 to Rs 359.92 crore in FY20.

The company has been able to continue with robust growth despite the impact of the COVID-19 pandemic and the nationwide lockdown. Its revenue from operations increased by 45.03 percent from Rs 371.8 crore in the nine months ended December 2019 to Rs 539.22 crore in the nine months ended December 2020. In addition, the value of exports increased by 27.87 percent from Rs 258.8 crore to Rs 330.95 crore in same period.

9) Promoters and Management

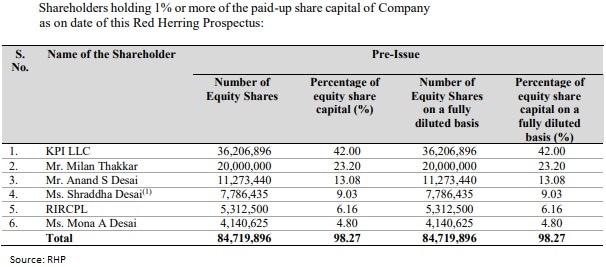

Anand S Desai, Kiran C Patel, Mona A Desai, KPI LLC and RIRCPL are the promoters and held 5,69,33,461 equity shares constituting 66.04 percent of the paid-up equity as of March 5.

Promoters and promoter group’s shareholding in the company will be reduced to 65.4 percent post public issue, from 75.8 percent.

Kiran C Patel is the chairman and non-executive director of the company. He is also a promoter director on the boards of Rudraksh Academy and Solace Healthcare.

Mona A Desai is the vice-chairperson and a whole-time director of the company. She has over 18 years of experience in chemicals industry and is involved in day-to-day running of the company.

Anand S Desai is the compnay’s managing director. He has over 28 years of experience in the chemicals industry.

Milan Thakkar is the non-executive director, while Hetul Krishnakant Mehta, Namrata Dharmendra Jariwala, Vijay Kumar Batra and Vinesh Prabhakar Sadekar are independent directors.

Chief financial officer Afzal Malkani is a trained chartered accountant from the Institute of Chartered Accountants of India. He joined the company in October 2005 and was appointed as CFO in December 2014.

10) Allotment, refunds and listing dates

The company and selling shareholders in consultation with merchant bankers will finalise the IPO share allotment around March 19 and unblock funds from ASBA account around March 22.

The shares will get credited to the demat accounts of eligible investors around March 23 and the stock will get listed on bourses around March 24.