It was a year ago Wednesday that the stock market’s COVID-19 meltdown began, triggering a slide that took equities into a bear market that bottomed out roughly a month later.

The chaos wasn’t confined to stocks. The Treasury market nearly seized up, prompting extraordinary responses from the Federal Reserve and other central banks. A soon-to-expire oil futures contract in April traded, and closed, in negative territory for the first time ever, while investors sought out havens and dumped assets perceived as risky.

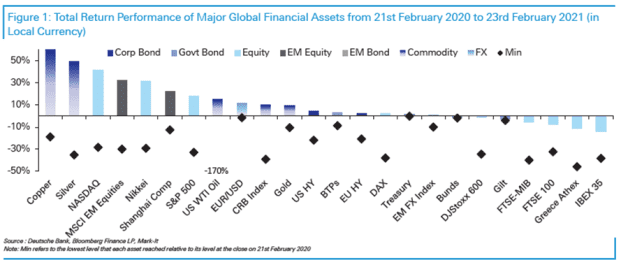

Stocks have since roared back from their March 23 bottom to push into record territory. Analysts at Deutsche Bank broke down the performance by major global financial assets from Feb. 21 through Tuesday. The chart below ranks them by performance, while also showing their maximum drawdown over the past year:

Deutsche Bank

While stocks have roared back, led by the tech- and tech-oriented shares that have benefited most from the pandemic’s stay-at-home dynamic, the leaders when it comes to total return are a pair of metals — copper HG00, +2.97% and silver SI00, +0.77% — benefiting from expectations for economic recovery.

It’s worth noting, though, that two assets that weren’t included in the list of “major” global financial assets have put in an even stronger performance. Bitcoin BTCUSD, +3.15% was up 395.8% over the 12-month period, while the NYSE FAANG+ index of large-cap tech stocks rose 85.8%, noted Deutsche Bank macro strategist Jim Reid, in a note.

Monday, Feb. 24, 2020, saw a major global correction as the number of Italian COVID-19 cases jumped over the weekend from single figures to 220, Reid recalled.

“Had you been told 12 months ago that we would now have around 113 million recorded cases and 2.5 million recorded deaths (both likely understated) with much of the world under lockdown conditions for most of the year, I suspect you would have found it tough to comprehend the course of markets,” he said.

At the same time, the Fed and the European Central Bank alone have added around $ 6 trillion to their balance sheets over the past year, while governments have provided trillions in fiscal injections, with more yet to come from Washington, he noted.

Economists, meanwhile, appear to be in a race to jack up their 2021 forecasts for economic growth.

Stocks and commodities were in rally mode Wednesday, with equities largely shaking off a recent round of wobbles tied to rising bond yields as expectations for growth and inflation have increased.

The Dow Jones Industrial Average DJIA, +1.34% was up over 400 points, or 1.3%, after hitting an intraday record, while the S&P 500 SPX, +1.04% rallied 1% and the Nasdaq Composite COMP, +0.67% gained 0.5%, at last check Wednesday afternoon.