The Indian equity market saw a pull-back in the third week of February. The Nifty and the Bank Nifty touched their all-time highs of 15,439 and 37,770 only to see profit-booking from the high level.

The Nifty gyrated in the 15,430-14,900 band and ended the week with a marginal loss of 1 percent. Meanwhile, Open Interest (OI) increased over by more than 3 percent due to shorts.

The Bank Nifty, too, was under pressure from the highs. It formed a broader range of 37,770-35,570 led by selling in private sector banks. Overall, Bank Nifty ended the week with a marginal loss of 0.5 percent with Open Interest (OI) falling 5 percent.

The Nifty monthly Option data reflects a broad range of Call addition from 15,000-16,000 strike, with immediate resistance level standing at 15,200.

Put has remained on the lighter side in terms of addition as compared to calls. Highest Put stands at 14,000, the next highest being 15,000. With the Nifty Future closed on the vital support level of 15,000, a further sell-off could see pressure intensifying on the downside.

The Bank Nifty monthly Option data reflects a wide range of addition in Open Interest for the Calls & Puts. Multiple resistance and support can be seen for the monthly expiry. However, vital resistance and support level stands at 37,000 and 35,000.

INDIA VIX, the barometer of riskiness, has gained marginally 30 basis points from 21.48 to 22.09 over the week. A sustained uptick in the India VIX level could be detrimental for the uptrend. A key level of 25 needs to be watched.

Looking at the sentimental indicator, the Nifty OIPCR has declined from 1.569 to 1.187, as Put writers unwind their position and Call writers are adding more position. Overall data indicate higher Call writers versus Put writing over the week. Same as the Nifty, call writers aggression can also be seen on the Bank Nifty as well. The Bank Nifty OIPCR has also declined heavily from 1.57 to 0.779.

Moving further to the weekly contribution from the sectors. OIL tried to provide support to the Nifty by contributing nearly 65 points. However, major sector like, PVTB (-150 points), auto (-62 points), IT & FMCG (-45 points each) dragged the Nifty down.

Looking at the top gainer and loser of the week in the F&O segment, IDFC First Bank topped by gaining more than 20 percent followed by the Bank Of Baroda (17 percent) and Torrent Power (13 percent). Idea lost the most (12.5 percent) followed by the Amara Raja Batterries (11 percent) & Page Ind (7.5 percent).

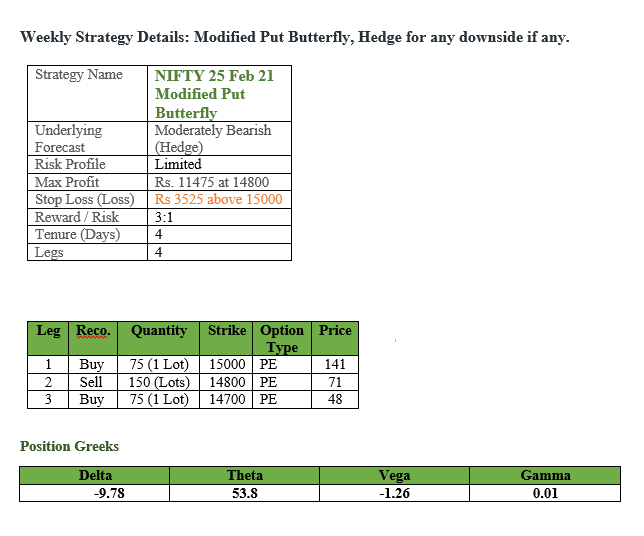

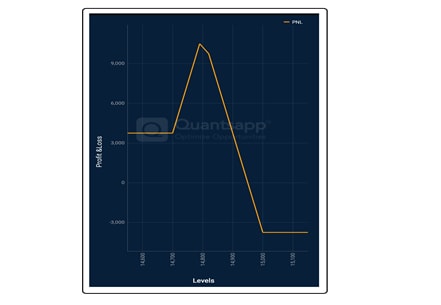

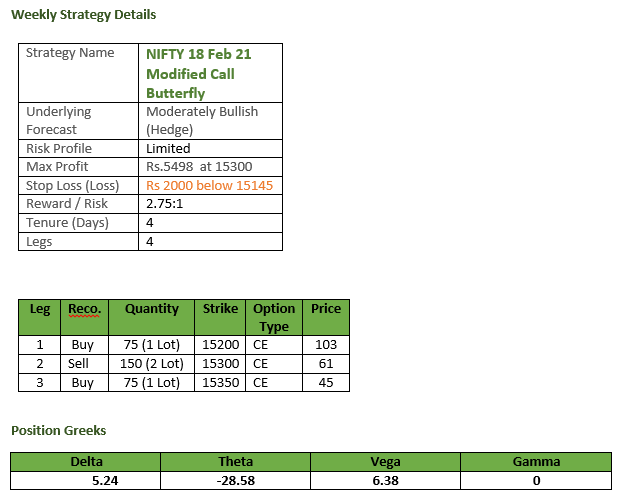

Considering cautiousness among the traders led by downward shift in range, rising India VIX level and mix of short and long unwinding in indices, it is prudent to approach the market with a low-risk strategy like Modified Put Butterfly to participate in the downward move, however, protect on the upside in case a reversal.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.