Indian markets have been on an upward trajectory since Union Budget which was announced on February 1. The growth-oriented proposals by Finance Minister Nirmala Sitharaman have helped Sensex climb 52,000 levels after a steep correction prior to the Budget.

Nifty50 also raced past 15,000 for the first time on February 5 and it took only six sessions for the 50-share index to surge past 15300 levels.

After a week of consolidation, the S&P BSE Sensex closed 609 points higher at 52,154 while the Nifty50 closed with gains of 151 points at 15,314 on Monday.

For the month of February – the S&P BSE Sensex and Nifty50 have rallied over 12 percent each. The S&P BSE Sensex hit a record high of 52,516 in intraday trade while Nifty50 recorded a life high of 15,431 on Tuesday.

“Sensex hit 52K level for the first time on February 15 and it took less than a month for the market to hit 52K from 50K. The Nifty50 might touch 15,800 by March 2021,” Gaurav Garg, Head of Research at CapitalVia Global Research Limited told Moneycontrol.

Garg further added that investors should be positively biased and any dip can be considered as a buying opportunity. Investors sitting on good profit can continue to hold on to their profits for some more time with a revision in their stop loss.

The outlook still remains strong and investors are advised to buy the dip and avoid going contra at this point in time. The big breakout on Monday has opened the gates for the S&P BSE Sensex to inch towards 53,000 in the near term, suggest experts.

“The markets are likely to inch towards 53,500 in the near term. 51,200 is now crucial support on the lower side,” Jay Thakkar – VP & Head of Equity Research at Marwadi Shares and Finance Ltd told Moneycontrol.

“Most importantly, the index has taken off its crucial resistance of 51,804 levels which has led to a breakout after a short-term consolidation in the markets,” he said.

Although there are no immediate near-term risks for the stock market, experts feel that the rise in crude oil prices along with the hardening of bond yields across global markets could be near-term concerns that could result in a knee-jerk reaction. Investors should remain cautious and stay stock specific.

“FIIs turning net seller on Friday indicate a pullback in the near term. Investors need to be cautious at these levels and must bet on quality names with robust earnings visibility and margins of safety,” Binod Modi, Head – Strategy at Reliance Securities told Moneycontrol.

“However, higher Brent prices and hardening of bond yields across global markets could be a near term concerns,” he said.

We have collated a list of key market data points that highlight Sensex’s journey from 50K to 52K:

Investors’ wealth rose by Rs 19 lakh crore in February:

Investors’ wealth captured by the BSE-listed companies rose to Rs 205 lakh crore (as on February 15) compared to Rs 186 lakh crore on January 29, data from BSEIndia.com showed.

“A good Budget which was in-line with the expectations, strong Q3 numbers by India Inc, high institutional inflows, and easing COVID-19 situation with the fast-paced implementation of vaccination drive are some of the factors which are leading the market indices to hit all-time-highs levels,” says Garg of CapitalVia Global Research Limited.

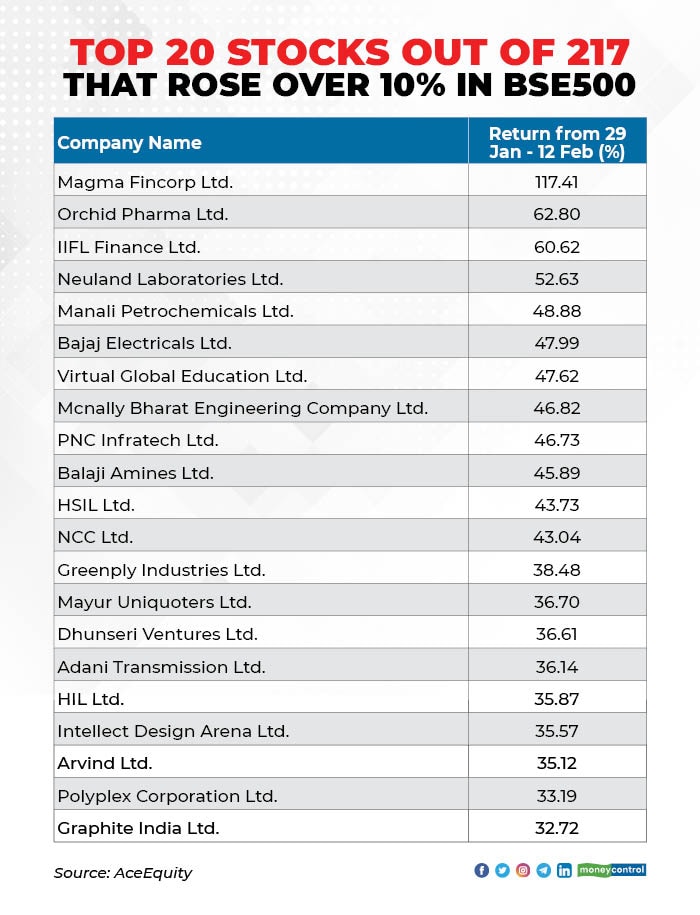

Over 200 stocks rose more than 10% in February:

About 217 stocks in the S&P BSE500 index that rose more than 10 percent so far in February. Experts advise investors to book profits in some of the names, and stay with the ones that are likely to benefit the most from the Budget 2021.

“The sectors which are likely to outperform from hereon are auto, IT, pharma, infrastructure, cement and chemicals. Investors can continue to hold stocks from these sectors on with a revised target and stop-loss if the estimated target is revised upwards,” says Thakkar of Marwadi Shares and Finance Ltd.

“Those stocks which fall under the aforementioned category but don’t have much higher revised targets on the upside should be exited in profit and some other stocks from these sectors should be added which are relatively available at cheaper valuations,” he said.

Banks, realty led the rally in February:

Sectors that led the rally include banks, finance, realty, private banks, infra, metals, and power indices.

Benchmark indices have surged on the back of broad buying across the board. Strong global cues, robust commentary from India Inc., accommodative policy by the MPC, as well as pro-growth Budget proposals help economy-linked sectors.

“With strong global health recovery, pro-growth public policies, systemic liquidity abundance, corporate earnings recovery and improving economic metrics, we seem to be entering a whole new cycle of wealth creation,” Nirav Karkera, Head of Research, Fisdom told Moneycontrol.

“Considering the strong positive undercurrent, we expect portfolios with an orientation towards financial services, discretionary consumption and industrials to benefit significantly in the medium term,” he said.