Shares of Zillow Group Inc. surged toward another record Monday, after upbeat calls from Wall Street analysts two days before the real estate website reports earnings.

The Class A shares ZG, +0.53% climbed 1.0% to $ 165.43 in morning trading, putting them on track for a third-straight record close. The more-active Class C shares Z, +1.45% rallied 1.8% to $ 159.56, and were also headed for a third straight record.

Deutsche Bank analyst Lloyd Walmsley boosted his stock price target for the Class A shares to $ 202, which is about 22% above current levels, from $ 160. He reiterated the buy rating he’s had on the stock for the past five months.

Walmsley said he believes Zillow is a “secular post-COVID winner,” and one of his handful of favorite internet names for 2021.

“We think the housing market strength and product cycles can drive upside to estimates over the next two years, as the macro backdrop likely allows the company to take its time with some major product unlocks we expected this year — namely Partner Leads and the broader rollout of Flex,” Walmsley wrote in a note to clients.

FactSet, MarketWatch

Zillow is scheduled to report fourth-quarter results after Wednesday’s closing bell. The FactSet consensus is for the company to swing to an adjusted per-share profit of 28 cents from a loss of 26 cents a year ago, while revenue is expected to fall about 22% to $ 740 million.

Wedbush’s Ygal Arounian reiterated the outperform rating he’s had on the stock since January, while maintaining his $ 167 price target on the Class A shares.

“We expect strong 4Q20 results as the housing market remains strong and drives upside to both the Premier Agent and Homes segment,” Arounian wrote. “[W]e see COVID and the current environment driving faster real estate technology adoption that can help accelerate Zillow’s flywheel.”

Optimism ahead of earnings is understandable, as the stock has soared by an average of 12.8% on the day after the past five quarterly results were reported.

Zillow also drew some attention on social media after the company was subject of skit by “Saturday Night Live” over the weekend, in which Zillow was a website older millennials used to fantasize about real estate.

Separately, Fannie Mae said Monday that its Home Purchase Sentiment Index rose to 77.7 in January from 74.0 in December, as consumers reported a “significantly more positive view of home-selling conditions” for the month.

Fannie Mae said the January jump in the index reversed much of what it lost December.

“Overall, the index’s monthly increase was driven largely by a substantial jump in the share of consumers reporting that it’s a good time to sell a home, with many citing favorable mortgage rates, high home prices and low housing inventory as their primary rationale,” said Fannie Mae Chief Economist Doug Duncan.

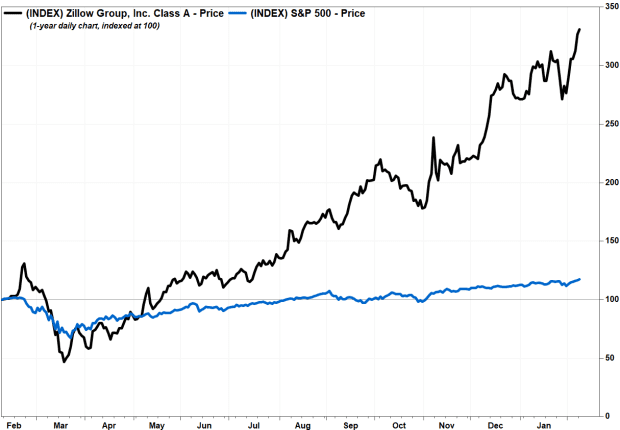

Zillow’s Class A shares have more than tripled (up 232%) over the past 12 months, while the SPDR Real Estate Select Sector exchange-traded fund XLRE, -0.53% has slipped 5.4% and the S&P 500 index SPX, +0.38% has advanced 17.4%.