The market has run up quite a bit post Budget and it looks overheated now. If this thought crosses your mind then you are not alone. The market has put up a strong show since Budget and is now trading in unchartered territory that could make anyone nervous.

The S&P BSE Sensex has rallied over 4,000 points post Budget to hit a record high above 50,600 levels for the first time on February 4, while the Nifty50 inched closer towards 15,000.

The valuations were a concern in the run up to the Budget but experts feel that proposals, if executed in a timely manner, could well put India on a growth path to hit the double-digit mark.

If someone plans to invest Rs 5-10 lakh now then the time is right, but yes a dip could be a better opportunity, but don’t miss out on investing in equities and rise the growth momentum which the Budget 2021 promised. Follow a staggered way of investing.

“On the valuation front, the market was overvalued before the Budget as well. But, the kind of pro-growth Budget got announced along with economy showing positive signs of progress is making the market more excited,” Harshad Chetanwala, Co-Founder- MyWealthGrowth.com told Moneycontrol.

“Having said that, if anyone has Rs 100 to invest today, they should look at investing Rs 20-25 in equities and follow the staggered manner of investing. The rest of the money can be invested over 3–6 months,” he said.

Chetanwala further added that for investors having an investible surplus and investing in mutual funds, SIPs are the best way to invest at present.

Dalal Street is enjoying the post-Budget rally after FM Nirmala Sitharaman announced a budget that checked most boxes and promised just one thing and that is growth.

Green shoots in the economy are already visible, and the massive capex which the Indian government plans to invest in the coming years will not just boost growth but also lift the earnings for India Inc. which will keep bulls in charge of D-Street.

The S&P BSE Sensex which climbed Mount 50K in the run-up to Budget is well on course to hit 51000 while Nifty50 could well surpass 15000 and then 15400, suggest experts.

“The Nifty recovered sharply from 13,600 and hit an all-time high in the very first week of February, Nifty might continue to trade bullish and for this series, Nifty might touch 15,400 and investors should try to buy any dip keeping 14,400 as immediate support to look for,” Rohit Gadia, Co-Founder & CIO, CapitalVia Global Research Limited told Moneycontrol.

“Higher Institutional inflows along with better quarterly results might push the index to record highs. I believe equity might outperform other asset classes and investors should go aggressive in equities,” he said.

We have collated 5 portfolio options from various experts on how investors could deploy Rs 5-10 lakh post Budget 2021:

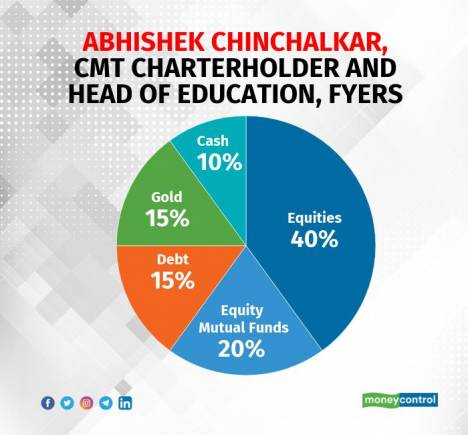

Abhishek Chinchalkar, CMT Charterholder and Head of Education, FYERS

Since the Union Budget on Monday, momentum has clearly continued favouring the bulls, with every minor intraday dip being aggressively bought.

With global cues quite favourable and laggards also joining in the post-Budget rally, it looks likely that Nifty could touch 15000 very soon.

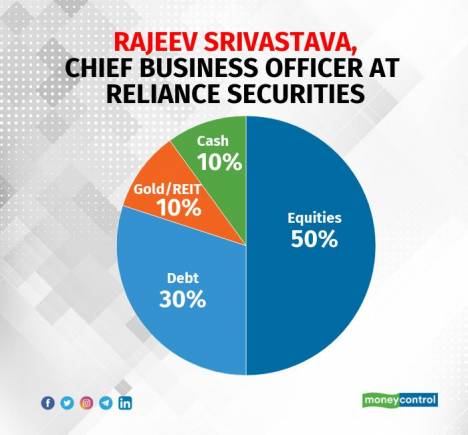

Rajeev Srivastava, Chief Business Officer at Reliance Securities

Well, the golden rule of investing in equities is (100-minus your age) is for better risk-adjusted returns in the long term. One should determine the goals, invest gradually and diversify your investments.

One should choose a well large research-based broking house to know more about investment products and trends on regular basis. With the sharp up move over the past 3 days, one should stagger the investments at regular periods of correction from current levels.

An ideal portfolio allocation will be as stated below and it could vary with respect to the risk profile of the investor.

Jashan Arora, Director at Master Capital Services

“The 2021-22 budget comes amid the COVID-19 pandemic, it is a significant one for the Finance Minister. Ms Nirmala Sitharaman’s first budget of the decade doesn’t have much for the common man.

No income tax for those with taxable income below Rs 2.5 lakh. For the startups, she has introduced that the center will reduce the margin money requirement to 15 percent from 25 percent for schemes under Startup India. There is nothing adverse as far as taxes are concerned.

Rohit Gadia, Co-Founder & CIO, CapitalVia Global Research Limited