The Reserve Bank of India monetary policy committee left interest rates unchanged as expected on Friday after data showed the economy is contracting less than expected amid softening prices.

RBI’s first monetary policy committee, which met for the first after the Union Budget 2021, decided to retain an accommodative policy stance at least for the current financial year and into the next to revive growth as inflation has eased below “tolerance level of 6 percent”.

The key lending rate of the RBI, or the repo rate, was left undisturbed at 4 percent while the reverse repo rate, or the key borrowing rate, was retained at 4 percent.

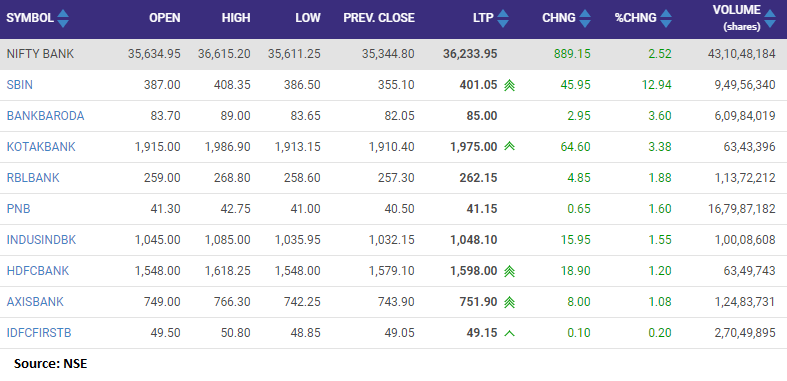

Bank Nifty has jumped 2 percent largely aided by the rally in PSU banks. The index has surged 17 percent since February 1 after Finance Minister Nirmala Sitharaman in Union Budget 2021-22 announced setting up ‘Bad Bank’.

The Bad Bank is expected by the government to adequately address the non-performing assets (NPA) crisis of the public sector lenders.

Apart from the PSU banks which are rallying on the back of surge in SBI stock price surge, private banking names have also advanced. The top gainers included IndusInd Bank, Kotak Mahindra Bank, RBL Bank, Axis Bank and HDFC Bank.

SBI along with Indian Bank, HDFC Bank and ICICI Bank have hit new 52-week high on NSE.

“Setting of Stressed Asset Fund and Privatization of PSU banks will be a great positive for the ecosystem. The merging of PSU banks was a step in this direction and now with privatization of PSU, it will help in encouraging new players with a proven track record to boost better productivity and lending practices,” Vijay Kuppa, Co-Founder, Orowealth told Moneycontrol.

Ruchit Jain, Senior Analyst – Technical and Derivatives, Angel Broking suggests holding IndusInd Bank. “The previous resistance zone of 980-960 is likely to act as support on any corrections, and we could see the prices approaching Rs. 1180 in the short term,” he said.

Hence, traders are advised to continue to hold the stock and look to buy on any corrective declines, he added.

Dolat Capital has maintained its accumulate rating with a target of Rs 940. “Our earnings upgrade for FY21E is mainly driven by improved operational metrics including NIM, fee lines and opex. Credit costs have not been altered materially. Valuing the bank at 1.6x Dec-22 ABV against a RoA/RoE of 1.5%/12.5%, it said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.