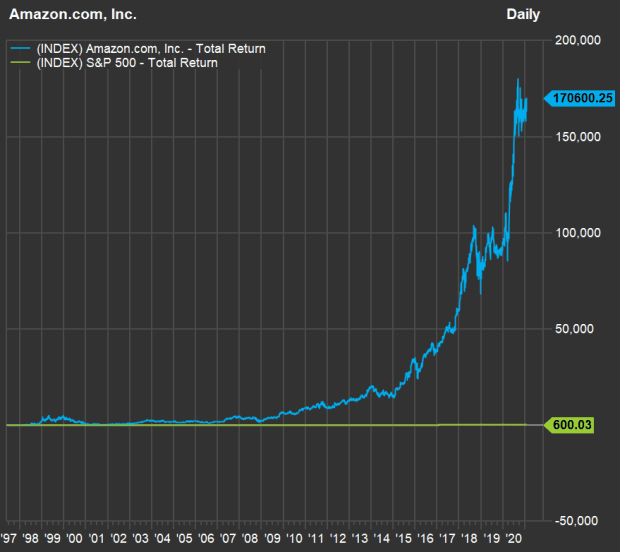

The career of Jeff Bezos as CEO of Amazon.com has been nothing short of amazing. And a very simple way to measure that is to look at one chart:

FactSet

This chart shows the total return for shares of Amazon.com Inc. AMZN, +1.11%, since Bezos led its initial public offering on May 15, 1997, through Feb. 1, 2021.

That green line under it is the total return for the S&P 500 index SPX, +1.39%, including dividends reinvested. The index has had a significant return for the nearly 24-year period, but Amazon leaves it looking rather flat.

Among the 351 current components of the S&P 500 that have stock histories going back to May 15, 1997, Amazon’s total return of 170,600% was actually second-best. The top position goes to Monster Beverage Corp. MNST, +2.48%, with an astounding return of 322,643%, according to FactSet.

Monster’s stock performance history includes the time when the company was known as Hansen’s Natural. It was renamed Monster in January 2012.

Here are the five best performers among the S&P 500 since Amazon went public, with total returns from May 15, 1997 through Feb. 1, 2021, according to FactSet:

- Monster Beverage: 322,643%

- Amazon.com: 170,600%

- Apple Inc. AAPL, +0.63% : 98,029%

- NVR Inc. NVR, -0.44% : 31,689%

- Ansys Inc. ANSS, +1.95% : 22,986%

Bezos said on Feb. 2 that he planned to step down as Amazon’s CEO during the third quarter, but remain as executive chair.

More about Amazon:

Meet Amazon’s first customer — this is the book he bought

How Amazon created AWS and changed technology forever

Amazon unveiled its design for new Virginia HQ2 — Here’s what it looks like

Don’t miss: Hey, Robinhood traders: These ‘non-bubble’ stocks can also be good bets for you