Rise in India VIX also has raised caution. Thus, deterioration in futures landscape and sentimental indicators at this height advocates a hedge in Nifty via Modified Put Butterfly

Shubham Agarwal

February 01, 2021 / 07:57 AM IST

Market

Nervousness among the market participants was clearly seen in Indian equity market, as Nifty saw a pull back in the last week of January. Selling pressure was seen in the past week that led the Nifty to correct almost 4.67%. Nifty continued the southward direction in each session of the week after touching all-time high level of 14,750 in the previous week.

Last week started on a negative note with a percent of loss. Selling pressure continued in the followed session as well and Nifty lost around 1.9%. Bears tightened their grip on Nifty that led the pull back in the last two days of the week. On the last day, Nifty gyrated in big range of 300 points and closed in negative note.

Same as Nifty, Bank Nifty has also started the week on negative note and lost marginally. Bank Nifty had selling pressure on the followed day that led Bank Nifty to bleed nearly 2.7%. Buying in the last two session came that has given small amount of relief in the Bank Nifty. Overall, Bank Nifty ended losing 1.5% in this week.

Follow Moneycontrol’s full coverage of Union Budget 2021-22 here

With final week of Jan expiry, Rollover was seen active in market. Nifty roll stands at 76% versus last expiry of 74.54 while Bank Nifty roll was 73.89% versus 77.47%. Month over month Nifty and Bank Nifty is down by ~ 2%. Top gainer were Tata Motors (43%), IDFC First Bank (27%) followed by Shriram Transport (25%). Top losers were Bandhan Bank (-24%), Biocon (-18.5%) and Sail (-17%).

After the stupendous rally seen in Nifty and Bank Nifty from Oct-Dec, Nifty saw sharp decline in aggregate OI (Open Interest) by 20% while Bank Nifty saw rise of OI by 20%.

Aggregate OI has marginally increased by 1.3%, nearly 24% of stocks added long and nearly 26% of stocks witnessed Short.

Sentimentally speaking, Nifty OIPCR declined sharply to close at 0.99 versus 14. Significant Call addition was seen in Nifty. Diving deep into Option Open interest shows highest Put in upcoming week at 13800 (OI of 17.31L) followed by 13000 while on higher side immediate resistance is placed at 14000 (OI of 23.9L). Monthly OI shows that highest Put still holds at 14000 strike with OI of 22.17L.

India VIX, barometer to gage the sentiment prevailing in the market saw spike up from 22.42 to 25.31. Sustain move above 25.5 could be detrimental to the bull ride for short term as historical India VIX holds inverse relationship with Nifty

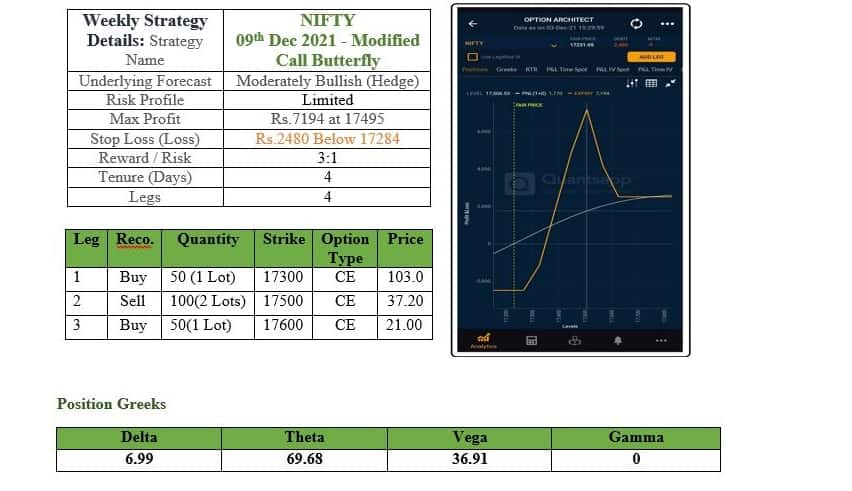

Finally, Unwinding in Nifty futures along with marginal higher number of shorts in stock futures deteriorates the bullish aggression. Fall in OIPCR indicates expectation of bit of softening. Rise in India VIX also has raised caution. Thus, deterioration in futures landscape and sentimental indicators at this height advocates a hedge in Nifty via Modified Put Butterfly.

Modified Put Butterfly is a 4-legged strategy where 1 lot of Put close to current underlying level is bought against that 2 lots of lower strike Puts are sold and 1 more lot of Put is bought but closer to the Put sold strike. This leads to lower, but constant profits in case of downward breakout. This is a fairly risk averse and a universal strategy.

Follow Market LIVE Updates here

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.