Dollar revenue during December quarter stood at $ 2,617 million, up from $ 2,507 million in the second quarter of FY21.

‘); $ (‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]); //if(resData[stkKey][‘percentchange’] > 0){ // $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); // $ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); //}else if(resData[stkKey][‘percentchange’] = 0){ $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); //$ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); $ (‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”); }else if(resData[stkKey][‘percentchange’] 0) { var resStr=”; var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) { $ (‘#backInner1_rhsPop’).html(data); $ .ajax({url:url, type:”POST”, dataType:”json”, data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs}, success:function(d) { if(typparam1==’1′) // rhs { var appndStr=”; var newappndStr = makeMiddleRDivNew(d); appndStr = newappndStr[0]; var titStr=”;var editw=”; var typevar=”; var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’); var phead =’Why add to Portfolio?’; if(secglbVar ==1) { var stkdtxt=’this stock’; var fltxt=’ it ‘; typevar =’Stock ‘; if(lastRsrs.length>1){ stkdtxt=’these stocks’; typevar =’Stocks ‘;fltxt=’ them ‘; } } //var popretStr =lvPOPRHS(phead,pparr); //$ (‘#poprhsAdd’).html(popretStr); //$ (‘.btmbgnwr’).show(); var tickTxt =’‘; if(typparam1==1) { var modalContent = ‘Watchlist has been updated successfully.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //var existsFlag=$ .inArray(‘added’,newappndStr[1]); //$ (‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’); //if(existsFlag == -1) //{ // if(lastRsrs.length > 1) // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’); // else // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’); // //} } //$ (‘.accdiv’).html(”); //$ (‘.accdiv’).html(appndStr); } }, //complete:function(d){ // if(typparam1==1) // { // watchlist_popup(‘open’); // } //} }); }); } else { var disNam =’stock’; if($ (‘#impact_option’).html()==’STOCKS’) disNam =’stock’; if($ (‘#impact_option’).html()==’MUTUAL FUNDS’) disNam =’mutual fund’; if($ (‘#impact_option’).html()==’COMMODITIES’) disNam =’commodity’; alert(‘Please select at least one ‘+disNam); } } else { AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function pcSavePort(param,call_pg,dispId) { var adtxt=”; if(readCookie(‘nnmc’)){ if(call_pg == “2”) { pass_sec = 2; } else { pass_sec = 1; } var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .ajax({url:url, type:”POST”, //data:{q_f:3,wSec:1,dispid:$ (‘input[name=sc_dispid_port]’).val()}, data:{q_f:3,wSec:pass_sec,dispid:dispId}, dataType:”json”, success:function(d) { //var accStr= ”; //$ .each(d.ac,function(i,v) //{ // accStr+=”+v.nm+”; //}); $ .each(d.data,function(i,v) { if(v.flg == ‘0’) { var modalContent = ‘Scheme added to your portfolio.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //$ (‘#acc_sel_port’).html(accStr); //$ (‘#mcpcp_addportfolio .form_field, .form_btn’).removeClass(‘disabled’); //$ (‘#mcpcp_addportfolio .form_field input, .form_field select, .form_btn input’).attr(‘disabled’, false); // //if(call_pg == “2”) //{ // adtxt =’ Scheme added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //else //{ // adtxt =’ Stock added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //$ (‘#mcpcp_addprof_info’).css(‘background-color’,’#eeffc8′); //$ (‘#mcpcp_addprof_info’).html(adtxt); //$ (‘#mcpcp_addprof_info’).show(); glbbid=v.id; } }); } }); } else { AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function commonPopRHS(e) { /*var t = ($ (window).height() – $ (“#” + e).height()) / 2 + $ (window).scrollTop(); var n = ($ (window).width() – $ (“#” + e).width()) / 2 + $ (window).scrollLeft(); $ (“#” + e).css({ position: “absolute”, top: t, left: n }); $ (“#lightbox_cb,#” + e).fadeIn(300); $ (“#lightbox_cb”).remove(); $ (“body”).append(”); $ (“#lightbox_cb”).css({ filter: “alpha(opacity=80)” }).fadeIn()*/ $ (“#myframe”).attr(‘src’,’https://accounts.moneycontrol.com/mclogin/?d=2′); $ (“#LoginModal”).modal(); } function overlay(n) { document.getElementById(‘back’).style.width = document.body.clientWidth + “px”; document.getElementById(‘back’).style.height = document.body.clientHeight +”px”; document.getElementById(‘back’).style.display = ‘block’; jQuery.fn.center = function () { this.css(“position”,”absolute”); var topPos = ($ (window).height() – this.height() ) / 2; this.css(“top”, -topPos).show().animate({‘top’:topPos},300); this.css(“left”, ( $ (window).width() – this.width() ) / 2); return this; } setTimeout(function(){$ (‘#backInner’+n).center()},100); } function closeoverlay(n){ document.getElementById(‘back’).style.display = ‘none’; document.getElementById(‘backInner’+n).style.display = ‘none’; } stk_str=”; stk.forEach(function (stkData,index){ if(index==0){ stk_str+=stkData.stockId.trim(); }else{ stk_str+=’,’+stkData.stockId.trim(); } }); $ .get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?sc_id=’+stk_str, function(data) { stk.forEach(function (stkData,index){ $ (‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]); }); });

Shares of India’s third-largest software services provider, HCL Technologies, gained in early trade on January 18 post company’s December quarter earnings.

On January 15, the company reported a 26.7 percent jump in consolidated profit for the quarter ended December 2020 at Rs 3,982 crore versus Rs 3,142 crore in the previous quarter.

Consolidated revenue for the quarter increased by 3.8 percent to Rs 19,302 crore, driven by broad-based growth in segments and geographies. Revenue stood at Rs 18,594 crore in the September quarter.

Dollar revenue during December quarter stood at $ 2,617 million, up from $ 2,507 million in the second quarter of FY21.

Also Read – HCL Tech Q3 result: Profit jumps nearly 27% to Rs 3,982 crore; firm raises CC growth guidance

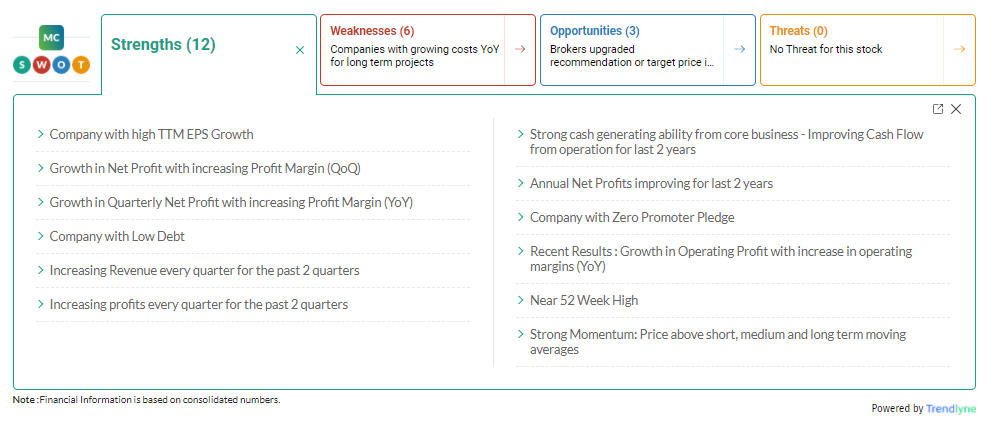

Here is what brokerages have to say about the stock and the company post-December quarter earnings:

ICICIdirect

We believe HCL Tech is in a sweet spot to capture demand traction in the cloud and cloud-related services considering its strength in IMS business & partnership with hyperscalers. In addition, better capital allocation and a healthy margin trajectory make us positive on the stock from a long-term perspective. Hence, we maintain buy on the stock with a target price of Rs 1150 (18x PE on FY23E EPS) (previous target was Rs 1105).

Dolat Capital

Given the strong performance, encouraging commentary, we upgrade our revenue growth estimates by 1-2% over FY21E-FY23E. We up our OPM estimates by 80bps/16bps/10bps for FY21E/FY22E/FY23E given the guidance upgrade and some sustainable cost saving in margins. These factors have led to EPS upgrade of about 4% for FY22/23E. Bigger upgrade in FY21E is skewed by lower ETR (tax reversal led).

We believe HCL Tech and other Tier-I IT companies would continue to deliver strong revenue momentum over next 5-6 quarters (translating into double-digit revenue growth in FY22E) and thus would sustain current valuations of 25x-30x which implies over 2x-3x on PEG basis. We currently value HCLT at 20x (from 18times) on FY23E Earnings of Rs 57 (earlier Rs 55) with a target price of Rs 1,140 per share (from Rs 990) and maintain our buy rating on the stock.

Sharekhan

We have raised earnings estimates for FY2021E/ FY2022E/FY2023E, to factor in strong all-around Q3 results, strong deal wins, robust deal pipeline and improving spends on digital transformation. We believe HCL Tech’s capabilities in infrastructure and application are expected to support its growth in strong cloud adoption environment.

We believe HCL Tech would return to the industry-level growth trajectory in the next few years on the back of capabilities in digital foundation, consistent deal wins and traction for its products portfolio. We maintain our buy rating on the stock with a revised price target of Rs 1,250.

Prabhudas Lilladher

We believe HCL’s unique capabilities in Mode 2 (digital & cloud) and Mode 3 (Products & platforms) should see accelerated growth from increasing demand for hybrid cloud adoption and large digital transformation deals. We have slightly increased our estimates (avg:0.7%) for FY22/23 led by strong revenue growth trajectory & consistent margin performance.

We value HCLT at 20X on Mar-23 EPS of Rs 58 to arrive at a changed target price of Rs 1160 (Earlier: Rs 1152). HCLT is trading at valuations of 18.2/17.1 X for FY22/23 at Rs 54.3/58 respectively.

Motilal Oswal

Given its deep capabilities in the IMS space and strategic partnerships, investments in Cloud, and Digital capabilities, we expect HCL Tech to emerge stronger on the back of an expected increase in enterprise demand for these services. The stock is currently trading at a modest ~ 15x FY23E earnings, which offers a margin of safety. Our target price is based on 20x FY23E EPS (a 20% discount to TCS). Maintain buy.

CLSA

The software business gains traction with a strong deal pipeline. It has reported healthy revenue & margin beats in Q3. The company expects the order book to scale further after a 13% YoY jump in Q3. The operating leverage in mode 2 & 3 business gives a structural margin defence.

We maintain a buy rating and raise the target to Rs 1,180 from Rs 1,120 and increase FY22/23 EPS estimates by 3%.

Credit Suisse

Research house Credit Suisse has kept outperform rating and raised the target to Rs 1,325 per share.

The outlook on demand environment remains positive with scope for further re-rating. The FY21-23 earnings estimates raised by 5-9% and also raised P/ E multiple to 22.5x from 18.5x. The slower-than-expected growth & a sharp rupee appreciation are the key risks, reported CNBC-TV18.

At 09:23 hrs HCL Technologies was quoting at Rs 994.20, up Rs 4.40, or 0.44 percent on the BSE.

The share touched its 52-week high Rs 1,073.55 and 52-week low Rs 375.50 on 13 January, 2021 and 19 March, 2020, respectively.

Currently, it is trading 7.39 percent below its 52-week high and 164.77 percent above its 52-week low.