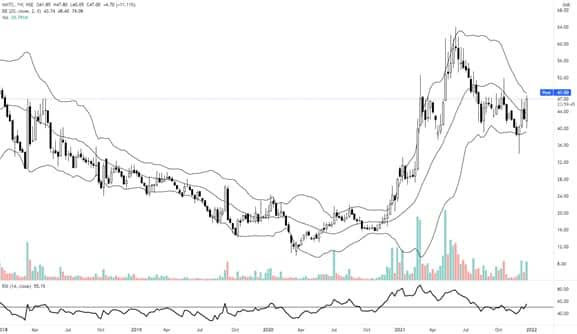

The Nifty50 closed at a record high for the fifth consecutive session following strength in the afternoon amid volatility on January 14. Index heavyweights Reliance Industries, HDFC Group, ITC, L&T and TCS supported the market but the selling in metals, select technology and banking & financials capped the gains.

The index formed a bullish candle which resembled a Hanging Man pattern, for the second consecutive session,on the daily charts.

Hence, traders should remain cautious and focus on stock-specific opportunities rather than waging directional bets on the index, Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisory at Chartviewindia.in told Moneycontrol.

The volatility declined for the first time in the last five trading sessions but it needs to fall below the 20-mark to form the higher market base. India VIX was down by 1.13 percent from 23.29 to 23.02 levels.

The Nifty50 opened lower at 14,550.05 and hit an intraday low of 14,471.50, but gained strength amid volatility in the afternoon and touched the day’s high of 14,617.80 before signing off the session at 14,595.60, up 30.70 points.

“The Nifty50 continued to witness buying on intraday dips, which once again resulted in a Hanging Man kind of formation, with a dominating lower shadow over candle body. However, advance-decline ratio remained negative for the second session in a row, as it slightly tiled in the favour of bears,” Mohammad said.

The last four trading sessions of indecisive formations with narrow trading ranges are hinting at a distribution phase at higher levels, which should eventually pave the way for a sudden and sharp cut in the near term. Hence, he advised traders to be cautious and maintain tight stop below 14,400 levels, as a breach on the closing basis may trigger a short-term downswing.

On the other hand, if the index closes above 14,653, then it shall extend the up move towards 14,750 –14,800.

On the options front, maximum Put open interest was at 14,000 followed by 13,000 strike, while maximum Call open interest was at 15,000 followed by 14,000 strike. Call writing was seen at 14,800 then 14,600 strike, while Put writing was seen at 14,500 then 14,100 strike.

The abovementioned option data indicated that the Nifty could see an immediate trading range of 14,300 to 14,800 levels.

The Bank Nifty opened negative at 32,526.70 and remained consolidative for the most part of the session. It witnessed some recovery from lower zones in the last hour but ended the day with a loss of 54.85 points at 32,519.80.

The index formed a Doji candle on the daily scale which indicates a tug of war at new high territory. “Now it has to continue to hold above 32,200 zone to witness an upmove towards 32,750 and 33,000 while on the downside support is seen at 32,000 and 31,750,” Chandan Taparia, Vice President | Analyst-Derivatives at Motilal Oswal Financial Services, said.

Positive setup was seen in Cadila Healthcare, BPCL, MRF, Lupin, HPCL, TCS, IOC, Dabur, Siemens, Voltas, Godrej Consumer Products, ITC, Amara Raja Batteries and HUL, while weakness was seen in SAIL, Vedanta, Jubilant Foodworks, Titan, Hindalco and Bajaj Finance, he added.

Disclosure: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd which publishes Moneycontrol.