Dollar bulls may try to go four-for-four on Wednesday when the Labor Department releases the March U.S. consumer-price-index report.

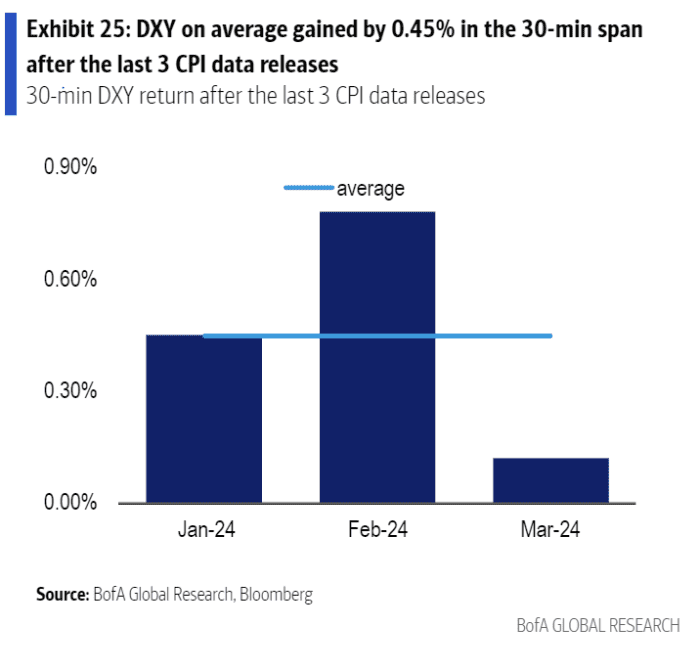

While inflation has continued to trend down, hotter-than-expected readings in the past three months have seen the ICE U.S. Dollar Index DXY, a measure of the currency against a basket of six major rivals, rise an average of 0.45% in the 30 minutes after the CPI release, Bank of America strategists Vadim Iaralov and Howard Du said in a note (see chart below).

BofA Global Research

March CPI is expected to show a 0.3% rise, according to economists surveyed by the Wall Street Journal, after a 0.4% increase in February. The year-over-year rate is forecast to accelerate to 3.5% from 3.2%. The core CPI reading, which excludes volatile food and energy prices, is expected to come in at 3.7% year over year, versus 3.8% in February.

Also read: Some good news on inflation? Fed might get it with the CPI this week.

Stock-market performance on CPI-release days so far in 2024 has been a mixed bag. The S&P 500 SPX fell less than 0.1% on Jan. 11, following the December CPI reading. The large-cap benchmark dropped 1.4% on Feb. 13 after the January CPI release and rallied 1.1% after the February data on March 12, according to Dow Jones Market Data.

As for the dollar, it has tended to retrace a portion of its knee-jerk rally over the rest of the trading day, BofA noted. The dollar index has seen an average gain of 0.37% on CPI-release days.

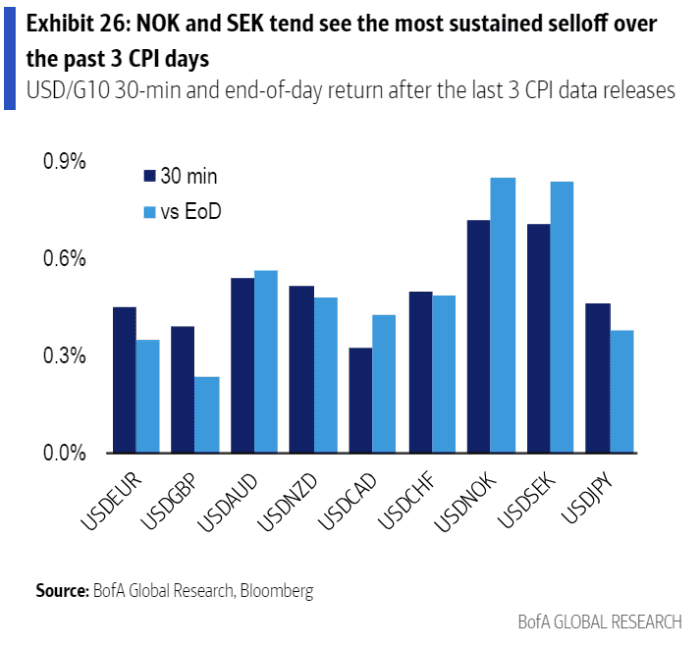

The strategists noted that the Norwegian krone USDNOK, -0.09% and Swedish krona USDSEK, +0.05% have suffered the brunt of the dollar’s post-CPI rallies (see chart below). And the Scandinavian currencies have tended to remain down versus the dollar over the course of the trading day.

BofA Global Research

The strategists noted that four consecutive months of hotter-than-expected CPI readings have been relatively rare since Bloomberg started tracking the consensus forecast in 2004. They found three such occurrences: February-May 2011, March-June 2021 and March-June 2022.

The last two such four-month runs, in 2021 and 2022 respectively, contributed directly to the Federal Reserve’s hawkish pivot at the June 2021 policy meeting and to the outsize 75-basis-point rate hike at the July 2022 meeting, they said.

The dollar index was flat Tuesday morning and has lost around 0.4% since the end of March, but it remains up 2.8% for the year to date.