The S&P 500’s torrid and top-heavy advance over the past year has convinced some bearish investors that U.S. stocks are in a bubble. But history says otherwise.

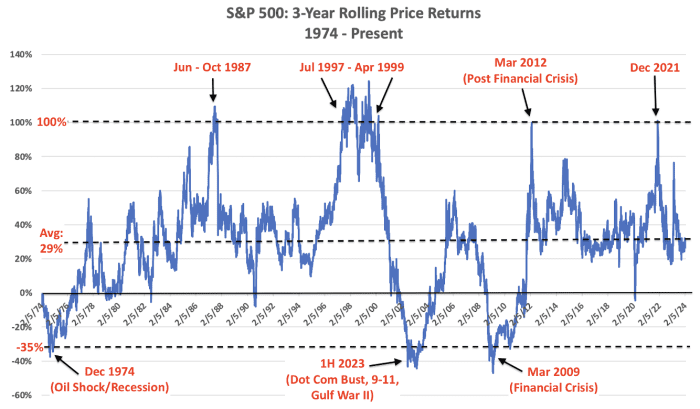

Since 1974, the S&P 500 has risen 100% of more during the three years that preceded every bubble peak, according to an analysis from a team of analysts at DataTrek.

Despite the wild ride that stocks have been on over the past three years, the S&P 500’s performance during this period has been relatively pedestrian. To wit, the index is up 31%, which is only slightly better than the average three-year rolling return of 29%.

The DataTrek team cited several examples to illustrate their point. The S&P 500 doubled during the three years leading up to the October 1987 market meltdown, the dot-com crash and even the post-COVID-19 bull-market peak in January 2022.

DATATREK

This means that if history is any guide, investors can take “bubble risk” off the table, DataTrek co-founders Nicholas Colas and Jessica Rabe said in a report shared with MarketWatch on Tuesday.

Although a more modest pullback isn’t out of the question, the DataTrek team said they continue to like large-cap U.S. stocks at these levels.

To be sure, past performance doesn’t guarantee future returns, and skeptical investors still have plenty of reasons to be cautious with stocks trading at or near record highs.

Gauges of investor sentiment point to extreme bullishness, which has presaged market peaks in the past. Bank of America’s bull and bear indicator shows investors are more optimistic about U.S. stocks than at any point in the past two years.

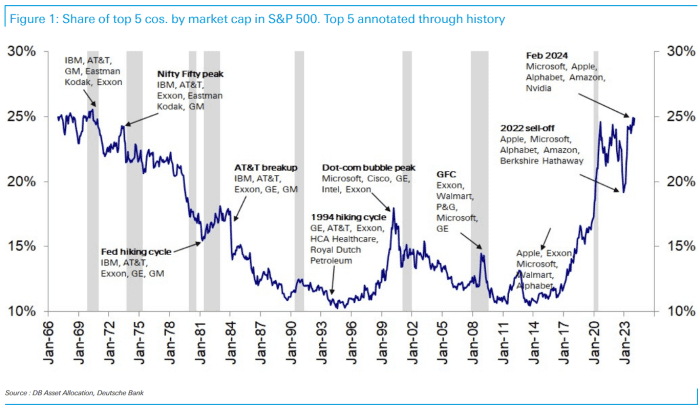

Meanwhile, the market’s advance over the past year has been heavily dependent on a handful of the largest companies, including megacap stocks like Nvidia Corp. NVDA, -0.49%.

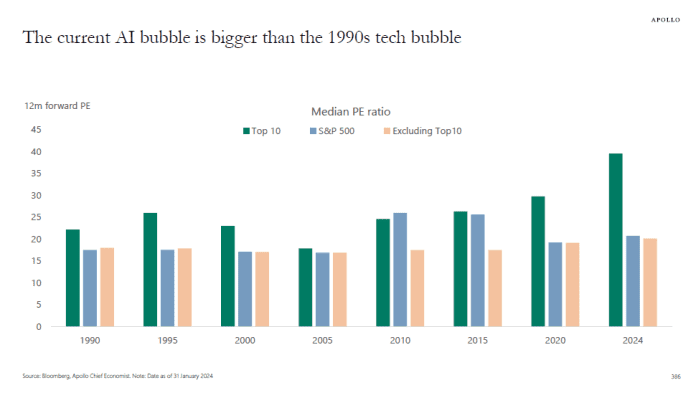

Although these companies have impressed investors with their earnings and guidance, they’re still trading at premium valuations relative to history.

According to Apollo’s Torsten Slok, the median valuation of the 10 largest companies in the S&P 500 is higher now than it was at the peak of the dot-com bubble, based on analysts’ earnings expectations one year out.

APOLLO

This top-heavy market has caused the S&P 500 to become more concentrated than it has been in decades. According to Deutsche Bank, the five largest U.S. companies — Apple Inc. AAPL, +0.81%, Microsoft Corp. MSFT, -0.01%, Nvidia Corp., Amazon.com Inc. AMZN, -0.68% and Alphabet Inc. GOOG, +0.97% GOOGL, +0.95% — now account for 25% of the market value of the index, the most since the 1970s.

DEUTSCHE BANK

However, all of this looks less extreme when factoring in stocks’ retreat from 2022. Nvidia may have seen its stock price surge by 440% since Jan. 1, 2023, but its share price was cut in half during the 2022 market rout, as were the shares of many of its peers in the megacap technology space.

The S&P 500 SPX is off to a strong start in 2024, having gained 6.4%, on top of its 24% advance in 2023. The index was trading at 5,075 late Tuesday, leaving it just shy of a fresh record close.

The Nasdaq Composite COMP, which is even more heavily weighted toward the largest technology stocks, has tacked on an additional 6.9% this year after rising more than 43% in 2023. At 16,032 in recent trade, it’s on the cusp of its first record close since Nov. 19, 2021, according to Dow Jones Market Data.

U.S. stocks were mostly higher on Tuesday, with only the Dow Jones Industrial Average DJIA trading in the red ahead of the close. The blue-chip gauge was down 94 points, or 0.2%, at 38,968.