A previous version of this article incorrectly listed Netflix as one of the Magnificent Seven stocks instead of Amazon.

Just days ahead of potentially pivotal results from Nvidia Corp., Goldman Sachs has lifted its year-end S&P 500 target to 5,200, but with much of that hinging on Big Tech’s ability to keep delivering strong profits.

“Our upgraded 2024 EPS forecast of $ 241 (8% growth) stands above the median top-down strategist forecast of $ 235 (6% growth) and reflects our expectation for stronger economic growth and higher profits for the Information Technology and Communication Services sectors, which contain 5 of the ‘Magnificent 7’ stocks,” said a team led by David Kostin, chief U.S. equity strategist, in a note late Friday.

With its new target, Goldman falls in step with some of Wall Street’s most bullish forecasters — Oppenheimer’s John Stoltzfus and Fundstrat’s Tom Lee who also see a 5,200 finish after each accurately called 2023’s rally. Ed Yardeni of Yardeni Research is at the top, with a target of 5,400.

It marks the second time Goldman has lifted its S&P 500 target, after a bump to 5,100 from 4,700 in late December. Earlier this year, RBC Capital boosted its S&P 500 forecast to 5,150 from 5,000 and UBS raised its own target to 5,150 from 4,850.

Behind that new forecast is a more bullish economic outlook — Goldman’s economists recently lifted their 4Q/4Q 2024 real U.S. GDP growth forecast to 2.4% due to stronger consumer spending and residential investment. That’s as they expect an S&P 500 forward price/earnings multiple of 19.5 times, slightly below the current 20 times.

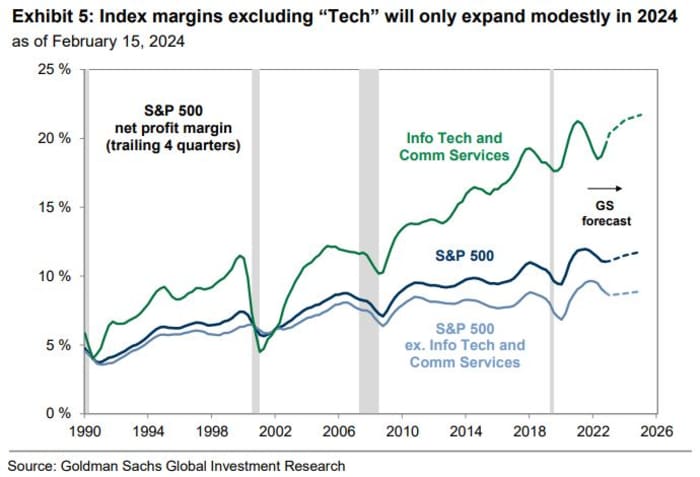

“The nearly-completed 4Q earnings season highlighted the ability of corporates to sustain profit margins despite slowing inflation,” said Kostin and his team.

But the bank’s rosier outlook hinges on the ability of Big Tech to keep performing. Kostin and his team noted how the fourth quarter had “highlighted the ongoing fundamental strength” of the Magnificent Seven stocks — Meta Platforms META, -2.21%, Microsoft MSFT, -0.61%, Apple AAPL, -0.84%, Alphabet GOOGL, -1.58%, Tesla TSLA, -0.25%, Amazon AMZN, -0.17% and Nvidia NVDA, -0.06%.

Analysts have warned that Nvidia earnings, due Wednesday, could mark a “make or break” moment for stocks, with expectations for earnings per share of $ 4.59, a more than 700% surge from the same quarter last year.

Read: Bullish bets on Nvidia, other ‘Magnificent Seven’ members near their most crowded levels in the past year

As Deutsche Bank strategist Jim Reid told clients on Monday, “it’s a reflection of the world we live in that the most important event of the week may be Nvidia’s earnings on Wednesday. It is now the 4th largest company in the world and the best performer in the S&P 500 so far this year (+46.6% YTD), so this will be very important for sentiment.”

Addressing Nvidia earnings directly, Goldman strategists said if the chip maker reports in-line estimates, “the Magnificent Seven will have grown sales by 15% year/year and lifted margins by 582 basis points year/year, leading to earnings growth of 58%.”

The bank expects Information Technology and Communications Services, which contain five of the Magnificent Seven — Meta, Microsoft, Apple, Alphabet and Nvidia — to post the strongest earnings growth among S&P 500 sectors this year. The rest of the index will see some slight improvements, but “to a much smaller degree,” they said.

Goldman added that strength in Big Tech has also driven higher forecasts among its peers, with Magnificent Seven earnings estimates revised up by 7% in the past three months and margins forecasts by 86 basis points. That’s versus 3% and 30 basis points downward revisions to earnings and margins forecasts for the rest of the 493 stocks.

The bank said stronger U.S. growth than expected or continued upside surprises from mega-caps could both be upside risks to their forecasts.

“Likewise, disappointing growth in the macroeconomy or from the largest stocks would create downside risk to our S&P 500 earnings forecasts. In addition, an acceleration in input cost inflation would diminish the outlook for the nascent profit margin rebound and therefore for broad corporate earnings growth,” said Kostin and his team.