Shares of One 97 Communications Ltd. continued to plunge after a bank used by the company’s popular Paytm mobile payments service was effectively shutdown by bank regulators, which prompted J.P. Morgan to recommend investors sell.

The Reserve Bank of India’s actions against PayTM Payments Bank Ltd., announced Wednesday, included not allowing further deposits, credit transactions, utilization of balances by its customers or banking services.

In addition, nodal accounts, or special intermediary accounts used by businesses, of One 97 and Paytm Payments Services Ltd. “are to be terminated at the earliest,” and no later than Feb. 29.

Paytm boasts being India’s “most popular” platform for money transfer, recharges and other online payments.

The RBI’s actions come after an investigation found “persistent non-compliances and continued material supervisory concerns in the bank.”

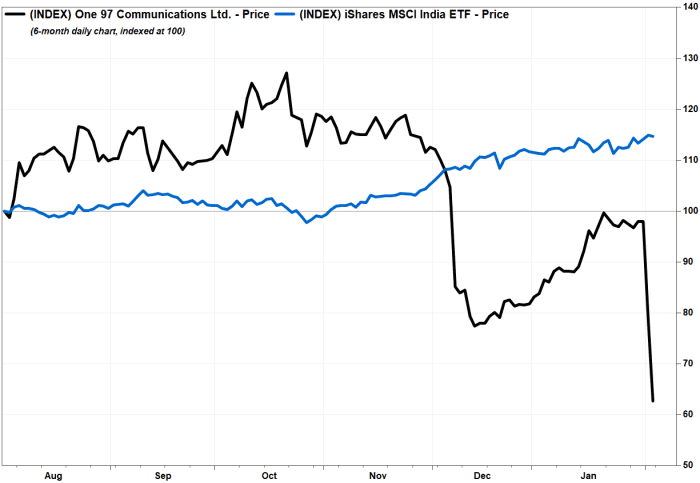

One 97’s stock 543396, -20.00% plummeted 36% the past two days in India trading, to close Friday at a 15-month low, after the RBI’s actions were announced. The stock has plunged 37.3% over the past six months, while the iShares MSCI India ETF INDA has rallied 14.7%.

One 97’s stock plunges after RBI takes action against a bank used by Paytm.

FactSet, MarketWatch

J.P. Morgan analyst Ankur Rudra downgraded the stock to underweight from neutral, and slashed his price target by 33% to INR600.

Rudra’s concern is that the order “materially impacts” Paytm’s payments business, which is 59% of revenue.

“While we don’t believe that the order is an end of the road for Paytm, it materially impacts near term growth, profitability, forces another pivot and necessitates it to restore credibility of durability of the business,” Rudra wrote in a note released to clients on Feb. 1.

Don’t miss: India is winning over investors as Chinese stocks struggle, these charts show.

One 97 said on Thursday that it already works with various banks, not just PayTM Payments Bank, but will now “accelerate” plans to work more with other banks following the RBI’s order.

“Going forward, [the company] will be working only with other banks, and not with Paytm Payments Bank Limited. The next phase of OCL’s journey is to continue to expand its payments and financial services business, only in partnerships with other banks,” One 97 said in a statement.

J.P. Morgan’s Rudra said it “has to be proven” that Paytm can maintain payment margins as it migrates its business to other banks.

“We anticipate this to dent Paytm’s consumer brand credibility that could drive market share losses in segments Paytm dominated in the past,” Rudra wrote.