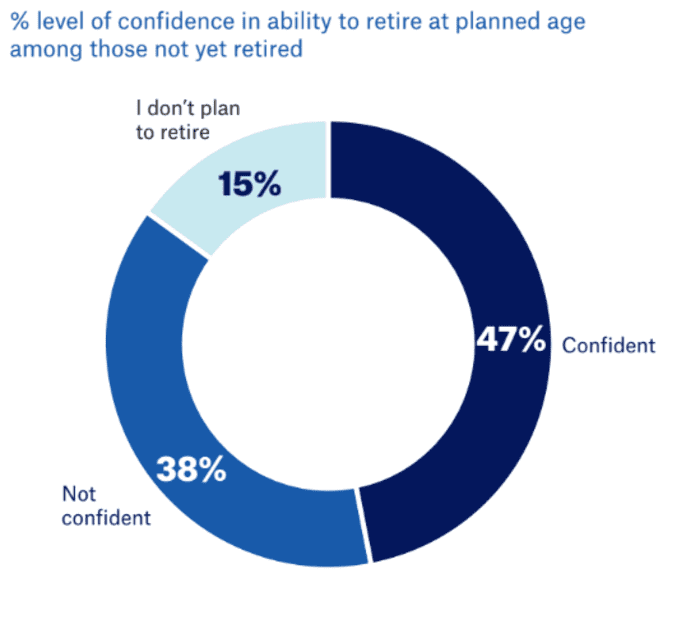

Not everyone believes they will retire one day: 15% of Americans overall said they don’t plan to retire at all, and younger people as a group were less confident than their fellow workers, a new study found.

More than one in five younger Americans have no plans to retire, and 21% of Hispanic participants said the same, according to TIAA Institute’s latest report, “State of Financial Preparedness in a Diverse America.”

The biggest reason to skip retirement? The inability to save enough. Social reasons, such as having a sense of purpose, avoiding boredom and career enjoyment, were also reasons not to retire, participants said.

“If most people are planning for retirement but can’t follow their plans, that’s a call to action for employers, policymakers, financial advisors, retirement services providers and others. We need to better identify the steps we must take to give people the resources they need,” Surya Kolluri, head of the TIAA Institute, said in a statement.

Source: TIAA Institute

Less than half of people still working were confident they’d retire one day. Young Americans and Hispanics were tied for lowest confidence, with more than a third in each demographic responding as such.

The survey included responses from 1,684 adults between the ages of 22 and 75 years old, who represented a mix of demographics, including age and racial and ethnic groups.

TIAA Institute also found Americans had little to no liquid investable savings — 26% of Black participants, 26% of Native American participants and a quarter of Hispanic Americans have none, the survey found — and three in 10 respondents said they’d be unable to pay for a $ 2,000 emergency. People are more likely to have no liquid investable assets (15%) or under $ 50,000 (29%) than to have more than $ 500,000 (19%), the survey found.

Read: Retirement planning for Gen X and millennials: To make it effective, make it bite-sized

For about three-quarters of current retirees, Social Security was the top retirement source, followed by more than half who said employer pensions. But that may not be the case for younger workers — almost half of participants between 22 and 34 years old said they don’t expect to take advantage of Social Security or pensions when they retire.

Two-thirds of people did have a retirement account, such as the 401(k), but almost a quarter of people didn’t know how much they had saved, including 24% of those currently retired and 22% planning to retire.