The residential real-estate asset class only partially acquitted itself over the last two years.

I’m referring to what stock market investors are looking for when considering whether to diversify their portfolio into another asset class: They are hoping that the new asset class can produce a decent long-term return while simultaneously having a low correlation with the stock market. To the extent it lives up to these goals, the net effect of adding it to a stock portfolio will be to reduce risk by more than return is forfeited—resulting in a superior risk-adjusted return.

Historically residential real estate has more than lived up to these goals, actually making money in all but one of the stock bear markets since the 1950s. Unfortunately, this was not the case during the 2022 bear market. And in the bull market since the October 2022 low, the asset class has continued to underperform.

I base these performance numbers on the ETF that appears to come closest to offering individual investors a convenient investment vehicle for gaining exposure to the residential real-estate market: The iShares Residential and Multisector Real Estate ETF REZ. Though the ETF is not a pure play on the residential real-estate asset class, I know of no investment vehicle that comes closer that is also readily attainable to the individual investor.

During the 2022 bear market, REZ produced a total return loss of 29.2%, versus 24.5% for the S&P 500 SPX. And since then, it has gained just 8.3% versus 39.7% for the S&P 500.

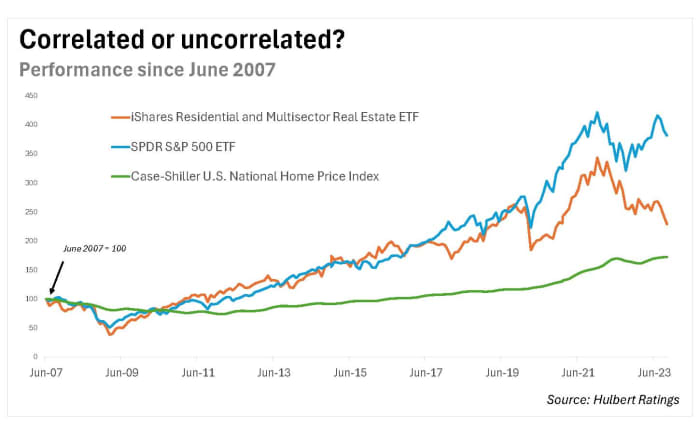

Despite these disappointing returns, it’s still theoretically possible for the REZ to improve a stock portfolio’s risk-adjusted returns—if its returns were sufficiently uncorrelated with those of the stock market. But, as you can see from the accompanying chart, it appears to be highly correlated with the S&P 500. And in this case appearances are not deceiving: Since the REZ’s inception in 2007, the correlation coefficient between its monthly returns and those of the S&P 500 has been a quite high 0.68.

Given this, you won’t be surprised that allocating a small portion of an equity portfolio to REZ does not improve risk-adjusted performance.

There’s still hope

Not all hope is lost, however. That’s because the REZ is an imperfect representation of the residential real-estate market. Its largest current holding, with a 12.5% weighting, is Welltower WELL, +0.11%, a healthcare infrastructure company. Its second largest holding is Public Storage REIT PSA, -0.86%, which operates self-storage facilities. Pointing this out is not a criticism of REZ, since it doesn’t hide its dual focus on both residential as well as “multisector” real estate.

A fund would be far less correlated with the stock market if were a pure representation of the residential estate market. We know that because of the Case-Shiller U.S. National Home Price Index. Over the same period in which the REZ has a 0.68 correlation coefficient with the S&P 500, the Case-Shiller index’s coefficient is just 0.15. (This index is also plotted in the accompanying chart.) You could improve your risk-adjusted performance by allocating a portion of your equity portfolio to the Case-Shiller index.

It’s unfortunate that such a fund doesn’t exist. Until and unless one is created, the asset class represents a tantalizing but unattainable diversifier for equity portfolios.

This doesn’t mean you should not invest in residential real estate. But it does mean that your performance may, and probably will, vary dramatically from that of the asset class itself, due to the myriad idiosyncratic factors that impact the price of a particular piece of real estate.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com.