The Federal Reserve’s 2022 Survey of Consumer Finances (SCF) summarizes changes in family finances between 2019 and 2022 — three years of COVID-19 and economic disruption — and 2022 was also a terrible year in terms of stock and bond returns.

At the same time, the government provided unprecedented fiscal support, employment remained strong, the stock market — even with the drop in 2022 — ended up substantially higher than in 2019, and the 401(k) system continued to mature. On balance, one would expect improved retirement balances between 2019 and 2022 across age and income groups.

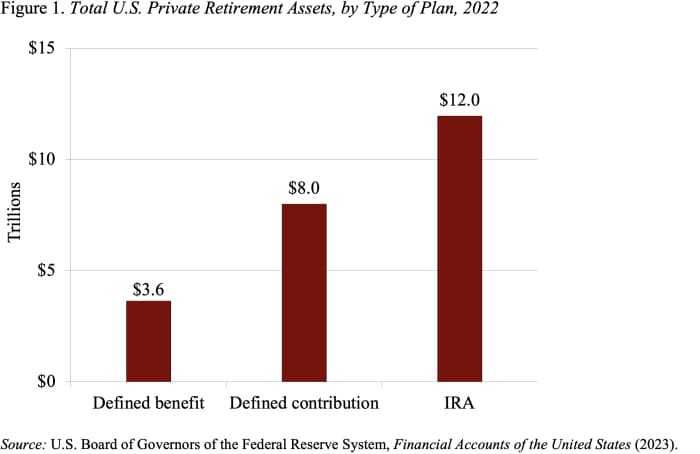

The advantage of the SCF over data on 401(k) plans from financial service firms is that it provides information not only about households’ 401(k) holdings but also about their IRAs, which are predominantly rollovers from 401(k)s and represent the majority of retirement account assets (see Figure 1).

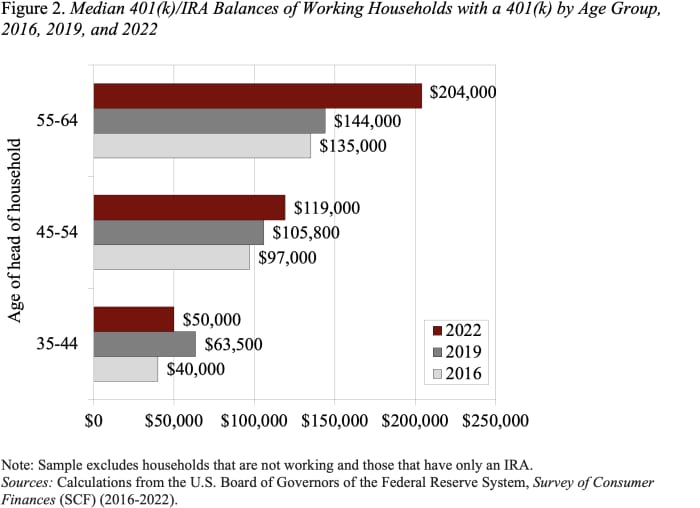

The good news from the 2022 SCF is that 401(k)/IRA balances for older working households with a plan totaled $ 204,000 in 2022 compared with $ 144,000 for comparable households in 2019. (see Figure 2). The news for younger households, however, is less rosy. The median 401(k)/IRA balances for households ages 45-54 increased only from $ 105,800 to $ 119,000: less than the rate of inflation. And the holdings of the youngest group (35-44) actually declined.

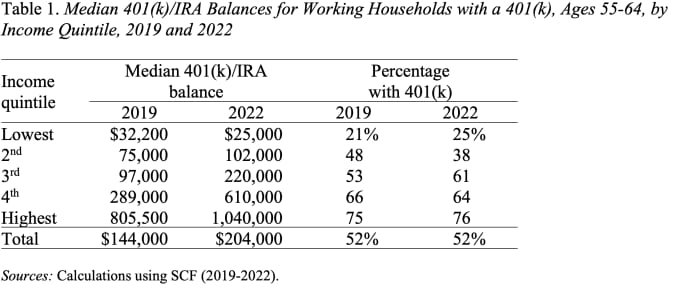

Moreover, the gains in 401(k)/IRA balances were not spread evenly across the income distribution of working households. The middle quintile gained not only in balances but also in the percentage of households with a 401(k) plan. That is clearly good news.

Higher-income households saw even larger percentage increases in their balances, and the share of households with a plan held steady.

For the bottom two quintiles, the news is not good. Either balances dropped or balances increased but the percentage with a plan dropped sharply (see Table 1).

On balance, given the strength of the economy and the gains in the stock market over the three-year period, the 2022 SCF provides a disappointing picture of the retirement assets for working households.

Moreover, the focus is on the 50% of households with a 401(k) plan; the other half of households have nothing but Social Security.

Clearly, ensuring the solvency of Social Security is a high priority.