Options contracts tied to more than $ 5 trillion worth of stocks, exchange-traded funds and indexes are set to expire on Friday as the latest “triple witching” expiration event collides with the rebalancing of the S&P 500 and Nasdaq-100.

The result could be a high-octane, and potentially extremely volatile, session where tens of billions of contracts and shares could change hands, market strategists said.

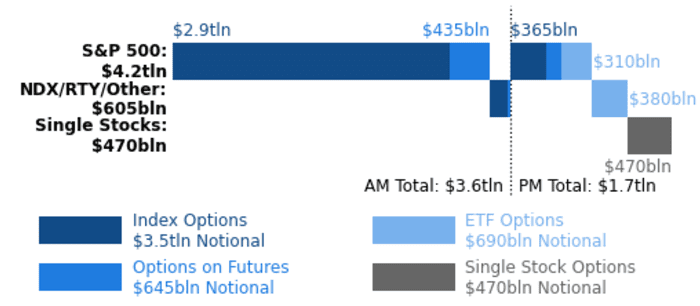

According to figures from Rocky Fishman, founder of Asym500, options with a notional value of $ 5.3 trillion are set to expire, with the biggest slug expiring ahead of the open.

ASYM50

On one side, many traders will be cashing in bullish bets that are deep in the money, while some roll their positions, forcing market-makers to continue to hedge their exposure.

At the same time, managers of index-tracking funds will need to finish adjusting their holdings before the announced index changes take effect.

Already, trading volume has been trending higher all week. In the U.S. market, 17 billion shares changed hands on Thursday, according to Steve Sosnick, chief market strategist at Interactive Brokers, during a phone interview with MarketWatch. That is up from 10.6 billion on Tuesday.

“I expect to see enormous volumes tomorrow in a lot of popular names,” Sosnick said.

“Not only will this one be the largest option expiration of the year (as is typical for December), but it is currently set up to become the largest SPX option expiration in more than a decade,” Fishman said in a report shared with MarketWatch.

Brent Kochuba, founder of Spotgamma, an options-market analytics provider, went even further during a phone interview with MarketWatch: “This might be the biggest options expiration ever.”

ASYM50

As markets have rallied, traders have been scooping up bullish options contracts at a record pace, according to data from Cboe Global Markets, the biggest operator of options exchanges in the U.S.

For S&P 500-linked options, typically the most popular product, 4.8 million contracts changed hands on Thursday, according to Cboe, a new record, surpassing the previous record from Nov. 14.

Also, total call-trading volume for all U.S. equity options exceeded 30 million contracts on Wednesday, according to Goldman Sachs Group, making it one of the busiest days for trading in bullish contracts this year.

Aggressive call-buying over the past month has helped push the S&P 500 to just shy of its record closing high, options-market experts said. The S&P 500 SPX gained 8.9% in November, its best month of 2023, and the 18th best-performing month of the past 73 years. And it has continued to climb in December, having risen 3.3% through Thursday’s close, according to FactSet data.

Earlier this week, options strategists warned that markets might run into trouble at 4,600 on the S&P 500. They warned that a “call wall” of open-interest in bullish contracts around that level could force market makers to put the breaks on the rally.

Instead, bullish traders blew through the call wall, pushing it higher to 4,700, said Kochuba.

The S&P 500 closed at 4,719.55 on Thursday, its highest close since Jan. 12, 2022, according to FactSet data. The index is now sitting within 1.75 percentage points of its record closing high of 4,796.56 on Jan. 3, 2022.

Traders’ bullishness recently helped push the Cboe Volatility Index VIX, otherwise known as Wall Street’s “fear gauge,” to multiyear lows, according to FactSet data.

To be sure, it isn’t just S&P 500 options and contracts tied to popular stocks like Tesla Inc. TSLA, +4.91% seeing explosive volume: Calls tied to the iShares Russell 2000 ETF IWM, which tracks the small-cap Russell 2000, hit 1.35 million contracts, the third-highest ever, according to Goldman. Activity in options contracts linked to small-cap stock indexes has surged since late October.

Heavy call buying has pushed the put-call skew for S&P 500 options to its lowest level in a year, according to data from Goldman Sachs Group.

This shows that investors have been scrambling to buy bullish contracts, while largely shunning bearish ones, as stocks marched higher. Goldman analysts described Friday as “the last major liquidity event of the year” in a note to clients obtained by MarketWatch.

GOLDMAN SACHS

“Triple Witching” days happen once a quarter. They are thusly named because options tied to single stocks, ETFs and indexes will expire, alongside index-tracking futures contracts. Options-market experts say they are typically associated with more intraday swings and higher trading volume.

Making things even more interesting is the fact that the quarterly rebalancing of the S&P 500 and Nasdaq-100 is due to take effect after markets close on Friday.

Normally routine, this quarter’s rebalancing is drawing outsize attention following an extremely rare ad hoc rebalancing over the summer to rein in the influence of megacap stocks in the Nasdaq-100.

Earlier this month, Standard & Poor’s announced its rebalancing plans, which included reducing the weighting of two Magnificent Seven stocks, Apple Inc. AAPL, +0.08% and Alphabet Inc. GOOG, -0.57% GOOGL, -0.48%. At the same time, Amazon.com Inc. AMZN, -0.95%, which is also part of the Mag 7, will see its weighting increased. Meanwhile, three companies will join the index, including Uber Inc. UBER, +0.86%, while shares of three other companies depart.

Kochuba believes Friday’s expiration could remove the last barrier holding stocks back from rocketing to record highs before the end of the year.

“After OpEx, markets will be able to move more freely,” Kochuba said.

Garrett DeSimone of OptionMetrics cautioned that investors shouldn’t place too much weight on options-market activity and other technical factors.

“At the end of the day, macro trumps everything,” he said during an interview with MarketWatch.