For the real-estate sector, 2023 is turning out to be the summer when it all came to a halt.

Mortgage rates have stayed around the 7% range over the last few days, making it more expensive to buy a home for many aspiring homeowners. Even if buyers come to terms with high rates, home listings have been scarce, as homeowners hold out on listing and selling their homes.

So how would one describe the housing market this summer? “Rock bottom,” Glenn Kelman, CEO of Redfin RDFN, -7.59%, a real-estate brokerage, told MarketWatch on an episode of Barron’s Live.

“Sales volume couldn’t be worse. The only people moving right now are the ones who absolutely have to,” Kelman added.

Sales of previously owned homes fell by 3.3% to an annual rate of 4.16 million in June, the National Association of Realtors said Thursday. July data will be released next week.

“‘Sales volume couldn’t be worse. The only people moving right now are the ones who absolutely have to.’”

Even though some buyers are finding good deals, they are purchasing homes at high interests rates, all while home prices have remained relatively steady, Kelman added. “Part of the problem is that there hasn’t really been a break in affordability, and homebuyers really need to catch a break right now,” he added.

As Bill McBride, author of the economics blog Calculated Risk, puts it, with the 30-year fixed interest rate at 7.24%, a $ 500,000 home with 20% down would equate to a rough monthly payment of $ 2,700.

If a home purchaser had bought that half-million-dollar property in August 2022 at 5.25%, the monthly payment would be around $ 2,208.

But if they had bought in August 2021, amid the pandemic, the monthly payment on the $ 500,000 home with a 30-year mortgage rate of 2.99% — with 20% down —would have been $ 1,706.

Glenn Kelman, Redfin CEO, speaking on Barron’s Live: “Apartments are expensive and houses are expensive. So I think household formation is going to be low”

MarketWatch/Barron’s Live

Rising cost of owning a home causing a generational shift

The surge in the cost of owning a home — widely regarded as a key part of the “American dream” — is causing a generational shift, Kelman said.

In the past, when people sought to live on their own, move out of their parents’ place, or transition from living with a roommate to living on their own, they tended to move towards places that had cheaper options.

“People could go across the country. So if a home was too expensive in [Los Angeles], they would be able to buy a $ 300,000 home in Oklahoma City,” Kelman said. “And now that trend is reversed. Apartments are expensive and houses are expensive. So I think household formation is going to be low.”

“It’s sort of an arrested-development problem,” he added.

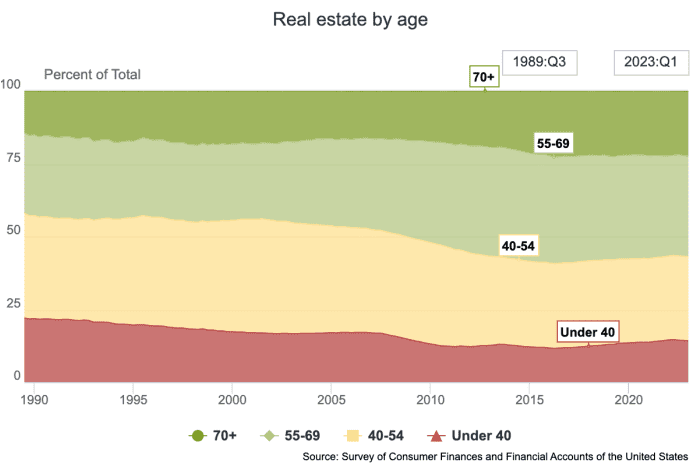

Baby boomers, born between 1946 and 1964, who came of home-buying age in 1991, owned considerably more real estate in their 30s than people in their 30s in 2023. In the first quarter of 1993, those under 40 owned 20.6% of real-estate, according to the Federal Reserve. In the first quarter of this year, those under 40 only owned 14.2%.

Distribution of Household Wealth in the U.S. since 1989

Board of Governors of the Federal Reserve System

Kelman noted the shift in wealth over generations. Younger generations “just haven’t been able to get the leverage to buy a home and home prices have been out of reach,” he added.

That could also push society to defer the American dream of homeownership, as renters stay put for longer before accumulating enough wealth to purchase a home.

“All the money is owned by old people in America and that transfer of wealth that normally happens when people are able to get a piece of the American dream just hasn’t been happening over the past few years,” Kelman stated, “because home prices have been so expensive, and credit has been tight.”