Trading in stock options with extremely limited lifespans is surging to record highs just as the 2023 U.S. stock-market rally is showing signs of stalling.

While in the past this this trade has been associated with subdued volatility in markets, some option-market experts fear the resurgence could set the stage for a selloff in the days and weeks ahead, depending on the reaction to major market-moving news like Thursday’s U.S. consumer-price index report.

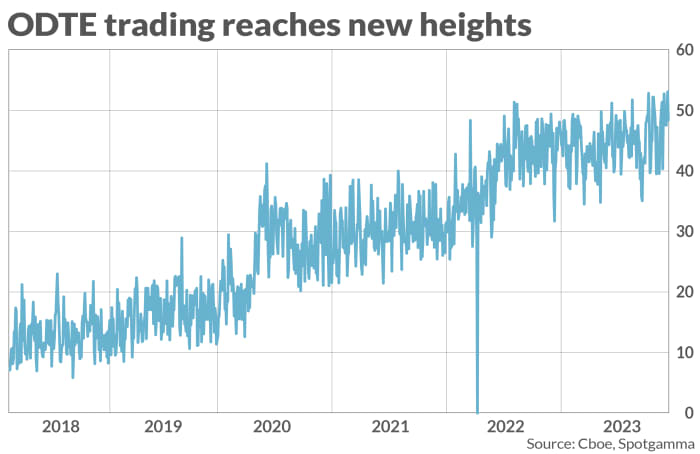

According to data provided to MarketWatch by SpotGamma, a provider of option-market data and analytics, trading in so-called “0DTEs,” shorthand for “zero days until expiration,” touched its highest level on record last Friday, as volume as a percentage of all S&P 500-linked options hit 53%. The figure includes trading on options tied to the S&P 500 index SPX, including those on ETFs like the SPDR S&P 500 ETF Trust SPY.

Cboe, SPOTGAMMA, MARKETWATCH

While 0DTE trading strategies were initially popularized by retail traders on social media like Reddit’s “Wall Street Bets” subreddit due to their risky all-or-nothing nature, the strategy is now overwhelmingly employed by institutional traders as a way to hedge their risk heading into events with potentially serious consequences for markets.

They are also used as part of tactical strategies that aim to profit from intraday swings in markets, option-market experts said.

Peng Cheng, a managing director at JPMorgan Chase & Co. JPM, +0.58%, told MarketWatch that over the past month, only 4.3% of total 0DTE volume has been handled by retail traders, while the rest has been institutional traders and market makers.

U.S. stocks have seen a year-to-date rally stall since the start of August as investors have contended with a disconcerting news. Examples include the Fitch Ratings’ decision to abandon its AAA credit rating on U.S. debt, disappointing economic data from China, and flagging performance by stock market leaders like Nvidia Corp. NVDA, -3.62% and Apple Inc. AAPL, +0.03%

0DTE traders have re-emerged to try to profit from these wider swings, experts said. The strategy received a lot of attention earlier this year for helping to keep stocks locked in a tight range between 3,800 and 4,200 on the S&P 500.

But data show volume tapered off in June after the S&P 500 index saw a decisive break above 4,200 as the 2023 stock-market rally accelerated. More recently, volumes have started to bounce back as the rally has slowed.

Brent Kochuba, founder of SpotGamma, which provides options data and analytics, said elevated 0DTE volatility is typically associated with mean reversion.

That is, heavy 0DTE flows have a tendency to spark intraday reversals in markets as traders and market makers try to push the market to their advantage. For example, last Friday, the spike in 0DTE volume coincided with a selloff that pushed stocks into the red during afternoon trading in New York. A similar dynamic was on display on Wednesday, as stocks reversed early losses.

Kochuba said SpotGamma data suggest 0DTE strategies could keep the market “pinned” to the 4,500 level on the S&P 500.

“When we look at the intraday flow, there has been this flow that’s pushed mean reversion around 4,500,” Kochuba said during a phone interview with MarketWatch. “When the market tried to rally over 4,500 on Friday, a large 0DTE flow emerged and smacked the market back down.”

However, two top option markets strategists at Oppenheimer & Co. fear that overlapping crowded positions in derivatives markets that profit from a phenomenon known as “volatility suppression” could tip over into a selloff should the Cboe Volatility Index, otherwise known as the Vix or Wall Street’s “fear gauge,” continue to climb, as it has over the past week.

0DTEs are known for suppressing expectations about how volatile the market might be as measured by the Vix, since 0DTE trading volumes aren’t factored into the fear gauge. That could in theory increase the likelihood that markets are blindsided by a sudden outbreak of volatility.

See:A complicated options trade that has helped prop up U.S. stocks is starting to unravel

Alon Rosin and Sam Skinner at Oppenheimer told MarketWatch during a phone interview that the market has recently tested the daily ranges within which option market makers expect it to trade. One example he cited was Aug. 2, the day after the Fitch U.S. credit-rating cut, when the S&P 500 saw its biggest pullback since April.

When this happens, it increases the risk that market makers will need to rapidly hedge their positions, potentially sparking a sudden surge in the Vix and corresponding selloff in stocks.

What’s more, the trajectory of stocks and stock futures over the past week is sending a signal that could portend a further move to the downside.

“We’ve seen lower session lows in U.S. stock futures during five of the last six days,” Skinner said during the phone interview. “That’s not good.”

MarketWatch reached out to several option market-makers for comment, including Wolverine Trading, Optiver and Akuna Capital, but didn’t receive a response.

Other analysts have raised concerns about the potential for 0DTEs to exacerbate market stress during periods of panic, an issue that MarketWatch explored in a story published earlier this year.

See: A potential stock-market catastrophe in the making: The popularity of these risky option bets has Wall Street on edge

Back in February, a top quantitative analyst at JPMorgan warned clients that 0DTEs could potentially spark “Volmageddon 2.0.” The original “Volmageddon” occurred on Feb. 5, 2018 as a popular short-volatility trade in derivatives markets collapsed, causing the collapse of an ETF that allowed retail traders to profit from bets that implied stock-market volatility would fall.

See: Another ‘Volmageddon’? JPMorgan becomes the latest to warn about an increasingly popular short-term options strategy.

On that day, the Vix roughly doubled to nearly 40 while the Dow Jones Industrial Average DJIA fell by more than 1,175 points. At the time, it was the biggest daily point decline on record for the blue-chip index.

“We’ve really only seen these options trade during a low volatility regime,” said Garrett DeSimone, head of quantitative research at OptionMetrics, a provider of analytics tied to the option market, during a call with MarketWatch.

“It is going to be really interesting to see what happens when you have a day where you have a 30+ reading on the VIX,” he said.

The S&P 500 SPX was on track to finish modestly lower on Wednesday after paring earlier losses. It was off 0.2% at 4,491 in recent trade, while the Nasdaq Composite COMP was down 0.6% at 13,802.

Meanwhile, the Dow DJIA was down 20 points, or 0.1%, at 35,289.