Personal assistants such as Alexa and Siri are being offered by the biggest names in technology, and Morgan Stanley analysts said Wednesday that one company should be favored to take a big chunk of that market as artificial intelligence adds to their capabilities.

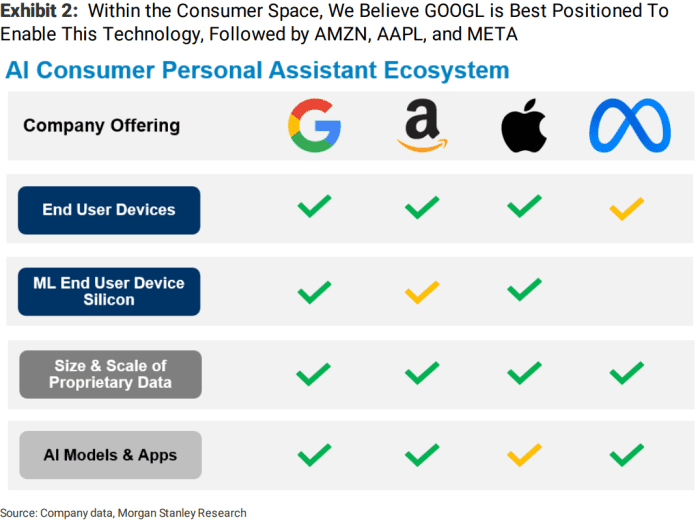

Morgan Stanley analysts think Alphabet Inc.’s GOOG, +0.87% GOOGL, +0.81% Google is best positioned on the hardware, data and AI tech fronts, as Amazon.com Inc. AMZN, -1.71% and Meta Platforms Inc. META, -0.84% AIs need “behavior changes…to lead,” and Apple Inc.’s AAPL, -0.54% AI play still faces “uncertainty.”

Current assistants like Amazon’s Alexa, Google’s Assistant and Apple’s Siri have had “limited” commercial and consumer adoption, the analysts said, but they see assistants driven by large language models, or LLMs, “changing this…with these tools enablers of the structural acceleration in online consumer spend and online ad growth we see coming from AI.”

“We see transformer models and large language models (LLMs) leading to the development of next-gen AI assistants with increased personalization, incremental use cases (interactive search and cross-sector online shopping with follow ups, improved personalization and recommendations, calendar management/scheduling, automated actions/task completion, monitoring of health status and financial condition, improved education/tutoring, and more) and higher consumer utility,” Morgan Stanley analysts — Brian Nowak covers Amazon, Alphabet and Meta, while Eric Woodring covers Apple — wrote in the note.

The analysts see AI as a “$ 6 trillion opportunity,” but believe that competing and winning in the assistant category will require three essentials: Hardware, proprietary data and AI investment/capabilities. Here are how the four Big Tech companies break down in those regards, according to the analysts.

Google has about 3 billion users on an estimated 2.6 billion Android devices and 350 million from other devices, the analysts said, but data is “a key differentiator.”

“YouTube, Google Maps and productivity tools like Gmail is industry leading,” Morgan Stanley said. Plus, Google “has existing partner/developer relationships through its AI developer tools that we expect to further its data-set and reach over time,” while “state-of-the-art LLMs and multimodal models such as LaMDA, PaLM, and MUM are likely to be differentiated to build personal assistants on top of.”

Morgan Stanley’s note coincided with Google’s I/O 2023 developer conference Wednesday, in which executives touted Google’s AI developments and plans.

Read also: Google developers conference is all about AI, as in email-generated refund requests, maps, work documents

Amazon

Amazon has the largest one-person consumer-purchase dataset and expanding AI capabilities, but its “hardware lags best of breed” even with 400 million devices, compared with Google and Apple, analysts said.

Meta Platforms

Meta Platforms has the user reach, data and AI expertise, the analysts wrote, but is woefully deficient in hardware.

“While Meta does not have a large hardware-installed base, its reach is underscored by 3 billion Daily Active People across its family of apps,” Morgan Stanley said.

Meta has about 3.8 billion active monthly users globally between Facebook and Instagram, and 1.8 billion on WhatsApp, the firm said, citing IDC figures.

Apple

Meanwhile, Apple is “positioned to deliver a broad-based personal AI assistant, but AI model capabilities are less clear.”

Hardware is not a problem, with about 2 billion devices — roughly 1.2 billion of those iPhones — and most of those are compatible with Siri, which is well-positioned to be integrated with LLMs, and Apple has a ton of user data.

The lack of any performance data on Apple’s AI capabilities are still a question mark, however.

“Little has been said around whether Apple is building its own LLMs, or if they’ll decide to partner with an open-source vendor such as StabilityAI,” Morgan Stanley said.

Morgan Stanley

All four companies have been seeing stock gains this year, as excitement for generative AI has ramped up. Apple’s stock is up 33.6% in 2023, Facebook parent Meta has nearly doubled with a 93.7% gain, Alphabet shares have increased 26.7% and Amazon’s stock is higher by 31.2%. For comparison, the S&P 500 index SPX, -0.16% has gained 7.3% so far this year, while the Dow Jones Industrial Average DJIA, -0.03% is up 1.3%.