For those who park their money in savings accounts, there’s been nothing but good news lately as interest rates climb ever higher. Just a few years ago, it was getting difficult to find banks that paid more than 1%. Now, some are offering rates that top 4%.

But many Americans are failing to take advantage of the situation — and they are losing out on the ability to earn hundreds, if not thousands, of dollars in interest annually.

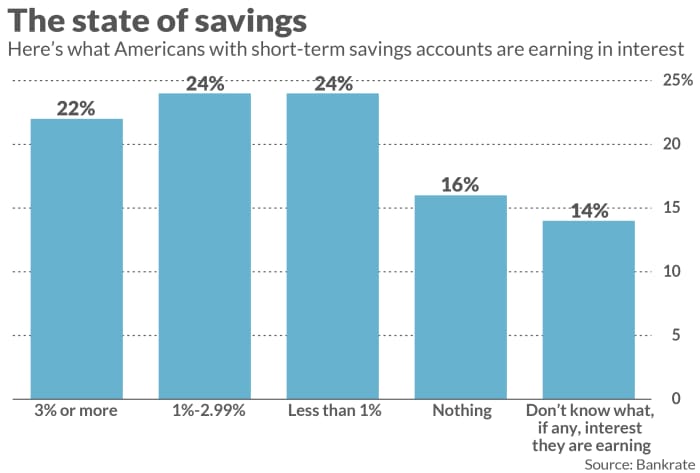

That’s the key finding from a new Bankrate survey. It noted that just 22% of those with a savings account are earning 3% or more, while 24% are earning less than 1%.

And 16% are earning nothing.

In fact, some don’t even seem to care what their bank is paying out: Bankrate said it found that 14% “don’t know what, if any, interest they are earning” on their savings.

And keep in mind that these are people who have savings accounts. As Bankrate also noted, 33% of Americans overall lack any short-term savings, period.

So, why aren’t more Americans being savvier when deciding where to put their money? Bankrate chief financial analyst Greg McBride told MarketWatch that different factors are to blame.

The high-yield savings accounts are typically online-only ones — and some savers may want the comfort of knowing that they can visit a local branch, he said. But McBride points out that savings accounts are usually linked to checking accounts — so savers can still opt to have their checking with an institution that has a brick-and-mortar presence, while earning more interest with their savings online.

“We’re not talking about moving all your accounts to an online bank,” McBride said.

Another factor may be just sheer inertia, McBride noted. That is, people often stick with the same bank because it’s a matter of comfort. Or, as McBride said, they had become so accustomed to rates being so meager for so long that they stopped looking for better opportunities.

“We got lulled to sleep in an environment of low-interest rates,” he said.

Clearly, that’s no longer the case. And McBride said it’s all the more disappointing that Americans aren’t seizing the opportunity to switch to banks offering higher rates when many of the institutions feature what he calls “no excuses” accounts — meaning ones that don’t even require a minimum deposit.

Brent Weiss, head of financial wellness at Facet, a firm that offers financial advice via an annual membership, said the Bankrate survey speaks to “a financial literacy crisis” — one that costs Americans billions of dollars each year simply because of their lack of knowledge.

“Unfortunately, we are treating it like the climate crisis,” Weiss said. “The data is real. The science is real. And yet we aren’t taking this threat to the financial health of everyday Americans seriously.”