Is stubbornly persistent U.S. inflation on the verge of a sharp slowdown? Some tantalizing hints point in that direction.

For one thing, wholesale prices have tracked lower and suggest inflation is easing more rapidly in the guts of the economy.

The cost of imports, meanwhile, have fallen sharply since last summer.

And consumers also expect inflation to wane, surveys show.

Prices are still rising too rapidly, of course, to ease the heavy financial burden on Americans or to mollify the Federal Reserve, the agency entrusted with keeping inflation in check.

The Fed is raising interest rates to snuff out inflation, adding to consumers’ misery. The central bank is expected to raise rates again next week.

“Inflation continues to be somewhat sticky, and that is why we continue to believe that the Fed has further tightening to do,” said economist Giampiero Fuentes of Raymond James.

To wit: The cost of living as measured by the consumer price index has climbed a sharp 6% in the past year.

While the rate of inflation is down from a 40-year peak of 9.1% last summer, prices are still rising more than three times as fast as they did in the decade before the pandemic.

The Fed is aiming to get inflation back down to its target of 2% a year, but even the central bank thinks it could take a few years to achieve its goal.

Could inflation fall even more rapidly than that? A very small but growing number of Wall Street DJIA, -1.19% SPX, -1.10% economists think it’s possible.

They point to easing global supply-chain disruptions that contributed heavily in 2021 to the worst inflation outbreak in decades. As supplies move more freely, price growth has slowed.

Higher interest rates are also doing their part to slow the economy, they point out, most notably in rate sensitive areas such as housing. Home sales and construction have slumped due to high mortgage rates.

The sudden collapse of California’s Silicon Valley Bank, for its part, could lead to a credit crunch of sorts in which U.S. financial institutions cut back on lending to safeguard their own interests. Less lending typically slows demand and eases the upward pressure on prices.

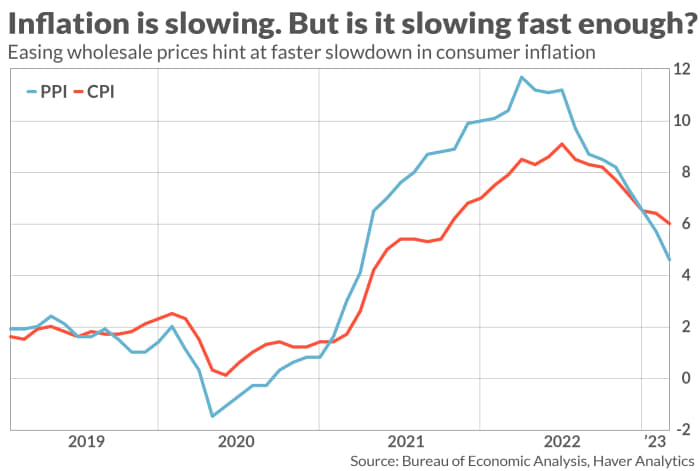

The signs of slower inflation are most evident in U.S. wholesale prices. Changes in wholesale costs tend to be foreshadow changes in consumer inflation, as the accompanying chart shows.

The so-called producer price index peaked at a yearly rate of 11.7% last summer and has slowed rapidly since then. Wholesale costs fell in February for the second time in three months to drag the yearly increase down 4.6%.

The last time wholesale inflation was that low was almost two years ago.

“The drop in producer prices in February should feed through to consumer prices over time and help lower consumer inflation in the months ahead,” said Scott Anderson, chief economist of Bank of the West

Even better, the cost of partly finished goods and raw materials are showing even more progress. Consumer prices are determined in large part by these costs.

Prices of partly finished goods have fallen in seven of the past eight months and they are up just 2.1% in the past year. These prices peaked at a whopping 26.6% annual rate about a year and a half ago.

The cost of raw materials have also fallen rapidly since last fall. Prices are down 11% in the past year.

Granted, a reversal in high oil prices since last summer have helped a great deal to ease inflation. But the runup in oil prices after the Russian invasion of Ukraine in early 2022 also played a big role in exacerbating inflation.

Lower oil prices have also spurred the reversal in the cost of imported goods, another release valve for U.S. inflation.

The anxiety over the U.S. financial system after the Silicon Valley Bank failure is another potential source of disinflation. As banks batten down the hatches and reduce lending, the decline in demand will also put downward pressure on prices.

“Even if the contagion doesn’t worsen, it will have an adverse impact on the real economy via a tightening in bank lending standards,” said Paul Ashworth of Capital Economics, one of the economists who thinks inflation is set to decline rapidly.

The battle against inflation is still in the early stages, however, and far from over. Prices have appeared read to decline rapidly a few times before only for inflation to intensify. So stay tuned.