If you pay a 1% management fee for a financial professional to handle your finances, you likely expect that advice to yield far more than it’s costing you. But how would you know?

There’s no one quantifiable measure of success for all the components that go into financial planning. Some research papers have tried to put a number on it, like 1.5% of assets, or so forth, but that’s mostly for investment performance. If you pay in any capacity for financial advice, you’re also going to get services like retirement and tax planning, investment selection and estate planning. Beyond that, there are economic factors at work that are out of the control of individuals, even ones who are supposed to have training and expertise in the field.

Your adviser could have done a fantastic job in 2022 and you still lost money because both stocks and bonds were down significantly. In the past, that same person could have been doing a lousy job and you might still have made far more than you were paying. And in the future? There’s simply no way of knowing.

“People have tried to say how many basis points of value you get from financial advice, but it’s so dependent on an individual’s particular circumstances,” says Roger Young, thought leadership director at T. Rowe Price. “How much do you benefit from the huge category of coaching and behavioral improvement? It’s very hard to measure.”

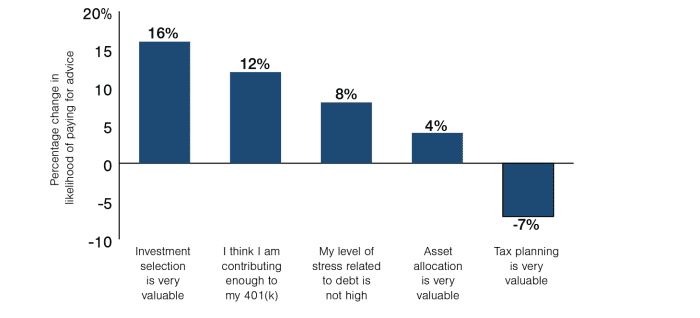

T. Rowe Price went through an exercise to try to see how customers value financial advice as a way of trying to identify the predictors of what would get people to pay for advice. The survey results show that people tend not to place much value on the financial planning services that are hardest to see a monetary return, like day-to-day money management, goal-setting and ongoing help and coaching.

Retirees were far more likely to pay for financial services than people still working, with 45% paying versus just 26%. Those retirees who were already working with advisers were most interested in investment management—investment selection, asset allocation and rebalancing.

Those services, not coincidentally, are the ones where it’s most easy to see a quantitative return on investment, especially at higher income levels. “You can show stats of how well we’ve done, and that’s an area where we can see evidence of the value of using an asset manager that can potentially exceed fees we pay,” says Young.

The tax planning conundrum

Surprisingly, tax planning fell low on the list of things people want to pay for, especially when T. Rowe Price did statistical analysis of the survey results.

Subjective Responses Most Highly Related to Paying for Advice (compared with only considering paying)

Source: T. Rowe Price

“For people still working, tax planning was second-highest in terms of being rated as very valuable, but at the same time, when you control for everything else, valuing tax planning didn’t drive people to seek advice and was kind of a negative,” says Young.

While T. Rowe Price didn’t capture a definitive reason for this, Young surmises that it’s because people don’t think of tax planning as part of financial planning, and think of it mostly as in-the-moment help filling out their yearly tax forms.

“Tax planning is definitely important to people,” says Young. “It’s a matter of where they are going to get that help.”

Is anyone listening?

Financial planning is also a matter of the client heeding the advice given, and maybe that’s where some of the perceived value gets lost for the behavioral aspects that scored low on T. Rowe Price’s study. Just hiring a professional is not enough; the client has to understand the advice and implement the suggestions in order to judge if it’s worthwhile.

“That’s where the rubber meets the road,” says Cary Carbonaro, a certified financial planner and director of women and wealth for Advisors Capital Management Wealth Services. “My job is to let you sleep at night and help keep you from making bad decisions.”

But not everyone listens, Carbonaro has found, and those clients keep her up at night. “Sometimes you can’t get through to them. That just kills me. I just eat myself up over it,” she says. “They’ll sell when the market’s down, cash out IRA and pay penalties and taxes because they want to buy something. They’ll put their whole life and future in jeopardy.”

During the market dip of 2020, she was able to convince 11 out of 12 clients who wanted to cash out to stay invested. The ones who listened ended up rebounding and were happy. The 12th, not so much. Last year, everyone lost money, despite Carbonaro’s best efforts.

“If I‘m just being judged on market performance, it’s hard. But I believe I’m doing more,” says Carbonaro. “If you listen to me and I can talk you out of the bad ideas, I will keep you on track for the rest of your life and you will meet your goals.”