Nifty closed the week, around 17,562, losing about 2.75 percent. During the week, the index gyrated between 18,112-17,510. On the OI (open interest) front, a short build-up was witnessed in the Nifty Jan Futures in the last week as there was an increase in OI, with losses witnessed on weekly closing basis.

On the other hand, the Bank Nifty Futures lost about 3.13 percent as it closed the week at 40,145. Bank Nifty Futures oscillated between 39,870-41,540 and ended the week with a loss.

Further diving into the Nifty upcoming weekly expiry, Nifty immediate resistance stands at 17,600 levels where nearly 96.16 lakh shares are the open interest followed by vital resistance at 18,000 levels where about 76.30 lakh shares are the open interest. On the lower side, the immediate support level is at 17,400 where nearly 40.31 lakh shares are the PE options open interest followed by 17,000 where nearly 54.41 lakh shares are the PE options open interest.

Looking at the Bank Nifty’s upcoming weekly expiry data, on the upside, immediate and vital resistance is at 41,000 where nearly 24.91 lakh shares are the CE open interest, whereas, on the lower side immediate and vital support is at 39,000, about 15.34 lakh shares, which is the PE open interest. At 43,000, about 37.96 lakh shares of CE open interest are present. At the ATM strike of 40,000, CE OI was 39.50 lakh shares and PE OI was about 32.03 lakh shares.

India VIX, fear gauge, increased to 14.19 over a week-to-week basis from 13.09. Further, any uptick in India VIX could start the downward move in Nifty and vice-versa.

Looking at the sentimental indicator, Nifty OI PCR for the week has decreased to 0.785 from 0.876. Bank Nifty OIPCR over the week decreased to 0.62 from 0.602 compared to last Friday. Overall data indicates PE writers are less aggressive than CE writers in Nifty.

Moving further to the weekly contribution of sectors to Nifty. Private Bank contributed negatively by -105.56 points, while NBFC and IT contributed negatively by -57.96 and -45.54 points, respectively. Oil & Gas also contributed negatively to Nifty by -32.65 points.

The only sector that contributed positively by 9.22 points to Nifty was Power.

Auto and metal contributed negatively to Nifty by about -25.34 and -18.39 points, respectively. Pharma, cement and PSU Bank contributed negatively to Nifty too.

Nifty monthly rollover stands at 63.59 percent in February to March series expiry, while Bank Nifty rollover stands at 80.99 percent in February to March series expiry.

MRF has the highest stock-wise rollover of 95.48 percent followed by AU Small Finance Bank and MCX with rollover standing at 95.39 percent and 94.68 percent, respectively, while SBI Life has the lowest rollover of 56.94 percent followed by Syngene and Hindalco with rollover standing at 56.95 percent and 63.40 percent, respectively.

Looking towards the top gainer & loser stocks of the week in the F&O segment. GAIL topped by gaining over 8.2 percent, followed by IEX 6.6 percent, Gujarat Gas 5.3 percent. Whereas Adani Enterprises lost -23.5 percent, Aditya Birla Fashion has lost over -11.7 percent, Indiabulls Housing Fianance lost -9.8 percent over the week.

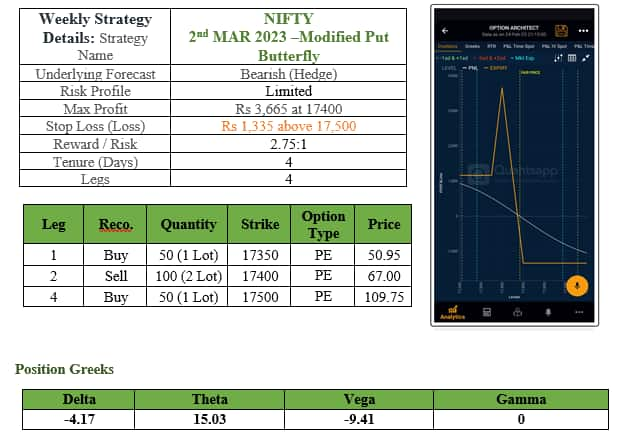

The upcoming week can be approached with a low-risk strategy like a modified Put Butterfly in Nifty.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.