Cartier, made famous by the sisters’ jangling Love Bangles, is in the sights of LVMH Moet Hennessy Louis Vuitton SE, according to Swiss paper Finanz und Wirtschaft. (Source: Bloomberg)

Just days after Louis Vuitton tapped Pharrell Williams to be its top menswear designer, might it now have its eye on the Kardashians, too?

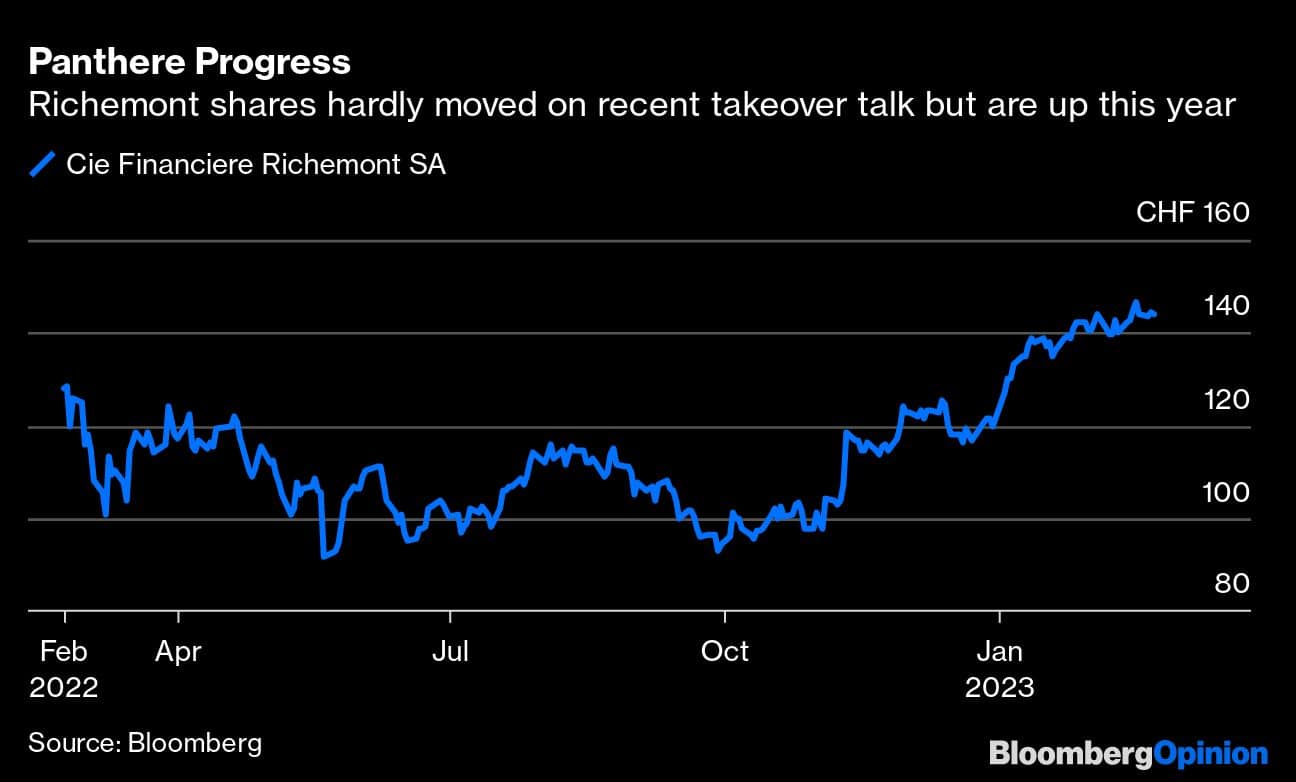

Cartier, made famous by the sisters’ jangling Love Bangles, is in the sights of LVMH Moet Hennessy Louis Vuitton SE, according to Swiss paper Finanz und Wirtschaft. There are “whispers” in the luxury industry of a potential takeover of Cartier-owner Cie Financiere Richemont SA by LVMH, it said. All parties have so far declined to comment.

But if Johann Rupert, who controls Richemont, should ever decide to sell, Gucci-owner Kering SA would be the better choice.

For Bernard Arnault, founder and chief executive officer of LVMH, acquiring Cartier would be a once-in-a-lifetime opportunity. It would complement Tiffany, which joined the luxury stable two years ago. Alongside Richemont’s Van Cleef & Arpels and LVMH’s Bulgari, Arnault’s group would become a jewelry powerhouse. Add in the fashion and leather goods names, and it would be in a different stratosphere to every other luxury player.

What a legacy that would make for Arnault, who recently appointed his daughter Delphine to run Dior, its second-biggest brand.

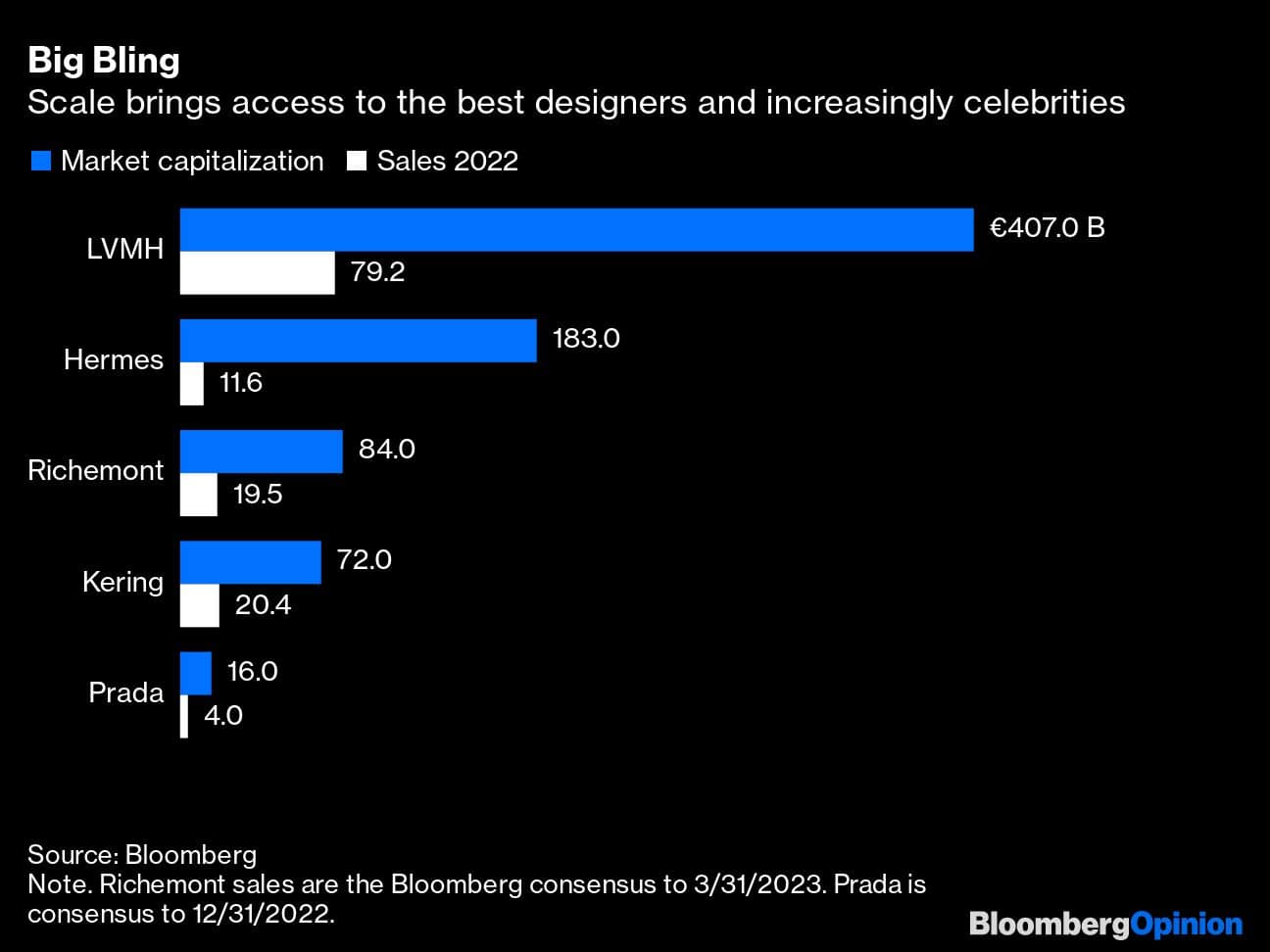

LVMH, with a market capitalization of over €400 billion ($ 424.2 billion), could afford it. Assuming a 30% premium, acquiring Richemont would cost about €110 billion. An all-cash deal might be a stretch, pushing LVMH’s leverage well above its historic levels. But the company could pay with a mixture of cash and shares. After all, its stock is trading close to an all-time high.

As for Rupert, who owns 10% of Richemont shares and 51% of the voting rights, a deal would resolve any future succession issues. Only one of his three children, Anton, is involved in the business. Rupert said last year that Anton was on the board to ensure that the company made decisions for the long-term, and his son would not become an executive.

Selling out would entrust Richemont’s brands — and employees — to the luxury leader, whose strength is transforming heritage names from classic to cutting edge. Like Rupert, Arnault takes decisions for the next decade, not the next quarter. And assuming a part-stock deal, the Rupert family would still be able to share in the upside.

In this scenario, Kering would clearly be disadvantaged. Already, it is grappling with how to revitalize Gucci after its bold maximalism fell out of style. Balenciaga, another star of the company, is on the back foot following a controversial advertising campaign.

Its best hope of bulking up, should Richemont be off the table, would be combining with other independent houses, such as Hermes International, Prada SpA or privately held Chanel. But none of these combinations looks easy or available.

A deal between LVMH and Richemont may face some competition constraints, of course. And Kering CEO Francois-Henri Pinault has a decent shot at persuading Rupert that their companies would make better partners.

A combination would marry Richemont’s jewelry sparkle with Kering’s fashion flair. The latter would also become less dependent on Gucci, which accounted for more than 50% of its sales and almost 70% of operating profit last year. It would also be interesting to see what Kering, master of reinvention, might be able to do with Richemont’s Chloe and Alaia fashion houses. Thanks to a deal to sell a majority stake in Yoox Net-a-Porter, Richemont is no longer saddled with the online retailer’s losses, removing a potential stumbling block.

Kering could not afford to pay cash for Richemont, but the two companies have similar market capitalizations, so they could merge with little or no cash changing hands.

Of course, egos and family shareholdings must be managed. But it helps that the Rupert and Pinault families already cooperate on Kering eyewear, and co-invested in online retailer Farfetch Ltd. That could make an accord easier. Analysts at Bernstein said recently that a deal could be constructed in a way gave the two families similar amounts of power.

Rupert has said several times that Richemont is not for sale. But with scale bringing trophy stores, star designers and increasingly celebrity tie-ups, there is a question mark over how long he can resist.

He usually takes decisions not just for today but for tomorrow too. Whichever path he chooses will determine the shape of the luxury landscape for decades to come.

Andrea Felsted is a Bloomberg Opinion columnist covering consumer goods and the retail industry. Views are personal and do not represent the stand of this publication.

Credit: Bloomberg