Small-cap stocks are outperforming large-cap U.S. equities this year, in an upbeat start to 2023 after suffering steep losses last year.

The Russell 2000 index, which tracks small-cap stocks in the U.S., was up 7.1% this year through Friday, according to FactSet data. That beats the 4.2% gain for the S&P 500, a gauge of large-cap stocks in the U.S., over the same period.

“Typically you get these long cycles where small or large leads, and we’re just coming out of an 11-year period where large beats small by a meaningful amount,” said Rayna Lesser Hannaway, a portfolio manager at Polen Capital who focuses on small-cap stocks, in a phone interview.

“Small-cap just looks really attractive on a relative valuation basis,” she said. “Small-cap typically tends to lead in the second half of interest-rate tightening cycles.”

The Russell 2000 RUT, +0.58% has also outperformed the blue-chip index Dow Jones Industrial Average and technology-laden Nasdaq Composite this year through Friday.

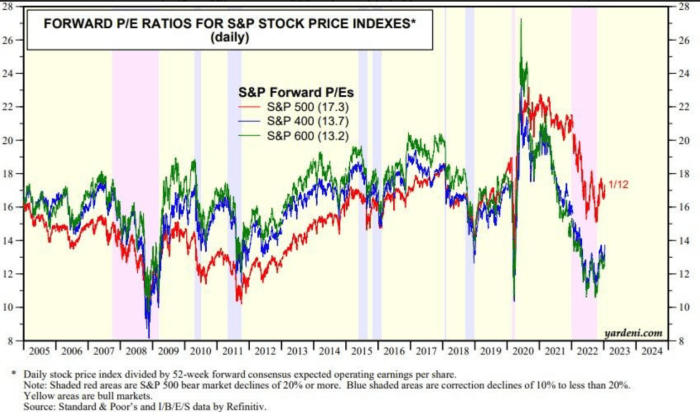

Small and mid-cap stocks “anticipated the bear market of 2022 back in 2021 as their valuation multiples plunged well ahead of the drop in the forward P/E of the S&P 500,” according to a Yardeni Research note Friday.

Forward price-to-earnings ratios, or P/E, for small and mid-cap stocks “seem to have bottomed during the bear market and may now be pointing higher,” Yardeni said in the note. “They are certainly cheap” relative to large-cap stocks.

A chart in his note highlights the valuation of the S&P Small Cap 600 index SML, +0.56% relative to the S&P 500.

YARDENI RESEARCH NOTE DATED JAN. 13, 2023

Last year the Russell 2000 dropped 21.6%, with losses exceeding the S&P 500’s 19.4% drop, according to FactSet data. The S&P Small Cap 600 fell 17.4% in 2022.

“It’s important to be discerning,” said Lesser Hannaway.

“In this past year, there’s been a lot of higher-quality, small growth companies that have both fiscal discipline and managerial experience” to continue to grow even in a “tough” environment, she said. “That’s been largely ignored by the market as these stocks experienced a really significant drawdown without a lot of focus on the individual company fundamentals.”

The U.S. stock market ended higher Friday as investors digested fourth-quarter earnings results from big banks.

The Dow Jones Industrial Average DJIA, +0.33% closed 0.3% higher, while the S&P 500 SPX, +0.40% rose 0.4% and the Nasdaq Composite advanced 0.7%, according to FactSet data. All three major benchmarks booked back-to-back weekly gains.

As for small-cap stocks, the Russell 2000 and S&P Small Cap 600 each ended 0.6% higher Friday. Both indexes also rose for a second straight week this year, with the Russell 2000 scoring a weekly gain of 5.3% to outperform the S&P 500’s 2.7% weekly rise.