Rising cases of Covid infection in several countries, fear of further tightening of key policy rates by the Federal Reserve, and a growth threat of recession-like situation pose challenges for markets around the world

Sunil Shankar Matkar

December 26, 2022 / 09:57 AM IST

‘); $ (‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]); //if(resData[stkKey][‘percentchange’] > 0){ // $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); // $ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); //}else if(resData[stkKey][‘percentchange’] < 0){ // $ (‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”); // $ (‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”); //} if(resData[stkKey][‘percentchange’] >= 0){ $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); //$ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); $ (‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”); }else if(resData[stkKey][‘percentchange’] < 0){ $ (‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”); //$ (‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”); $ (‘#gainlosstxt_’+articleId).find(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”); } $ (‘#volumetxt_’+articleId).show(); $ (‘#vlmtxt_’+articleId).show(); $ (‘#stkvol_’+articleId).text(resData[stkKey][‘volume’]); $ (‘#td-low_’+articleId).text(resData[stkKey][‘daylow’]); $ (‘#td-high_’+articleId).text(resData[stkKey][‘dayhigh’]); $ (‘#rightcol_’+articleId).show(); }else{ $ (‘#volumetxt_’+articleId).hide(); $ (‘#vlmtxt_’+articleId).hide(); $ (‘#stkvol_’+articleId).text(”); $ (‘#td-low_’+articleId).text(”); $ (‘#td-high_’+articleId).text(”); $ (‘#rightcol_’+articleId).hide(); } $ (‘#stk-graph_’+articleId).attr(‘src’,’//appfeeds.moneycontrol.com/jsonapi/stocks/graph&format=json&watch_app=true&range=1d&type=area&ex=’+stockType+’&sc_id=’+stockId+’&width=157&height=100&source=web’); } } } }); } $ (‘.bseliveselectbox’).click(function(){ $ (‘.bselivelist’).show(); }); function bindClicksForDropdown(articleId){ $ (‘ul#stockwidgettabs_’+articleId+’ li’).click(function(){ stkId = jQuery.trim($ (this).find(‘a’).attr(‘stkid’)); $ (‘ul#stockwidgettabs_’+articleId+’ li’).find(‘a’).removeClass(‘active’); $ (this).find(‘a’).addClass(‘active’); stockWidget(‘N’,stkId,articleId); }); $ (‘#stk-b-‘+articleId).click(function(){ stkId = jQuery.trim($ (this).attr(‘stkId’)); stockWidget(‘B’,stkId,articleId); $ (‘.bselivelist’).hide(); }); $ (‘#stk-n-‘+articleId).click(function(){ stkId = jQuery.trim($ (this).attr(‘stkId’)); stockWidget(‘N’,stkId,articleId); $ (‘.bselivelist’).hide(); }); } $ (“.bselivelist”).focusout(function(){ $ (“.bselivelist”).hide(); //hide the results }); function bindMenuClicks(articleId){ $ (‘#watchlist-‘+articleId).click(function(){ var stkId = $ (this).attr(‘stkId’); overlayPopupWatchlist(0,2,1,stkId); }); $ (‘#portfolio-‘+articleId).click(function(){ var dispId = $ (this).attr(‘dispId’); pcSavePort(0,1,dispId); }); } $ (‘.mc-modal-close’).on(‘click’,function(){ $ (‘.mc-modal-wrap’).css(‘display’,’none’); $ (‘.mc-modal’).removeClass(‘success’); $ (‘.mc-modal’).removeClass(‘error’); }); function overlayPopupWatchlist(e, t, n,stkId) { $ (‘.srch_bx’).css(‘z-index’,’999′); typparam1 = n; if(readCookie(‘nnmc’)) { var lastRsrs =new Array(); lastRsrs[e]= stkId; if(lastRsrs.length > 0) { var resStr=”; let secglbVar = 1; var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) { $ (‘#backInner1_rhsPop’).html(data); $ .ajax({url:url, type:”POST”, dataType:”json”, data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs}, success:function(d) { if(typparam1==’1′) // rhs { var appndStr=”; //var newappndStr = makeMiddleRDivNew(d); //appndStr = newappndStr[0]; var titStr=”;var editw=”; var typevar=”; var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’); var phead =’Why add to Portfolio?’; if(secglbVar ==1) { var stkdtxt=’this stock’; var fltxt=’ it ‘; typevar =’Stock ‘; if(lastRsrs.length>1){ stkdtxt=’these stocks’; typevar =’Stocks ‘;fltxt=’ them ‘; } } //var popretStr =lvPOPRHS(phead,pparr); //$ (‘#poprhsAdd’).html(popretStr); //$ (‘.btmbgnwr’).show(); var tickTxt =’‘; if(typparam1==1) { var modalContent = ‘Watchlist has been updated successfully.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //var existsFlag=$ .inArray(‘added’,newappndStr[1]); //$ (‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’); //if(existsFlag == -1) //{ // if(lastRsrs.length > 1) // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’); // else // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’); // //} } //$ (‘.accdiv’).html(”); //$ (‘.accdiv’).html(appndStr); } }, //complete:function(d){ // if(typparam1==1) // { // watchlist_popup(‘open’); // } //} }); }); } else { var disNam =’stock’; if($ (‘#impact_option’).html()==’STOCKS’) disNam =’stock’; if($ (‘#impact_option’).html()==’MUTUAL FUNDS’) disNam =’mutual fund’; if($ (‘#impact_option’).html()==’COMMODITIES’) disNam =’commodity’; alert(‘Please select at least one ‘+disNam); } } else { AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function pcSavePort(param,call_pg,dispId) { var adtxt=”; if(readCookie(‘nnmc’)){ if(call_pg == “2”) { pass_sec = 2; } else { pass_sec = 1; } var postfolio_url = ‘https://www.moneycontrol.com/portfolio_new/add_stocks_multi.php?id=’+dispId; window.open(postfolio_url, ‘_blank’); } else { AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function commonPopRHS(e) { /*var t = ($ (window).height() – $ (“#” + e).height()) / 2 + $ (window).scrollTop(); var n = ($ (window).width() – $ (“#” + e).width()) / 2 + $ (window).scrollLeft(); $ (“#” + e).css({ position: “absolute”, top: t, left: n }); $ (“#lightbox_cb,#” + e).fadeIn(300); $ (“#lightbox_cb”).remove(); $ (“body”).append(”); $ (“#lightbox_cb”).css({ filter: “alpha(opacity=80)” }).fadeIn()*/ $ (“.linkSignUp”).click(); } function overlay(n) { document.getElementById(‘back’).style.width = document.body.clientWidth + “px”; document.getElementById(‘back’).style.height = document.body.clientHeight +”px”; document.getElementById(‘back’).style.display = ‘block’; jQuery.fn.center = function () { this.css(“position”,”absolute”); var topPos = ($ (window).height() – this.height() ) / 2; this.css(“top”, -topPos).show().animate({‘top’:topPos},300); this.css(“left”, ( $ (window).width() – this.width() ) / 2); return this; } setTimeout(function(){$ (‘#backInner’+n).center()},100); } function closeoverlay(n){ document.getElementById(‘back’).style.display = ‘none’; document.getElementById(‘backInner’+n).style.display = ‘none’; } stk_str=”; stk.forEach(function (stkData,index){ if(index==0){ stk_str+=stkData.stockId.trim(); }else{ stk_str+=’,’+stkData.stockId.trim(); } }); $ .get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?sc_id=’+stk_str, function(data) { stk.forEach(function (stkData,index){ $ (‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]); }); }); function redirectToTradeOpenDematAccountOnline(){ if (stock_isinid && stock_tradeType) { window.open(`https://www.moneycontrol.com/open-demat-account-online?classic=true&script_id=$ {stock_isinid}&ex=$ {stock_tradeType}&site=web&asset_class=stock&utm_source=moneycontrol&utm_medium=articlepage&utm_campaign=tradenow&utm_content=webbutton`, ‘_blank’); } }

A host of news such as a spike in Covid cases across several countries, fear of further policy tightening by the Federal Reserve and a growing chance of recession battered the market in the week ended December 23. India’s benchmark indices hit near two-month lows as all sectors, barring healthcare, witnessed heavy selling.

The BSE Sensex crashed nearly 1,500 points during the week to 59,845, while the Nifty50 tanked 460 points to 17,807, the lowest closing level since October 28.

The 50-share NSE benchmark index has formed a long bearish candle on the weekly timeframe with lower highs, lower lows for the second straight week, while on the daily charts, after a sharp gap-down opening, there was also a long bearish candle formation with lower lows, lower highs for the second straight day.

The Nifty50 closed near its 50 percent Fib retracement (from 16,747 on September 30 and new high of 18,887 on December 1), which can be crucial level to watch out for the next week. Also the index is close to 100 DMA (daily moving average) as well as 100 EMA (exponential moving average) which is around 17,840. All these indicate that 17,800 is expected to be a crucial level in the coming week, and considering the RSI (relative strength index) near the oversold zone on the daily charts, the rebound can’t be ruled out led by short-covering, experts said.

“Taking a glance at the daily and weekly time-frame charts, we see a cluster of technical evidence. We reckon the downside will be limited hereon. This expectation will become a reality in the coming sessions,” Sameet Chavan, Chief Analyst, Technical and Derivatives at Angel One, said.

As far as levels are concerned, he feels 17,900–18,050 are to be seen as the immediate hurdles, and only a close above the upper range would confirm the resumption of an uptrend.

On the flipside, an extended correction below 17,750–17,700 would drag the Nifty towards the next important support zone of 17,600–17,450, the expert said.

The broader markets faced intense selling pressure last week, with the Nifty Midcap 100 and Smallcap 100 indices declining 5.8 percent and 8.3 percent.

Sameet Chavan advised traders to avoid making aggressive bets for a while and wait for the Nifty to reclaim 18,050. “It’s an excellent opportunity for investors to start nibbling at quality propositions as most of the counters are significantly off their recent highs,” he said.

Let’s take a look at the top 10 trading ideas by experts for the next three-four weeks. Returns are based on the December 23 closing prices:

Expert: Shrikant Chouhan, Head of Equity Research (Retail) at Kotak Securities

Bank of Baroda: Buy | LTP: Rs 169 | Stop-Loss: Rs 159 | Target: Rs 188 | Return: 11 percent

The stock made an all-time high at Rs 197.20, however, later it failed to form a higher range which pushed the stock lower. Selling was equally intense and the stock fell to Rs 170, which is its support line based on the Fibonacci retracement. It is at 38.20 percent support line.

If the weakness extends then the stock will slide towards Rs 160 which will be the support level as per the 50 percent retracement ratio. As the sector is in a bullish trend, we can expect a sharp bounce back if support is found.

The strategy should be to buy between Rs 171 and Rs 162, with a stop-loss at Rs 159. Resistance will be Rs 180 and Rs 188.

Sun Pharma: Buy | LTP: Rs 1,001 | Stop-Loss: Rs 970 | Target: Rs 1,100 | Return: 10 percent

The stock has completed a corrective pattern at Rs 975 and has reversed sharply on the back of fundamentally positive news flow, which will help the stock to exhibit a trending move in the near term.

However, we can be buyers only if it crosses Rs 1,030 or dips towards Rs 980. In either case, the stop-loss would be Rs 1,000 or Rs 970 respectively. Above Rs 1,030, it will find resistance at Rs 1,070 and Rs 1,100.

Ashok Leyland: Sell | LTP: Rs 138 | Stop-Loss: Rs 143 | Target: Rs 128 | Return: 7 percent

The stock was forming a descending triangle and the support was at Rs 139, which remained for more than 2 months. Based on the charts, the stock is moving towards the next supports, which are at Rs 131 and Rs 128.

The stock is trending down and a breakdown of the formation should generate further bearish momentum in the near term. One can sell at Rs 137 and sell at Rs 140, with a stop-loss at Rs 143.

Expert: Jigar S Patel, Senior Manager – Equity Research at Anand Rathi

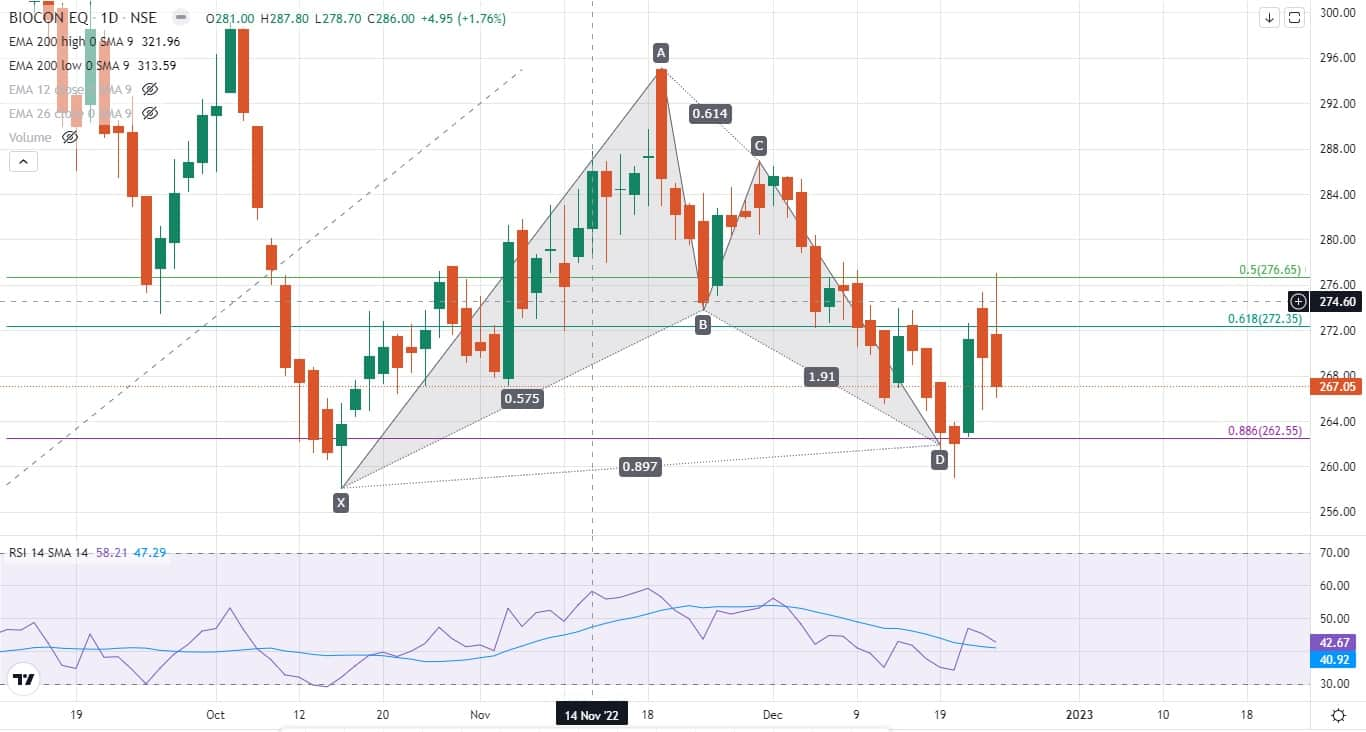

Biocon: Buy | LTP: Rs 267 | Stop-Loss: Rs 250 | Target: Rs 300 | Return: 12 percent

On November 21, 2022, the said counter made a high of Rs 295 and since then it started free fall to Rs 259 resulting in a 12 percent cut in price.

At the current juncture, Biocon has made a bullish BAT pattern near its historical support of Rs 260 which is also one of the double bottoms formed in recent times with the daily RSI (relative strength index) bullish divergence.

Last but not least volume has picked up from lower levels which is a sign of early reversal in the counter.

One can buy with an upside target of Rs 300 with plausible support at Rs 250.

LTIMindtree: Buy | LTP: Rs 4,266 | Stop-Loss: Rs 4,000 | Target: Rs 4,825 | Return: 13 percent

LTIMindtree has observed free fall after registering the top of Rs 5,360 on November 15, 2022, resulting in a 21 percent drop in price. At the current juncture, the said counter has stabilized near Rs 4,250-4,300.

On a daily scale, it has made a bullish AB=CD pattern near historical support of Rs 4,250-4,350 along with a Bullish Hammer confirming an early reversal in the counter.

Even volume from lower levels is rising further complementing the bullish reversal in the counter.

One can buy with an upside target of Rs 4,825 with a stop-loss of Rs 4,000.

Glenmark Pharma: Buy | LTP: Rs 429 | Stop-Loss: Rs 400 | Target: Rs 480 | Return: 12 percent

Glenmark Pharma has observed a steep fall of 49 percent between July 2021 and June 2022. Since then, the stock has been making higher highs and higher lows structure thus confirming its uptrend.

For the last 2 months, the said counter has maintained its price above 200 DEMA (days exponential moving average) HL band (high & low) which is an indication of more strength coming in.

On the indicator front, weekly RSI (relative strength index) has taken support near 50 levels and rebounded from there along with weekly MACD (moving average convergence divergence) approaching the zero-line denoting further upside in Glenmark.

One can buy in the mentioned above range with an upside expected till Rs 480, with a stop-loss of Rs 400.

Expert: Jatin Gohil, Technical and Derivative Research Analyst at Reliance Securities

Biocon: Buy | LTP: Rs 267 | Stop-Loss: Rs 258 | Target: Rs 320 | Return: 20 percent

The stock formed an indecisive pattern-Doji around its prior swing low of Rs 258 and poised for a bullish reversal.

This could take the stock towards Rs 310-320 zone, where its 50-week EMA (exponential moving average) and prior point of polarity are placed.

The key technical indicators gave buy signal post bullish divergence. In case of any decline, its prior swing low will restrict the loss.

Max Financial Services: Sell | LTP: Rs 671 | Stop-Loss: Rs 710 | Target: Rs 600 | Return: 11 percent

The stock oscillated around its short-term supply zone (placed at around Rs 720) and witnessed a range breakdown.

This could drag the stock towards its prior swing low (Rs 625) initially and its psychological level (Rs 600) subsequently.

Its daily RSI reversed after testing bear market resistance zone (60-67) and witnessed a bearish cross-over.

In case of pullback, its downward sloping 20-day and 50-day EMAs will cap the up-move, which are placed at Rs 696 and Rs 707, respectively.

Dalmia Bharat: Sell | LTP: Rs 1,770.5 | Stop-Loss: Rs 1,950 | Target: Rs 1,500 | Return: 15 percent

The stock faced hurdle around its prior point of polarity and gave bearish reversal confirmation.

We believe the stock could move towards its intermediate horizontal trendline, which is placed at around Rs 1,500.

Its weekly RSI gave sell signal after testing its bear market resistance zone (60-67).

On the higher side, its prior swing high will restrict the rise, which is placed at Rs 1,947.

Expert: Rohan Shah, Head of Technical Analyst at Stoxbox

Brigade Enterprises: Buy | LTP: Rs 471 | Stop-Loss: Rs 448 | Target: Rs 520 | Return: 10 percent

The Primary trend of the stock continue to remain bullish as on the higher time frame chart, stock denoting formation of series of Higher highs and lows.

Post printing a life high, price retraced lower to confluence of support and has reversed smartly outperformance the broader market.

The stock has dropped to 89 band moving average which coincides with rising trendline support and 61.8 percent retracement levels of its prior advance denoting strong support for the stock.

On the lower time frame chart, stock has reversed completing Bullish AB=CD Harmonic pattern with above average volume and wide bullish candle.

The RSI inching higher and has entered into the bullish territory denotes strength in price and stock likely to outperform the benchmark index.

Zydus Lifesciences: Buy | LTP: Rs 420 | Stop-Loss: Rs 402 | Target: Rs 460 | Return: 9.5 percent

In the last couple of days, the Pharma index has relatively outperform the benchmark index, with the absolute pharma index chart has shown strong reversal from the lower end of the rising parallel channel highlighting upside momentum to continue ahead.

Earlier stock registered a decisive breakout from multi week consolidation with strong volumes and momentum which signals bullish bias for medium term trend.

Price has reversed finding support long and short term average (200 weekly EMA & 20 weekly EMA) highlighting strong support for the stock.

The volumes are higher on the up days whereas lower on the down days which denotes strength in trend and robust price action.

The RSI have reversed from neutral readings and converging around its average and upward sloping trendline complementing bullish view on price.

SBI Card: Sell | LTP: Rs 771 | Stop-Loss: Rs 806 | Target: Rs 700 | Return: 9 percent

The stock has been under pressure from last couple of months and in the process stock has broken multiple significant support levels which signals bears dominance likely to continue ahead.

The stock has registered breakdown from 61.8 percent retracement level of its prior advance from Rs 656 to Rs 1,028 suggesting weakness to continue and price likely to drop lower to hit 78.6 percent – 88.6 percent retracement level respectively.

Since couple of weeks, the stock has been oscillating below its cluster of key moving averages (20-week EMA, 50-week EMA and 100-week EMA) which highlights lack of strength in trend.

On the lower time frame chart, stock has witnessed breakdown from Squeeze Bollinger Band which highlights volatility to expand on the downside direction.

The key momentum indicators are negatively poised, RSI has surpassed below 40 readings, and MACD has earlier given bearish crossover and currently placed into bearish territory.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.