Gasoline prices have started to hit the brakes, but it has been full steam ahead for diesel, with U.S. supplies of the fuel used in freight transportation and agriculture dropping to their lowest on record for this time of year.

That has kept U.S. diesel prices high at the pump, with a gain of more than 8% in October, even as gasoline saw little change to prices this past month, based on data from GasBuddy.

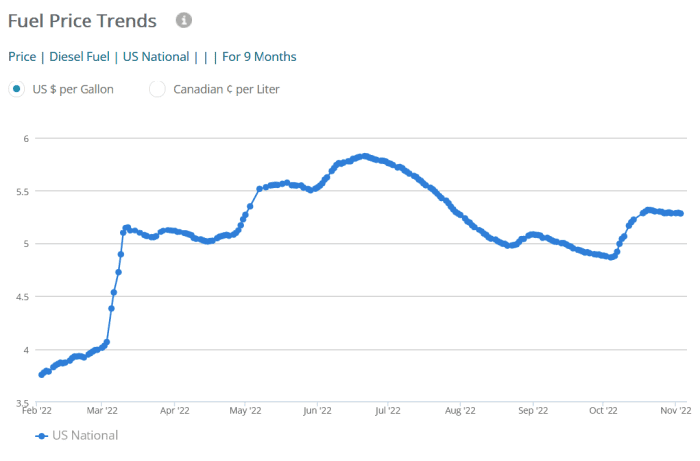

Retail prices for diesel were at $ 5.32 a gallon on Nov. 7, and have climbed 3.4 cents in the last week, according to data from GasBuddy. Prices have posted a decline of less than 9% from their record in June.

Nine-month chart of U.S. retail diesel prices.

GasBuddy

Shortages of diesel fuel around the globe and in the U.S. spurred the latest price advance, said Brian Milne, product manager, editor, and analyst at DTN. Milne refers to U.S. diesel fuel inventory as “extraordinarily low,” with supplies in the Northeast “critically low.”

A cold winter for consumers in the New England states, the region with the largest concentration of households that use heating oil, would be “very problematic,” said Milne. Diesel can be used in place of heating oil for furnaces.

Domestic supplies of distillates, which include diesel and heating oil, stand at 106.8 million barrels as of the week ended on Oct. 28. That’s 19% below the five-year average and the lowest level on record for this time of year, based on data going back to 1982, according to the Energy Information Administration.

Refineries have generally reduced capacity as a result of policy preferences for biofuels, and power demand is an “incremental demand driver for distillates because the world is super tight” on liquefied natural gas, said Craig Golinowski, managing partner at Carbon Infrastructure Partners.

U.S. retail gasoline prices, meanwhile, have dropped nearly 25% from their record high in June, while U.S. crude-oil prices CL.1, +0.82% CLZ22, +0.82% CL00, +0.82% have fallen around 25% from their year-to-date peak.

“The world finds itself with a reasonable supply of crude oil and gasoline, but some distinct problems with diesel, heating oil, jet fuel, and kerosene,” said Tom Kloza, global head of energy analysis at the Oil Price Information Service, a Dow Jones company. The four products, as of late October, fetched prices of $ 150 to $ 200 a barrel, while crude-oil benchmarks are largely ranging from $ 85 to $ 100, he said, and of those four, diesel is the “most critical.”

Kloza estimates U.S. distillate demand at about 5.4 million barrels a day, and with domestic inventory around 106 million barrels, that is roughly just 19 days of supply.

‘Multidecade’ global inventory shortage

Joe DeLaura, senior energy strategist and executive director at Rabobank, says that “diesel is in a multidecade global inventory shortage.” Diesel inventories at three major storage hubs excluding China — the U.S., Europe’s Amsterdam-Rotterdam-Antwerp hub, and Singapore — are at 132 million barrels, he said, compared with the 10-year average of 174 million.

Supply has been reduced, as China has kept export quotas down all year and the U.S. is “shedding refining capacity,” DeLaura said. Demand, however, is relatively strong and “inelastic,” given that even in a recession, people will still buy groceries and get Amazon deliveries, all of which are “transported by the diesel economy.”

Salem Abraham, president of Abraham Trading, meanwhile, said that “a price will be paid for the lack of investment in new drilling and new refineries.”

The market must “ration the demand for diesel with higher prices,” said Abraham, who is also portfolio manager of the Abraham Fortress fund FORTX, +0.42%. If oil, natural gas NG00, +10.88%, and diesel prices are high in a recession at the tail end of a pandemic, as some believe, “imagine what things look like in 12 [to] 24 months when we are past all of that and demand increases.”

Some signs of supply improvement

For now, diesel supplies in the U.S. have shown signs of improvement.

Patrick De Haan, head of petroleum analysis at GasBuddy, said Monday that while national diesel supply remains tight, they did edge up in the latest week.

The EIA reported a 400,000-barrel increase in U.S. distillate inventories for the week ended Oct. 28.

“The majority of stations, especially away from the East Coast and Northeast, should have very few issues with diesel supply, though some stations in those regions could see diesel delivery times slip, said De Haan.

“Brief outages at a limited number of stations are possible, but with refineries continuing to churn out product and maintenance wrapping up, I’m optimistic the situation will improve,” he said.