Shipping giant A.P. Moeller-Maersk on Wednesday said it’s clear that freight rates have peaked as it produced another surge in third-quarter profit.

The company MAERSK.B, -5.39% AMKBY, +1.53% said its profit in the third quarter rose to $ 8.88 billion from $ 5.44 billion, as revenue climbed to $ 22.78 billion from $ 16.61 billion. Its earnings before interest, tax, depreciation and amortization of $ 10.86 billion came in ahead of consensus estimates of $ 10.1 billion.

The average loaded freight rate in its ocean division surged 42%.

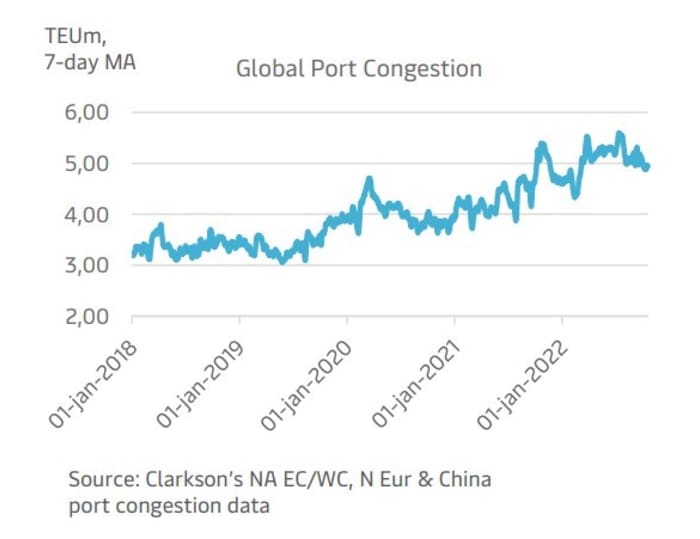

“Profitability was driven by the substantially higher freight rates, however, as expected, freight rates began to decline in the second part of the quarter, due to weakening customer demand, coupled with markets beginning to normalize with fewer supply chain disruptions and progressive unwinding of congestion,” the company said.

A.P. Moeller-Maersk

While it confirmed its underlying EBITDA guidance for the year of around $ 37 billion — which it had hiked twice this year — it lowered its outlook for global container demand, now seeing a decline of between 2% and 4%. It previously had estimated demand would be at the lower end of a range of -1% to +1%.

It said the average contract rate for 2022 is expected to be around $ 1,700 per forty foot container equivalent unit higher than last year, down from its previous estimate of $ 1,900 higher.

The company expects container demand to be broadly flat to negative next year.

Shares dropped 6% on Wednesday morning and have dropped 35% this year.