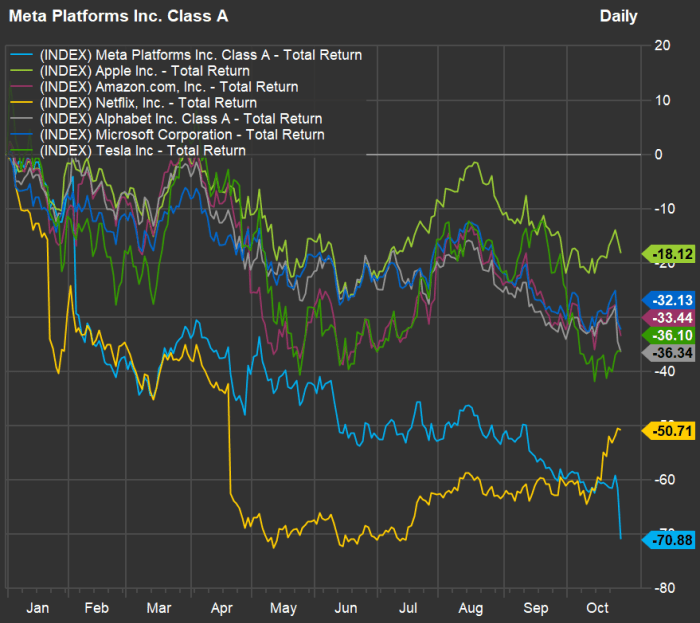

This has been a brutal year for Big Tech, as you can see in the chart below, with Meta Platforms META, +1.29% leading the way. Shares of the Facebook holding company plunged 26% on Oct. 27, bringing the 2022 decline to 71%.

Many of the largest technology companies have fared worse than the S&P 500 during this year’s broad bear market.

Believe it or not, the broad market is still trading high by some historical valuation measures.

So how can you know when such a large decline for a tech stock has gone too far? When is it time to buy, in other words? Mark Hulbert analyzes the herd behavior of Wall Street analysts as they cut estimates and ratings for Meta for insight on when the stock will turn the corner.

The season for tech earnings and disappointments

FactSet

The chart above shows 2022 stock performance, with dividends reinvested, for the FAANG group of stocks, including Facebook’s renamed holding company Meta Platforms, Apple AAPL, +7.56%, Amazon.com AMZN, -6.80%, Netflix NFLX, -0.41% and Google holding company Alphabet GOOGL, +4.41%, plus Microsoft MSFT, +4.02% and Tesla TSLA, +1.52%. All but Apple have fared worse this year than the S&P 500 SPX, +2.46%, which has fallen 19%.

There was tremendous action for Big Tech stocks this week as quarterly financial results were released. Here’s a selection of reporting and analysis:

Two timely guides to the bond market

There are sweet spots in the bond market now, depending on your time horizon, risk tolerance and need for income.

Getty Images

With interest rates rising this year as the Federal Reserve takes action against inflation, bond prices have tumbled. Yields have become so attractive that it is time for you to consider moving some money toward bonds if income is, or soon will be, one of your investment objectives.

Here are two in-depth guides to different areas of the bond market:

- Municipal bond yields are attractive now — here’s how to figure out if they are right for you

- Take advantage of this sweet spot in the bond market now to bolster your portfolio

Did you miss the I-bonds deadline? There’s hope

The U.S. Treasury’s I-bonds have an interest rate of 9.62%, but that deal expires on Oct. 28, which has caused a flurry of interest that may overwhelm the TreasuryDirect.gov website.

But you may be able to get an even better deal next week.

Related: The limit for 401(k) contributions will jump nearly 10% in 2023, but it isn’t always a good idea to max out your retirement investments

An estate planning feature built into your iPhone

iStock/Getty Images

The iPhone has a fascinating feature that allows a user to designate a legacy contact. There is a similar feature available for Android phones. They allow a survivor to access the phone in the event of the user’s death. This can be a very useful estate planning tool, as Beth Pinsker explains.

An activist pushes for change at an LSD company

MindMed is working to develop medications that use LSD to help people suffering from anxiety.

Fabrice Coffrini/Agence France-Presse/Getty Images

Ciara Linnane and Steve Gelsi interview an activist investor pushing for change at MindMed MNMD, +4.14%, whose CEO punches back. The New York-based biotechnology company develops psychedelic-inspired therapies for addiction and mental illness.

Year-end tax planning as stock market losses mount

Here’s how this year’s lousy market may help your bottom line come tax time, even if you aren’t rich.

Read on: ‘Help is on the way’: Need to speak to someone at the IRS about your taxes? It’s about to get a lot easier, IRS commissioner says

Changes to credit scores in the housing market

The U.S. mortgage market is effectively nationalized, with Fannie Mae and Freddie Mac direct wards of the state and purchasing nearly all newly originated mortgage loans.

Now, the federal government has directed Fannie and Freddie to make use of alternative credit scores, which may well affect someone you know who is looking to buy a home.

On Oct. 27, Freddie Mac said the average interest rate on a fixed 30-year mortgage loan in the U.S. was 7.08%, up from 3.14% a year earlier.

But with all the talk about a possible recession, some mortgage bankers expect loan rates to drop in 2023. Here’s how far rates may fall.

Now it’s truly Twitter time for Elon Musk

Tesla, SpaceX and now Twitter CEO Elon Musk.

AP

Tesla and SpaceX CEO Elon Musk is now running Twitter as well — he began by firing three of the social-media company’s top executives, for which he is on the hook for $ 200 million.

More about Musk and Twitter:

- Elon Musk says Twitter ‘obviously cannot become a free-for-all hellscape’ but should encourage debate

- Crypto exchange Binance was a big investor in Musk’s Twitter deal

Want more from MarketWatch? Sign up for this and other newsletters, and get the latest news, personal finance and investing advice.