Representative image

The Reserve Bank of India is expected to continue to intervene in the forex markets as the depletion of foreign exchange reserves is not a major concern at the moment, experts have said.

India’s forex reserves dropped by more than $ 100 billion in the past year as the RBI intervened in the forex market in the wake of the Russia-Ukraine war and the US Federal Reserve’s policy tightening.

The RBI is likely to continue with its forex interventions, currency experts and economists told Moneycontrol on October 27.

“While there has been a steady dip in India’s foreign exchange reserves in the last few months, it is unlikely to be a cause of major concern for the RBI,” said Aditi Gupta, economist at Bank of Baroda. “This is because despite the depletion, India’s forex reserves remain comfortable by any given matrix.”

Gupta said India has the fourth-largest forex reserves in the world. When compared to other emerging market peers, India performs better with respect to reserve adequacy, she said.

Forex reserves fall

India’s foreign exchange reserves hit a record high of $ 642.45 billion on September 3, 2021, according to data from the RBI. Thereafter, reserves have depleted steadily, with the pace accelerating after Russia’s invasion of Ukraine in February. In April, forex reserves fell below $ 600 billion and currently stand at $ 528.37 billion, the lowest since July 2020.

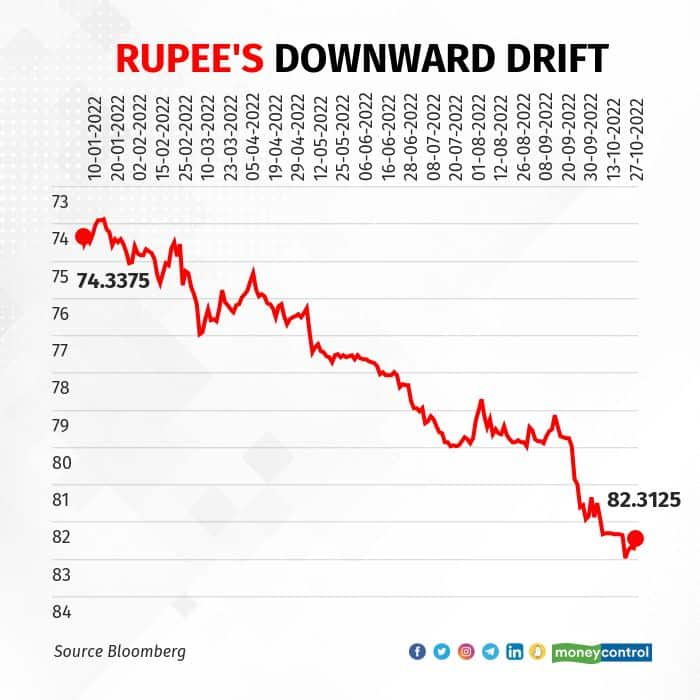

The rupee has also gradually depreciated this year. In 2022, the rupee has fallen 10.14 percent against the dollar and hit a record low of 83.29 on October 20, as per Bloomberg data.

The rupee has also gradually depreciated this year. In 2022, the rupee has fallen 10.14 percent against the dollar and hit a record low of 83.29 on October 20, as per Bloomberg data.

Aggressive policy tightening by the Fed has strengthened the appeal of the US dollar, prompting investors to shun risky assets in emerging markets.

The RBI has intervened in the spot and forward markets every time the rupee has depreciated rapidly, according to forex market dealers. However, the central bank has maintained that it intervenes in the market “to curb excessive volatility and anchor expectations”.

The RBI sold $ 23.11 billion on a gross basis in August, after selling $ 38.77 billion in July on, the data shows. The RBI’s outstanding net forward book declined by $ 1.86 billion in August to $ 20.16 billion at the end of that month. The outstanding net forward book stood at $ 65.79 billion at the start of FY23.

Also read: Rising global interest rates take sheen off foreign currency deposits

Floor of $ 500 billion

While experts said the RBI will continue to dip into its forex kitty to intervene in the markets, the central bank made it clear as recently as September 30 that the rupee’s rate is set by the market.

“The rupee is a freely floating currency and its exchange rate is market determined,” RBI governor Shaktikanta Das said on September 30. “The RBI does not have any fixed exchange rate in mind. It intervenes in the market to curb excessive volatility and anchor expectations. Our interventions in the forex market are based on continuous assessment of the prevailing and evolving situation from the point of view of our approach, which I just explained. The aspect of adequacy of forex reserves is always kept in mind. The umbrella continues to be strong.”

Das said the overarching focus is on maintaining macroeconomic stability and market confidence and its actions have helped in engendering investor confidence, as reflected in the return of capital inflows since July.

“One should not worry about depleting forex reserves as it is meant for such times,” said Dilip Parmar, an analyst at HDFC Securities. “If we compare the current scenario with 2013, we have better import cover and lower external commercial borrowing as a percentage of gross domestic product.”

Parmar added that the RBI will continue to use the combination of both spot and forward intervention.

Assuming the RBI continues to intervene in the forex market, experts expect reserves to drop towards $ 500 billion in the coming sessions. However, that could be the bottom, given that the Fed’s hawkish commentary has already been priced in, said experts.

“We expect the Fed to tone down its hawkish rhetoric and enter a wait-and-watch mode,” said Abhishek Goenka, founder of IFA Global, a Mumbai-based forex advisory.

The Fed would prefer to assess the impact of the tightening so far on the US economy as it would take time for the effect of rate hikes to percolate through the economy and their impact would reflect in macroeconomic data only with a lag, he said.

“If there are no further shocks on the current account front, we may see the reserves bottom out by December at around $ 500 billion to $ 510 billion and start inching higher from there on, especially if the market senses a pivot in the Fed’s communication,” Goenka added.

Arnob Biswas, head of forex at SMC Global, concurred with Goenka’s view. He said the RBI’s forex reserves will find a floor at around $ 500 billion in the next two months and possibly in this financial year.

Rupee’s path ahead

Forex experts and economists expect the rupee to depreciate further against the dollar in the coming sessions but pull back eventually. The rupee is trading at 82.31 to the dollar.

“We believe there could be reasonable depreciation in the rupee in the coming months,” said HDFC Securities’ Parmar. “By December, spot USD/INR could trade in the range of 82 to 83.50 and by March it may reverse some losses and could be back in the range of 80.50 to 82.50.”

The RBI can also use indirect modes to encourage dollar inflows, added Parmar. He referred to the RBI’s measures in September 2013 to bolster forex reserves and stabilise the rupee by mobilising dollar funds. As a part of the measures, the RBI bore the risk in a swap scheme for banks. This made mobilisation of leveraged foreign currency non-resident bank deposits highly lucrative.

HDFC Bank’s economist Swati Arora said that the near-term outlook for the rupee “remains clouded” and the currency could breach 83 levels yet again. She expects the rupee to trade in the range of 82.5-83.5 against the dollar by the end of this year. However, if the Fed becomes less aggressive and reassesses its pace of rate hikes, that could support the rupee, she said.