Gold has been a store of wealth for millennia and in more recent times the price of gold has tended to move inversely with equities and dollars, providing investors with some diversification in their portfolios.

However, this year gold has so far failed to work as a safety cushion for investors against the volatility in financial markets. Gold prices GC00, +1.39% hit their lowest levels in two and a half years on Friday morning with the most active gold futures GCZ22, +1.39% falling $ 15.30, or 0.8%, to $ 1,621.10 per ounce. It was the lowest intraday level since April 2020 when gold traded as low as $ 1,595.20 on Comex, according to Dow Jones Market Data.

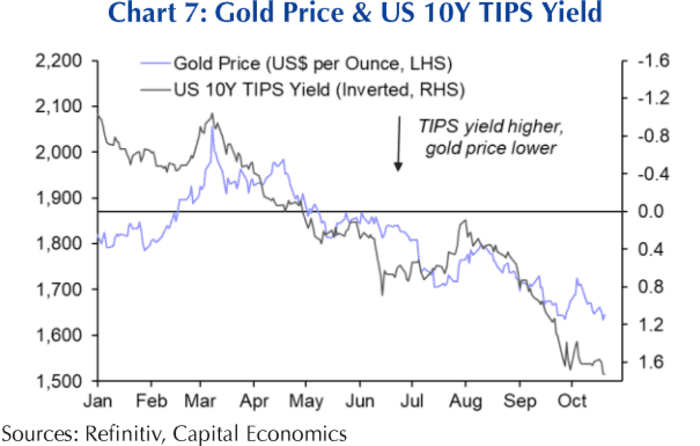

“The key driver was the roughly 20 basis point increase in 10-year Treasury yields TMUBMUSD10Y, 4.217%, as recent signs that high inflation might be stickier than previously expected suggest that the Fed will remain in a hawkish mood,” said Caroline Bain, chief commodities economist at Capital Economics, in a Friday note. “Admittedly, the gold price hasn’t fallen as far as the sharp rise in real yields might have suggested. But we suspect that the reduced liquidity of inflation-linked bonds might be a reason for this divergence.”

See: ‘Fragile’ Treasury market is at risk of ‘large scale forced selling’ or surprise that leads to breakdown, BofA says

Rising bond yields and strength in the U.S. dollar dim gold’s appeal as they increase the opportunity cost of holding an non-yielding asset. The yield on the benchmark 10-year Treasury attempted to set another multiyear high on Friday, advancing to 4.226% from 4.225% on Thursday afternoon. Thursday’s level was the highest since June, 2008.

John Higgins, chief markets economist at Capital Economics, explained the inverse relationship between the price of gold, which pays no interest, and the yield of long-dated government bonds (see chart below).

In a hypothetical example he wrote in a note dated Oct.14, an investor hoping to have $ 1,000 in “safe haven” in today’s money after 30 years has two options to invest. Either they can invest $ 1,000 in gold, or they can invest in a 30-year zero-coupon Treasury bond which offers a real yield of 2%. One day later, the real yield of the bond has fallen to 1.5%, which means they have to invest more in the bond for its real value at the end of the period to be the same. In order to preserve the same initial costs of the alternative investments, the price of gold will also need to rise.

SOURCE: REFINITIV, CAPITAL ECONOMICS

See: The U.S. dollar is wreaking havoc: What that means for the stock market and investors

Meanwhile, the ICE U.S. dollar index DXY, -0.97%, a gauge of the greenback’s strength against a basket of currencies, was down 0.8% at 113.94 on Friday, but it has risen 16.7% year to date, hurting yellow metal’s appeal for those holding other currencies.

Gold is always considered as a hedge against inflation as market volatility and geopolitical instability should enhance its appeal as a “safe haven”. However, this year’s red-hot inflation has been countered by the Federal Reserve and other central banks raising interest rates sharply, fueling fears of a recession.

“There is scope for the price of gold to drop further in the near term, as it adjusts to the higher, liquidity-distortion-adjusted level of long-dated TIPS yields,” wrote Higgins. “We forecast that it will end this year around where it is now, and that it will rise a bit next year as the Fed changes tack and real yields drop back. Our end-2022 and end-2023 forecasts are $ 1,650/oz. and $ 1,700/oz., respectively.”

Fed officials are barreling toward another interest-rate rise of 0.75 percentage point in their benchmark interest rate when they meet Nov. 1-2, but some have begun signaling whether and how to slow down the pace of increases soon, The Wall Street Journal reported Friday.

Meanwhile, San Francisco Fed President Mary Daly said on Friday that the Fed needs to start talking about slowing down their rapid pace of recent increases in their benchmark interest rate.

Market participants already priced in 94.5% odds of another 75 basis point hike at the November meeting, according to the CME Group’s FedWatch tool. The Fed has raised its fed fund futures by 300 basis points since its meeting in March, one of the fastest moves in history including three-straight 75 basis point rate hikes.

Read: Stock market live: Dow up nearly 600 points as traders ponder potential Fed slowdown in rate rises

The indication that the central bank might shift to smaller interest-rate rises after its November meeting calmed the stock market on Friday, with the Dow Jones Industrial Average DJIA, +2.45% jumping over 500 points, or 1.8%, while the S&P 500 SPX, +2.34% gained 1.6% and the Nasdaq Composite COMP, -1.01% climbed 1.4%. However, three major indexes are still all in bear markets since late September. For the year, the S&P 500 was down 21.6%, while the Dow declined 14.8% and the Nasdaq slumped 31%.