The Nifty closed the week on a negative note. During the week, it gyrated between 17,367-16,927. It witnessed a short build-up on the OI (open interest) front over the week gone by as there was an increase in OI.

On the other hand, the Bank Nifty gained about 0.39 percent as it closed the week around 39,445 and futures gyrated between 39,677-38,520. Overall, the Bank Nifty ended the week with a gain of about 154 points.

Diving into the upcoming Nifty weekly expiry, immediate resistance stands at 17,500 levels with the OI comprising nearly 55.40 lakh shares, followed by vital resistance at 18,000 levels where the OI includes 63 lakh shares. On the lower side, the immediate support level is at 17,000 where nearly 34.68 lakh shares comprise the PE (put) options OI, followed by 16,500, where nearly 32.56 lakh shares comprise the PE options OI.

Looking at the upcoming Bank Nifty weekly expiry data, on the upside, we see that the immediate and vital resistance is at 39,500, where nearly 24.5 lakh shares comprise the CE (call options) open interest. On the lower side, the immediate and vital support is at 39,000, with 12 lakh shares comprising the PE open interest.

The India Vix fear gauge decreased to 18.24 from 18.81 over the week. It is trading below 20. Decrease in India Vix has allayed some of the fear in the market. Further, any downtick in India Vix can push the upward move in Nifty further, and vice versa.

Looking at the sentimental indicator, the Nifty OI PCR (put-call ratio) for the week has decreased to 0.917 from 0.97. The Bank Nifty OI PCR decreased to 0.821 over the week, from 0.872 last Friday. Overall data indicates call writers are more aggressive than PE writers, which is a bearish signal.

Looking at the weekly contribution of sectors to the Nifty, we see that private banks and IT contributed the most on the positive side, with 22.72 and 19.49 points, respectively. Oil & gas, and FMCG contributed about 43.10 and 37.77 points, respectively, on the negative side.

Power and Capital Goods contributed 9.16 and 1.59 points, respectively, on the positive side while Metals contributed 17.40 points on the negative side.

Looking at the top gainers & losers of the week in the F&O segment, we find that IDFC topped the list of gainers by jumping over 7.6 percent, followed by Federal Bank at 6.5 percent, Axis Bank at 6.2 percent, and GNFC jumping 4.6 percent. India Cements led the list of laggards with a fall of 17.4 percent, Samvardhana Motherson lost over 9.4 percent, and Indian Hotels 9.4 percent, over the week.

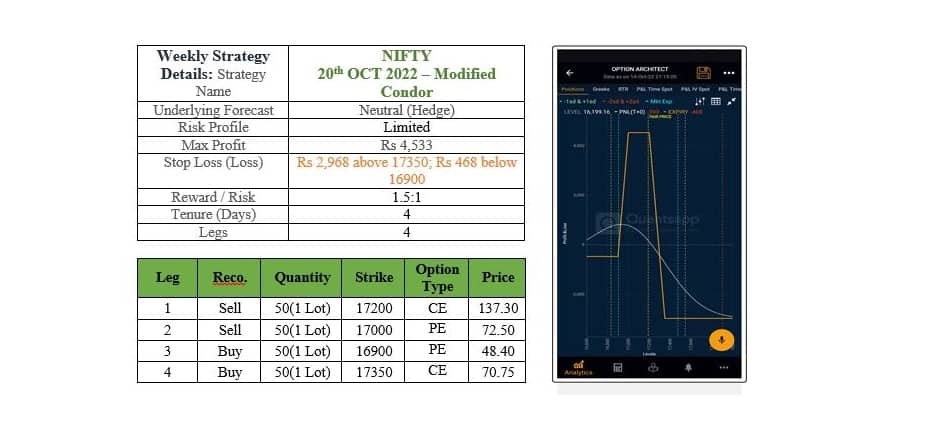

The upcoming week can be approached with a low-risk strategy like the Modified Condor.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.