Faced with stiff competition in the U.S. housing market over the last year, home buyers upped their down payment to reach a record of $ 66,000 in May, according to a new report.

Down payments peaked in May, hitting a nine-year high, where the typical down payment was 18% of a home’s purchase price, a report from real-estate brokerage Redfin found.

In May and June, the typical buyer was putting down $ 66,000, Redfin said

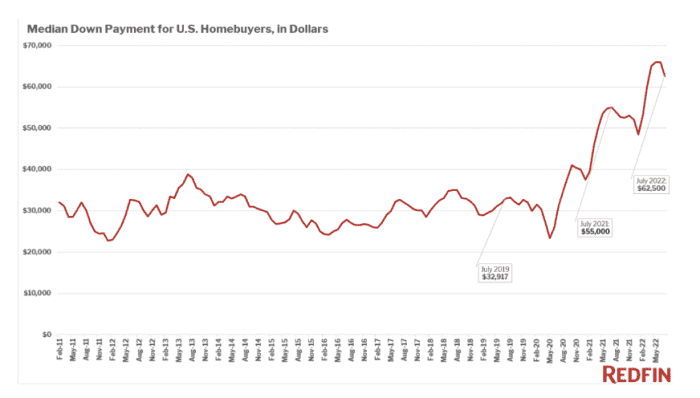

But that number has cooled slightly since. Redfin also said that the typical U.S. homebuyer who took out a mortgage in July 2022, made a $ 62,500 down payment.

That’s still up 13.6% from a year ago. And compared to the median amount people were putting down before the pandemic in July 2019 of $ 32,917, the typical down payment doubled.

Nearly 60% of buyers who had taken out a mortgage had put down more than 10% down payment, which was up from the 50% range before the pandemic.

(Redfin)

5 cities where down payments rose the most

Out of the top five metros where down payments rose the most, the East Coast dominated the list.

Down payment dollar amounts rose the most in Nashville, Tenn., by nearly 40% from a year ago. The typical down payment was $ 64,250 in July.

That’s followed by these four cities:

- Newark, N.J. – typical down payment was $ 90,000 in July, up 36.4% from a year ago

- New York City, N.Y. – typical down payment was $ 197,875, up 34.8% from a year ago

- New Brunswick, N.J. – typical down payment was $ 90,000, up 34.3% from a year ago

- Charlotte, N.C. – typical down payment was $ 48,200, up 32.6% from a year ago.

But down payments fell in many cities in the U.S., particularly out west.

Down payments fell the most in Riverside, Calif., by 15.4% from a year ago, to $ 55,000.

People were also putting down less in San Francisco, at $ 364,000, down 7.8% from a year ago.

Oakland, Calif., Warren, Mich., Detroit, Mich. and Seattle, Wash. followed.

In terms of percentages, the typical home buyer in Denver was the most aggressive, putting down 20% down in July, according to Redfin.

That’s up from the typical Denver buyer putting down 15% a year ago.

Expect down payment amounts to come back down

Higher mortgage rates are partly the reason why down payments have decreased.

“Higher monthly mortgage payments and the rising cost of other goods and services cut into buyers’ budgets, making it harder to come up with huge down payments,” Redfin said.

Redfin on Wednesday also added a feature which shows users down payment assistance information, attached to home listings, on its website. For-sale listings on Redfin in future will include programs in the area that potential home buyers can tap on for down payment assistance.

But a slowing housing market means that people don’t need to put down large down payments to win bids on homes, Redfin noted.

“Homebuyers don’t need to make enormous down payments anymore because they’re much less likely to encounter bidding wars now that so many Americans have bowed out of the market,” Sheharyar Bokhari, senior economist at Redfin, said in a blog post.

So “while down payments will likely remain elevated above pre-pandemic levels, they’ll probably fall a bit in the short term,” he added.

Got thoughts on the housing market? Write to MarketWatch reporter Aarthi Swaminathan at aarthi@marketwatch.com