The OPEC+ group of oil-producing countries has agreed on a drastic cut to the global supply. The speculation has helped oil reverse its recent declines.

And that means it’s time to take another look at stocks of U.S.-listed energy companies that are favorably positioned to take advantage of higher prices.

The cartel agreed on Wednesday to reduce its output by two million barrels a day, according to news reports.

William Watts explained why the actual production cuts by the OPEC+ group might not turn out as expected.

Below is a screen of favorite energy stocks among analysts polled by FactSet, drawn from the S&P 1500 Composite Index SP1500, -0.23%. The screen is followed by a longer-term look at oil prices and industry comments from Gabelli analyst Simon Wong.

Oil-stock screen

An easy way to play U.S. energy companies as a group is by tracking the 21 stocks in the S&P 500 energy sector, which you can do with the Energy Select Sector SPDR Fund XLE, +2.07%. The large-cap sector is dominated by Exxon Mobil Corp. XOM, +4.04% and Chevron Corp. CVX, +0.57%, which together make up 42% of XLE because of market-capitalization weighting. The ETF isn’t quite as diversified as some investors might expect it to be.

To dig deeper for a stock screen, we began with the 62 stocks in the S&P 1500 Composite Index, which is made up of the S&P 500 SPX, -0.20%, the S&P 500 Mid Cap Index MID, -1.03% and the S&P Small Cap 600 Index SML, -0.63%.

We then narrowed the list to the 53 companies that are each covered by at least five analysts polled by FactSet.

Here are the 10 energy stocks with at least 75% “buy” or equivalent ratings that have the highest 12-month upside potential, based on consensus price targets:

| Company | Ticker | Industry | Share “buy” ratings | Oct. 4 closing price | Consensus price target | Implied 12-month upside potential |

| Green Plains Inc. | GPRE, -1.83% | Ethanol | 89% | $ 30.64 | $ 48.67 | 59% |

| Halliburton Co. | HAL, +3.98% | Oil-field services/ Equipment | 81% | $ 28.12 | $ 42.34 | 51% |

| PDC Energy Inc. | PDCE, +2.06% | Oil and Gas Production | 79% | $ 63.58 | $ 94.33 | 48% |

| Baker Hughes Co. Class A | BKR, +2.24% | Oil-field services/ Equipment | 77% | $ 23.19 | $ 34.11 | 47% |

| Targa Resources Corp. | TRGP, +1.16% | Oil Refining/ Marketing | 95% | $ 65.37 | $ 93.00 | 42% |

| EQT Corp. | EQT, +0.96% | Oil and Gas Production | 90% | $ 44.91 | $ 63.68 | 42% |

| Talos Energy Inc. | TALO, +3.25% | Oil and Gas Production | 83% | $ 20.29 | $ 28.20 | 39% |

| ChampionX Corp. | CHX, +3.16% | Chemicals for Oil and Gas Production | 80% | $ 21.25 | $ 29.11 | 37% |

| Civitas Resources Inc. | CIVI, +1.93% | Integrated Oil | 100% | $ 63.09 | $ 81.80 | 30% |

| Diamondback Energy Inc. | FANG, +2.25% | Oil and Gas Production | 88% | $ 136.30 | $ 173.17 | 27% |

| Source: FactSet | ||||||

Any stock screen has its limitations. If you are interested in stocks listed here, it is best to do your own research, and it is easy to get started by clicking the tickers in the table for more information about each company. Click here for Tomi Kilgore’s detailed guide to the wealth of information for free on the MarketWatch quote page.

Setting a floor price for oil and gas producers

On Sept. 20, I published this opinion piece: Four reasons you should buy energy stocks right now if you are a long-term investor.

It included a chart showing how the oil industry cut its capital spending just as demand was increasing over the past few years through 2021. That was a great reversal from previous oil cycles and underscored just how focused oil producers’ management teams have been on not cutting out their own legs from under them by flooding the market and killing their own profits.

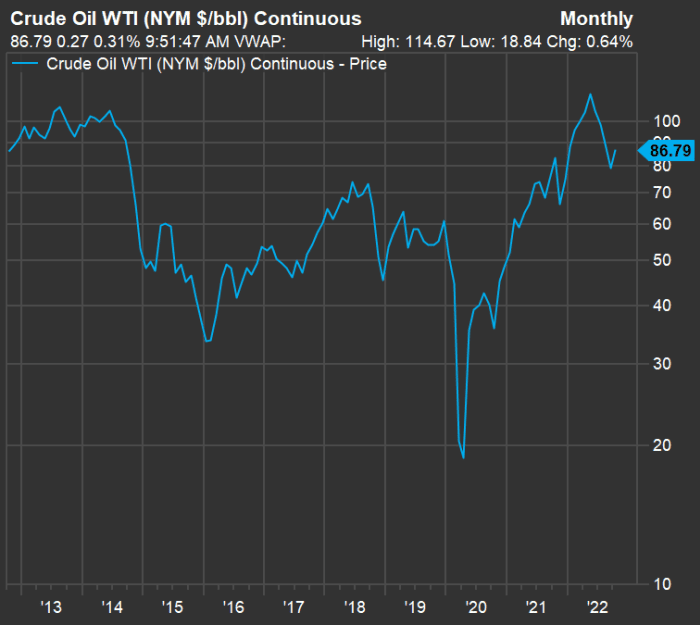

Here’s a 10-year chart showing the movement of West Texas Intermediate crude oil CL.1, -0.36% prices, based on continuous front-month contract prices compiled by FactSet:

FactSet

Leaving aside the temporary price crash during the early phase of the coronavirus pandemic in 2020, when a collapse in demand led to the industry running out of storage space, you should turn your attention to the West Texas Intermediate (WTI) crude price action in 2014, 2015 and 2016. It turns out that the U.S. shale industry’s success led to its own turmoil, as prices collapsed to levels that meant some producers were losing money on every barrel of oil they pumped.

The domestic producers are now being very careful not to repeat their overproduction mistake.

And that begs the question: Can we estimate a magic number for WTI at which the U.S. producers will not only remain profitable but will be able to continue raising dividends and buying back shares?

Simon Wong of Gabelli went with a conservative estimate during an interview. Existing shale wells might be operated for as little as $ 10 to $ 20 a barrel, he said, but it is the nature of shale extraction that new wells must be brought online continually to maintain supply. Wong estimated that the price of WTI would need to average $ 55 a barrel to break even on a new well.

Taking that further, he said a conservative estimate for shale U.S. producers to break even would be $ 65 a barrel.

“Companies have built their cost structures on $ 60 oil. I still think at $ 80 they will generate plenty of free cash flow,” he said, pointing to continuing share buybacks and dividend increases at that level.

He added: “A year ago we were happy when oil was $ 75.”

Don’t miss: Dividend yields on preferred stocks have soared. This is how to pick the best ones for your portfolio.