Mortgage rates that briefly touched a 20-year high this week aren’t likely to crash this U.S. housing market, according to Al Otero, portfolio manager for HAUS, Armada ETF Advisors.

Instead, a robust employment backdrop and the huge equity cushion homeowners have been sitting on after two years of enormous price gains will give the housing market “a lot of wiggle room, even if we get pushed into a recession,” Otero said, by phone.

“I think the housing market can take a pretty big beating, because it has gone up so far, so fast. Letting some air out of that balloon is healthy,” he said, adding that a fall in home prices of 10%-15% wouldn’t necessarily be a bad thing after their 45% surge nationally during the pandemic.

In some markets like Tampa and Phoenix those increases have been closer to 71%, according to Black Knight data.

“It stinks if you are a recent home purchaser, because it will take a bit more time to get above water,” Otero said. But overall, he sees housing as healthier than it was a decade ago after the subprime bubble popped, fueling the global financial crisis and breeding a new class of institutional landlords.

In the new housing era, Otero thinks there still is “a runway for rents to continue to increase,” even though home prices appear to have peaked. His fund, Home Appreciation U.S. REIT ETF HAUS, +1.24%, launched in March and invests in shares of public companies that own apartments and single-family rentals, including Equity Residential EQR, +1.51% and American Homes 4 Rent AMH, +0.34%.

REITs tend to be sensitive to rate increases and the HAUS ETF was down about 10.3% so far in September, compared with a roughly 8% decline for the S&P 500 index SPX, -1.51%, according to FactSet data.

Even so, Morgan Stanley analysts said earlier this month they expect higher rates and low housing supply “to force households into the rental market.”

See: Most economists see the U.S. turning into a buyer’s housing market in 2023. Here’s where you’ll see the biggest declines in value.

A $ 6.5 trillion risk

With home prices pulling back only slightly from record levels, and the 30-year fixed mortgage rate more than doubling this year to nearly 7%, more families will be frozen out of homeownership.

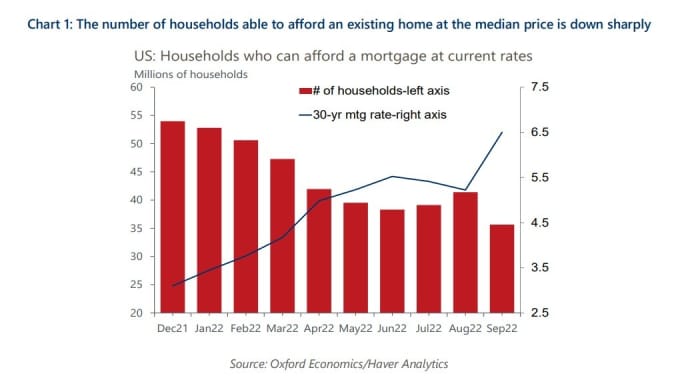

Nancy Vanden Houten, lead U.S. economist at Oxford Economics, estimated that the spike in mortgage rates translates to roughly 18 million fewer households (see chart) qualifying for a mortgage on a median-priced existing home than at the end of 2021.

An estimated 18 million households can no longer afford a home mortgage as rates near 7%.

Oxford Economics

While risks of a housing and economic downturn have been building as the Federal Reserve has sharply raised interest rates to tame inflation near a four-decade high, its efforts have been complicated by stubbornly high shelter costs.

See: High rents and Fed’s inflation fight to push key mortgage rate above 7%: BofA Global

Vanden Houten thinks a housing crash “is improbable,” but said a low probability risk of a 15% fall in home prices would wipe out $ 6.2 trillion of home equity, or more than two-thirds of the $ 9.5 trillion in housing wealth gained during the pandemic.

On the bright side, however, relatively steady mortgage debt levels over the past decade would mean U.S. households still retain about a 65% equity stake in their real estate under that scenario.

Otero said that while it’s painful to be a renter, “in most markets renting is still a better financial proposition than trying to buy a home, given where housing prices have gone to.”

What’s more, with rental occupancy rates near 96% nationally, renters have few choices but to pay up.

“The number one risk to a landlord is the jobs market,” Otero said. “As stretched as the consumer is, they are luckily still employed and still getting wage gains.”

Read: Fed must try to avoid a ‘harsh recession,’ Daly says