Recent studies have found that past generations drew down their financial assets very slowly in retirement, leaving much of their savings untouched throughout old age.

This finding always seemed obvious to me, given that older cohorts had lifetime income from defined-benefit plans to cover their spending and could keep their financial assets for late-life medical expenses or bequests.

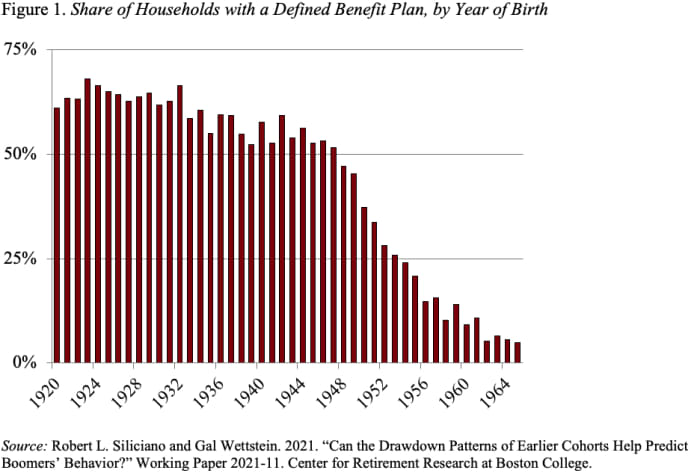

The nature of pension coverage, however, has changed dramatically (see Figure 1). While most households with heads born between 1920 and 1940 had access to a defined-benefit plan, the youngest baby boomers, born in 1965, have almost no access to such plans. Thus, one would think that looking at the behavior of these early cohorts would tell us little about what boomers will do with their 401(k) balances.

I am delighted to report that a recent study led by my colleague Gal Wettstein confirms this intuition. This project, using data from the restricted Health and Retirement Study (HRS), relates household drawdown behavior to having a defined benefit pension and some control variables.

Read MarketWatch’s Help Me Retire column

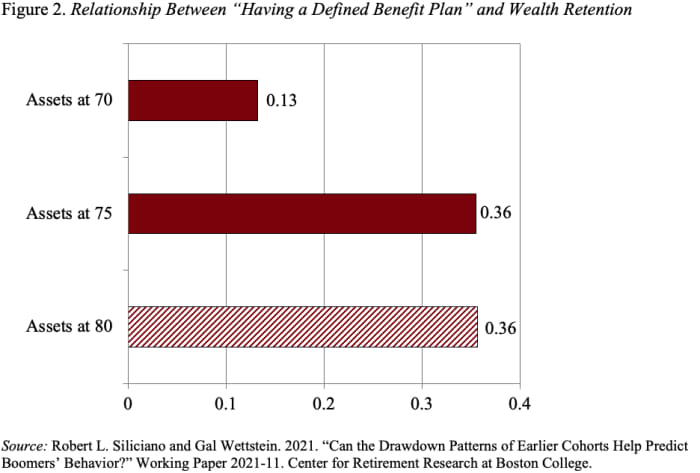

Drawdown of retirement assets is measured as the change in log financial wealth between retirement and a target age (70, 75, or 80). The log of financial wealth ensures that drawdown is measured relative to a household’s overall wealth. Financial wealth includes all financial assets, 401(k)s and IRAs, and the net value of non-home real estate, net of any nonmortgage debt. A positive value for the coefficient on “has defined-benefit plan” means that households with these plans have retained a greater share of their wealth and therefore have drawn down more slowly than those without.

Read about Social Security on MarketWatch Retirement

The results show that at all three target ages, individuals with a defined-benefit plan have retained more of their initial retirement wealth — that is, they have drawn down their initial wealth more slowly than those without such a plan. And the magnitudes are large (see Figure 2). By age 70, a household with a defined-benefit plan drew down 13 log points less of their starting wealth than households without such a plan. That is, a household that entered retirement with $ 200,000 in savings, approximately the median in the sample, would have $ 28,000 more wealth remaining at age 70 than a household with the same initial wealth but no defined-benefit plan. By age 75 and by age 80, the household with a defined-benefit plan drew down 36 log points less of their initial wealth, corresponding to $ 86,000 more wealth. The results at age 80 are not statistically significant, likely due to the small sample for this analysis.

Given the large impact of “having a defined-benefit plan,” using the drawdown speed of older generations for younger generations could significantly underestimate the drawdown speed of baby boomers. The rough estimate from this study is that recent retirees without defined-benefit plans would draw down about a quarter of their wealth by age 70. At this rate, boomers would deplete their assets by 85, even though roughly half would survive past this age. With this faster pace of drawdown, many face the risk that they will outlive their savings.