Only the crisp pastel outfits of children may top the rainbow of confections this time of year, with chocolate prominent in nearly every Easter basket.

But the youths at the very beginning of chocolate’s journey through the global supply chain deserve attention, as well. In the areas of the world that haul in the beans that are eventually sweetened to become the packaged chocolate we all know, harvesting crews skew very young.

It’s an issue few consumers spend much time pondering when shopping for Easter candy. Few may even think about chocolate needing to be farmed, at all. Both cocoa and cacao beans make their way onto global markets. “Cacao” refers to beans that have not been roasted. And what is called “cocoa” is made of beans that have been roasted. Cocoa futures CC00, -0.57% take their place on the commodities exchange just like coffee, corn, soybeans and lumber.

When it comes to labor issues, the good news is that even major global chocolate interests — some of the makers and distributors behind much of the packaged food we eat, who always have an eye on the bottom line — are trying to remedy this inequity.

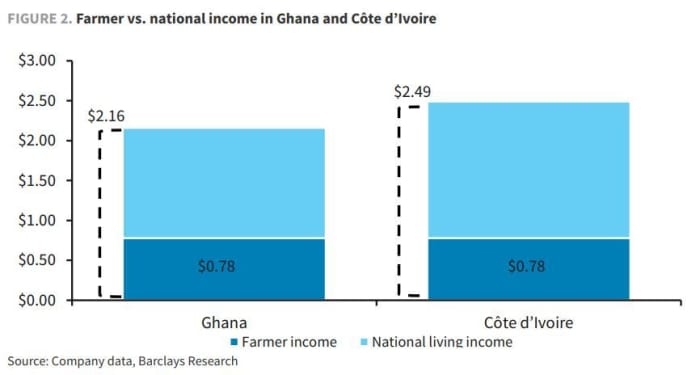

Cocoa farmers are subjected to large market price swings and make less than the national income in the countries where this crop is prominent. That can mean young children work to provide income for their families.

Barclays

“While the topic of child labor remains a complex part of the cocoa supply chain, one approach which is widely agreed upon by all chocolate players is that income diversification is essential to shield farmers from the vagaries of cocoa prices,” a Barclays research team, led by Warren Ackerman. said in a report.

“The harsh reality is that smallholder cocoa farmers simply often can’t afford professional and legal working-age employees, so they revert to child labor,” they said.

About 70% of the world’s cocoa beans come from four West African countries: Côte d’Ivoire, Ghana, Nigeria and Cameroon. The Ivory Coast and Ghana alone account for more than 50% of the world´s cocoa.

An estimated 1.5 million minors in Côte d’Ivoire and Ghana involved in child labor are linked to the structural issues facing cocoa-growing communities: poverty, exclusion, and lack of access to healthcare and clean water.

“‘The harsh reality is that smallholder cocoa farmers simply often can’t afford professional and legal working-age employees, so they revert to child labor.’”

Palm oil, used for baking and as an additive, is another controversial industry, in large part because its use around the world is prolific, and because the tree stands used for its production aren’t as protected as climate groups would like.

Related: Cookies and wet markets: Here’s where coronavirus and climate change collide

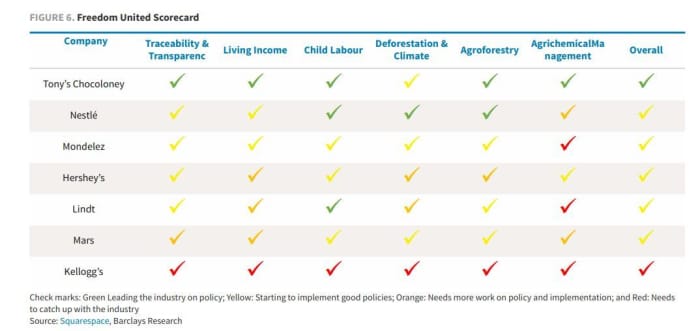

Barclays researchers, looking at child labor and other factors, scored leading chocolate and candy firms.

Barclays

The U.K.-based Barclays team focused much of their research on European chocolate habits. They highlighted a few practices that could set the tone for the broader sector. Nestlé, for one, has made some drastic improvements in recent

years, focusing on an income accelerator program, Barclays said.

The company Barry Callebaut was given high marks because its sustainability disclosure on the subject provides strong details and levels of transparency. Lindt & Sprüngli’s disclosure has improved, and while incidents of child labor appear to be low, the Barclays team said it believes the level of data and transparency can be improved.

“The intense poverty surrounding these children means many begin working from a young age to support their families. Some children are even sold to farmers, often unaware of the dangerous working conditions and are faced with a lack of any provisions for worker education,” the Barclays team said. “This is despite decades of work on the issue, and progress has been slow going. We believe more urgency is

required, so it was encouraging to see the ground-breaking announcement by Nestlé’s CEO Mark Schneider [on income programs].”

“ Global chocolate consumption has grown by about 2% on a compounded annual growth rate since 2007.”

Though it scored low by Barclay’s calculations, Kellogg Co. K, -0.12%, for one, has this to say in its defense, in a statement on its website: “One way we manage human rights concerns is by working closely with our suppliers to ensure their operations and supply chains align to our values. And, we hold them accountable to their commitments through screenings, assessments, third-party site audits and providing direct feedback.”

What’s also true is concern for child labor issues has grown out of Environmental, Social and Governance (ESG) investing. ESG is expanding, though remains a small slice of the broader stock marketSPX and in the mutual-fund space.

Read: SEC’s Gensler: Make ESG stock fund labels as clear as fat-free versus whole milk

Easter — and Passover, which begins April 15 this year — are religious holidays, of course, so mindfulness about the health and safety of children everywhere feels appropriate. And no doubt, we love our chocolate.

Global chocolate consumption has grown by about 2% on a compounded annual growth rate since 2007, but spiked during the pandemic as more people have been working from home, Barclays said.

A recent survey found that in the U.S., Mondelez International’s 0R0G, MDLZ, -0.20% Cadbury Creme Eggs — the chocolate eggs filled a yellow and white fondant-like filling that resembles a real egg yolk — were dubbed the most popular Easter candy in nearly half of all states. Some 100 million Cadbury Creme Eggs are sold here every year.

Read: What is the most popular Easter candy? The divisive answer may surprise you