The day of reckoning for office buildings might be around the corner yet, even as commercial property prices press higher into record territory.

This roughly $ 3.2 trillion slice of the U.S. commercial property market has held up during the pandemic, despite deep rooted changes taking hold since COVID first upended the workplace.

The problem is most markets have been reflecting a picture frozen in time, like a cup of coffee abandoned by a worker rushing home to work remote. The outside might look the same, but not on the inside.

“We haven’t seen a big return to the office, although we are starting to see things improve week-to-week, month-to-month with warmer temperatures,” said Ray Wong, a researcher at the Altus Group, a commercial real-estate data services firm.

“Companies are still trying to figure out how much office space they need,” Wong said by phone.

Gauging future needs

Getting to the new “normal” as more companies tee up big decisions about their future office needs now also includes navigating market signals that warn the next recession could be on the horizon.

“We expect 20-25% structural decline in office demand,” Ed Reardon’s research team at Deutsche Bank said Tuesday, in a weekly client note.

For one thing, office buildings were only 40% occupied on average as of March 23, according to Kastle System’s latest gauge of keycard swipes for nearly 3,000 buildings in 10 major cities.

The weekly gauge helps provide a snapshot of office use since the pandemic gave rise to work-from-home, including showing occupancy rates that have improved from a low of 23.3% on average since the start of this year, but it doesn’t show leasing trends or predict what happens next as companies navigate employee demands for flexible work.

While office loan delinquencies remain low currently, there have been hints the situation could easily get worse. A recent survey by Barclays of senior decisionmakers found that global office demand could drop 14% from peak levels as more companies make hybrid work permanent.

And in the office megamarket of New York City, with its avenues of older office buildings, Reardon’s team expects office occupancy rates to struggle to top 60% by the end of 2023.

“We are starting to see lease activity pick up,” Wong said, speaking of the U.S. and Canadian markets. “But now, what we’ve also been seeing is some people giving space back.”

A look at past recessions

Uncertainty about the office sector comes as the Federal Reserve and other central banks plan to raise key interest rates this year to tighten financial conditions in an attempt to cool high inflation, while also seeking to avoid a “hard landing” that can hurt jobs and the economy.

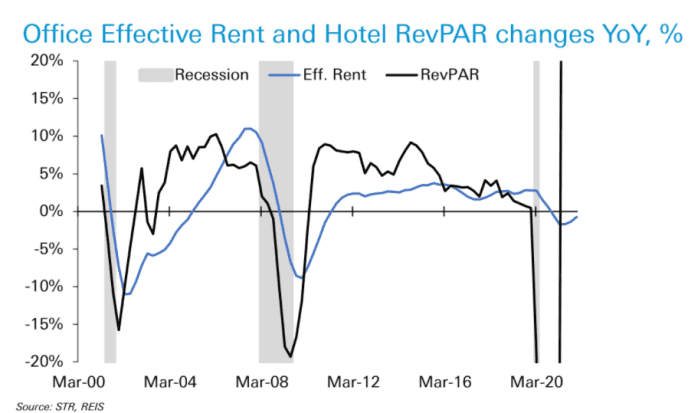

“Yield curves are flashing recession risk in 2024/2025,” Reardon’s team wrote, adding that office rents dropped 19% after the late 1990s internet bubble popped (see chart) and 12% in the wake of the 2008 global financial recession.

Office rents and hotel revenue per room sank in past recessions

Deutsche Bank Research, STR, REIS

Their chart also compares revenue at hotels, which were hit harder than offices in prior recessions.

In the next recession, a large percentage of “COVID-cured” office loans would be highly vulnerable to becoming delinquent again, according to the Deutsche team, which warned it will coincide with companies giving up even more office space than in than past downturns “as they accommodate WFH.”

See: The bond market’s recession warning isn’t fazing stocks — yet. Here’s why.

Like in the red-hot residential sector, prices for commercial properties have shot up during the pandemic, increasing 21% in March from a year before, according to the Green Street Commercial Property Price Index. Office prices contributed only slightly to the gains, edging 6% higher in the past 12 months through March, according to the index.

“On the investment side, you are definitely seeing more activity industrial and in apartments,” Wong said. “It is the office market that has really slowed down in activity.”

Borrowing rates also have been increase for property owners from the lows of recent years, with the 10-year Treasury TMUBMUSD10Y, 2.385% rate near 2.4% on Wednesday.

Still, Wong thinks there’s more waiting ahead for the office sector, perhaps another nine to 18 months, before a fuller picture emerges of the future of the office, based on if people will flock back into the office or not.

See also: Is this it? More than half of workers still are not returning to office