Investors are juggling a host of risks, including inflation, higher interest rates and commodity market disruptions. Another challenge is the threat of widespread cyber disruption.

Just this week, Russian hackers launched a major cyberattack on Ukraine that crashed the nation’s internet—including connectivity used by its military. And while Europe and the U.S. have largely been unaffected by cyber issues and there is hopes for peace talks, a recent report pointed to disruptions in both Russia and Ukraine that could lead to “collateral damage that is difficult to avoid in cyberspace.”

But this is hardly a new trend. Remember the infamous SolarWinds hack we learned about in early 2021? Or sanctions levied against Russia less than a year ago for cyber meddling related to the U.S. election?

Still, the risk of disruptions because of hacking is very real in 2022. If you’re an investor looking at how to play events like rising rates or energy price inflation, you may want to put cybersecurity on your list of trends to follow with your portfolio.

Not all cyber stocks are equal

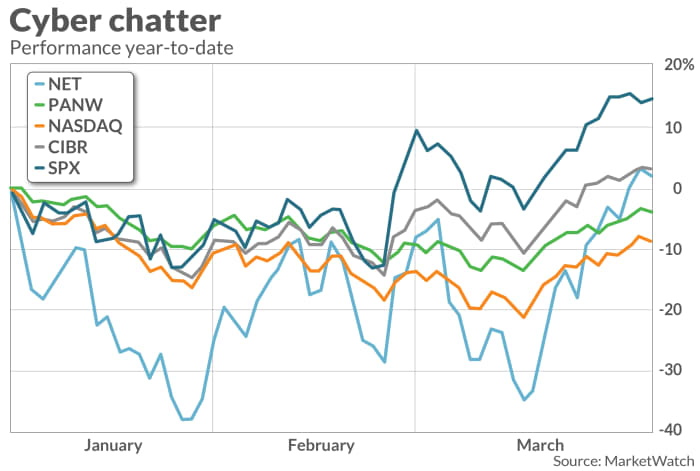

Most cybersecurity stocks have outperformed the stock market so far this year. By way of example, leading sector fund the First Trust NASDAQ Cybersecurity ETF CIBR, is up about 2% while the broader S&P 500 SPX, +0.34% is still under water through Tuesday. Furthermore, CIBR is up about 28% in the last 12 months vs. about 16% for the S&P in the same period.

With roughly $ 6.5 billion in assets, this ETF offers a simple, diversified way to get exposure to major cyber stocks.

But some companies in the space have performed much better than others. A big reason is because the previous “risk-on” environment has been replaced by a more subdued outlook in 2022. And with growth falling out of favor in many portfolios, previously highflying stocks that traded for massive multiples of forward earnings have fallen out of favor too.

Look at Cloudflare NET, +3.17% as one prominent example. The stock was full of buzzworthy factors last year that caught investors’ eyes: it’s native to the cloud, as the name implies, and it interconnects with 10,000 networks to potentially service every major internet service provider and public cloud vendor in the world.

However, despite a 50% compound growth rate over the last five years, the top line is still non existent; Cloudflare barely finished the year at break-even. And with an average earnings estimate of just 3 pennies per share in FY2022 earnings and a share price of around $ 130 … that gives this stock a forward price-to-earnings ratio of more than 4,000.

No wonder Cloudflare has cratered more than 40% from its 2021 highs in this risk-off environment.

Other stocks that don’t have much in the way of profits to back up their narrative have also suffered. Another prominent example is SentinelOne, S, +0.36% which is still operating deeply in the red and is down almost 20% since Jan. 1.

The best cybersecurity stock to buy now

On the flip side, one cybersecurity company stands out: Palo Alto Networks PANW, -1.83%.

Year-to-date, this stock has outperformed its peers as well as the broader market with an impressive 12% gain since Jan. 1. That’s building on long-term success, too, as the stock has roughly doubled the last 12 months.

Palo Alto boasts the impressive top-line growth investors demand from this sector, with its second-quarter numbers showing 30% revenue growth year-over-year and 20% revenue expansion predicted for the full fiscal years of both 2022 and 2023. But where it really delivers is profitability, with earnings projected to grow roughly 18% in FY2022 to $ 7.29 per share and 23% in FY2023 to $ 9.03 according to consensus targets.

Small wonder that after these details dropped in its Feb. 22 earnings report, we saw shares take off even in the face of significant volatility elsewhere on Wall Street. And since its books were closed well before the invasion of Ukraine and recent cyber chatter, there’s a lot of hope that it can replicate that success going forward, too.

Sure, the earnings multiple is elevated at a forward P/E of around 80. But that’s not out of whack with peers—particularly names like Cloudflare that aren’t significantly profitable. Beyond its growth and profitability, Palo Alto Networks is sitting on more than $ 4.2 billion in cash and equivalents on the books. What’s more, it has spent roughly $ 3 billion on stock buybacks since 2018 in a commitment to delivering shareholder value and still has headroom to buyback $ 1 billion more worth of stock.

This is a cyber stock that is standing on more than just a flashy narrative. Total billings are accelerating and the company continues to land big-ticket deals with a current lineup of 18 different customers with $ 100 million commitments. It’s also noteworthy that it launched twice as many product offerings in fiscal 2021 as it did just two years ago, building a pipeline for continued success well into the future.

Palo Alto certainly isn’t the only stock out there in the space that’s attractive. Another name worth researching is Fortinet FTNT, -0.80%, a $ 55 billion leader that is also comfortably profitable and has seen shares rise about 90% in the last year—and it “only” has a forward price-to-earnings ratio of about 65.

But as cyber risks are sure to linger, it’s worth asking which companies are actually putting up material profits and which ones are just riding the narrative. Personally, I like Palo Alto because it was putting up strong numbers well before the conflict in Ukraine caused heightened cyber concerns, and it seems to have the right product mix and growth plans to deliver right now.

Jeff Reeves is a MarketWatch columnist. He doesn’t own any of the funds or stocks mentioned in this article.

Now read: Why the main semiconductor stock index is a better bet than the S&P 500 right now