Stock Market Today:

The Indian stock market was trading deep in the red on February 7 on weak global cues amid growing concerns about economic growth but the banking index bucked the trend, powered by heavyweight State Bank of India.

At 11.58 am, the Sensex was down 670.65 points, or 1.14 percent, at 57,974.17, and the Nifty shed 199.80 points, or 1.14 percent, at 17,316.50.

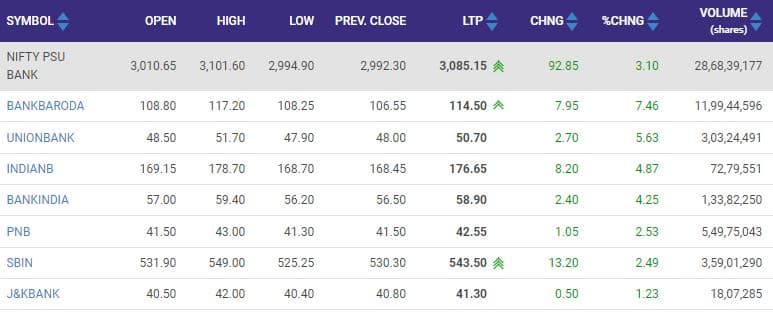

The Nifty PSU bank index, however, was up more than 3 percent led by gains in State Bank of India (SBI) that rose over 3 percent, hitting a new high after the lender declared its third-quarter earnings.

On February 5, SBI reported a 62 percent year-on-year (YoY) rise in net profit to Rs 8,431.9 crore for the quarter ended December, which was above analysts’ expectations of Rs 7,957.4 crore.

The sharp rise in the bottom-line was down to a 32.6 percent on-year decline in provisions to Rs 6,974 crore. Asset quality continued to improve as the gross non-performing assets (NPA) ratio came in at 4.5 percent for the quarter against 4.9 percent in the previous three-month period.

Also read: Nifty turns negative for 2022; here’s what is ailing sentiment on D-Street

Credit Suisse has maintained an “overweight” call on the stock and raised the target price to Rs 640. The growth pick-up would aid steady re-rating. CET1, including nine-month profit will be at 10.32 percent. It raised FY22/23/24 EPS by 2/3/3 percent, respectively.

JP Morgan has also kept an “overweight” rating with the target at Rs 650. Activity normalisation would likely see limited additional stress development and credit costs to remain contained.

The growth has picked up, while capital and liquidity both remain strong, it said, adding it expected the bank to return to normalised RoE of 15 percent in FY23. The valuations are attractive at current levels, JPMorgan said.

The stock was trading at Rs 544.25, up Rs 14.05, or 2.65 percent. It touched a 52-week high of Rs 549.05. It has touched an intraday high of Rs 549.05 and an intraday low of Rs 525.65.

Catch all the market action on our live blog

The share price of Union Bank of India, which would report its December quarter earnings later in the day, added 3 and Bank of India 6 percent.

The other gainers included Bank of Baroda, Indian Bank, Punjab National Bank and J&K Bank.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.