When Jason Gutierrez kept refreshing GameStop’s performance between work tasks during the wild, early days of 2021, he admits future tax obligations weren’t his No. 1 priority.

“It was in the back of my mind. If I come out huge, I have to pay it,” said the 32-year-old Greenville, S.C. mechanical engineer.

Gutierrez’s approximate $ 3,500 to $ 4,000 wager on GameStop was his first attempt at stock picking after he contributed to his 401(k)’s target date fund, and took advantage of the company match.

At one point, he was up by $ 4,500 to $ 5,000, but Gutierrez ended up selling most of his GameStop shares in late February and early March, eking out a loss less than $ 1,000.

That’s pretty much a wash in his view. In the following months, Gutierrez tucked up to $ 1,000 in a savings account just in case he had to cover any additional taxes.

He still holds a small amount of GameStop, just for the good memories of a “whirlwind” time.

Gutierrez was almost one of the lucky ones. A year ago, the short squeeze on stocks like GameStop and AMC became a social-media phenomenon and Wall Street morality play wrapped into one pandemic-era event.

Now, the early 2021 trading frenzy could represent something else: a lesson for new retail investors on the perils of bad tax planning.

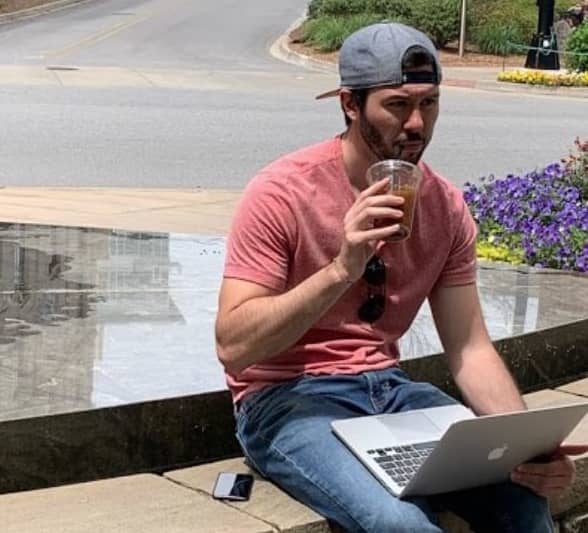

Future taxes weren’t exactly what Jason Gutierrez was thinking about in the heights of the early 2021 GameStop saga.

Photo c/o Jason Gutierrez

If someone bought and sold last year, but plowed all their profits from meme stocks and cryptocurrency back into the market — without putting aside cash for taxes on the capital gains — they may have a smaller 2022 portfolio to pay for a 2021 tax bill.

After hitting a share price high of $ 324 in late January, GameStop GME, +3.13% stock closed Wednesday at $ 100.11. In several price spikes last year, AMC AMC, +3.23% jumped from $ 3.51 to $ 13.26 in January, soaring to $ 59.26 in mid-June; the stock closed Wednesday at $ 15.40.

Meanwhile, the value of bitcoin BTCUSD, -0.55% plummeted from nearly $ 64,000 in early November and now hovers below $ 40,000. In that same span, ethereum ETHUSD, -0.73% dropped from close to $ 5,000 to less than $ 3,000.

This is coinciding with the income-tax season. The IRS wants taxpayers to pay tax liabilities by April 18.

The concern, some financial experts say, is there may be too many others who didn’t have the same foresight, causing their good memories to turn bad.

“We’re worried that some of these newer individual investors might be receiving a tax bill that they aren’t prepared for,” said Lindsey Bell, chief markets and money strategist at Ally ALLY, +0.50%, a financial-services company with banking, lending and broker offerings.

“‘We’re worried that some of these newer individual investors might be receiving a tax bill that they aren’t prepared for.’”

Here’s one sign of the times: A 60% year-over-year increase in the size of the estimated tax payments that Ally bank customers sent to the IRS for the fourth quarter.

“The largest component of that, based on our own analysis, is likely the payments related to stock gains,” Bell said.

“I think the meme stockers don’t actually know about their problem yet,” said Matt Metras, an enrolled agent with MDM Financial Services, a Rochester, N.Y.-based tax preparation and bookkeeping firm with a specialty in cryptocurrency.

That will happen once their brokerage platforms send along tax forms recording the person’s stock-market proceeds and losses, he noted. “That’s when I think they are going to be in for a surprise.”

These forms are on the way. Robinhood HOOD, +7.28% users can access their 1099s in mid-February, a spokesman said. TD Ameritrade has been sending its 1099s since mid-January and will wrap the process in the coming weeks, a spokeswoman said. Charles Schwab Corp. SCHW, +3.39%, where Gutierrez traded, will make the forms available online by the end of the first week in February.

Some but not all cryptocurrency exchanges send tax forms to users, Metras noted. The recently passed infrastructure bill requires people and entities who regularly carry out digital-asset transfers to report those transactions to the IRS. The hotly disputed reporting requirements are scheduled to take effect in 2024.

IRS rules on selling stocks

It’s tough to say how many people will find themselves in a jam. On one hand, with the pandemic giving rise to the “retail bro,” 10 million new brokerage accounts were opened in 2020, according to J.D. Power, a consumer analytics firm.

On the other hand, as companies like GameStop and AMC briefly reached the stratosphere, it was in no small part thanks to the buy-and-hold strategy from people on Reddit’s WallStreetBets. That “diamond hands” approach could be a saving grace, come tax time.

The tax on capital gains can be as much as 20% when the sale or “realization” happens at least one year after the purchase. (The tax is 0% for people making up to $ 40,4000 and 15% for individuals making between $ 40,400 and $ 445,850, the IRS says.)

If the purchase and sale happens within a year, however, that’s a short-term capital gain and the proceeds count as ordinary income. That’s subject to income tax brackets which can run up to 37%.

The IRS “wash sale rule” essentially blocks investors from taking a capital loss (which reduces their tax exposure) if they buy the same or substantially same securities in the 30 days before the loss or the 30 days after.

Metras said this rule increases tax bills every year — and he’s expecting the same this year. Many clients playing the market “don’t realize that they can’t deduct those loses and they have a ton of gains on paper. I see that every year, especially with platforms that make it super easy to trade a lot like Robinhood,” he said.

Robinhood does notify users about the wash sale rule in its help center, a spokesman noted.

Crypto concerns ‘People are going to be left holding a bag and owing taxes’

There are parallels between 2021 and the recent past, said Jordan Bass, a CPA at his Los Angeles-based accounting firm, Taxing Cryptocurrency, and a tax attorney specializing in digital assets.

Bitcoin experienced a significant drop in early 2018, Bass said. “The cascading effect of prices depreciating and people selling and panic selling is still there and people are going to be left holding a bag and owing taxes. It’s a similar concept with equities.”

“‘The cascading effect of prices depreciating and people selling and panic selling is still there and people are going to be left holding a bag and owing taxes.’”

Like stocks, capital gains taxation apply to crypto — and the IRS is keen on making sure anyone using cryptocurrency is paying their full tab.

People who have tax bills they can’t pay have several options. They can arrange installment agreements or they can try to arrange an “offer in compromise” with the IRS. For these offers, the tax collector will accept less than the full liability, but there are a string of caveats. (Read more about those rules here.)

When some crypto investors get in a tax bind, Bass said it’s not that they can’t afford to settle their tab if they started to liquidate. It’s that they’re not willing, because they think the market that went down will come back up again — and soon.

“If they bet correctly and the market does come back, yes, that’s brilliant. But if they bet incorrectly, it’s not. The reason why I say the word ‘bet’ is because it’s almost like a gamble,” Bass said.

Bitcoin owners are hoping for a jump back to over $ 55,000 in six months, according to a Morning Consult poll on Tuesday.

GameStop, meanwhile, was a turning point for Gutierrez. He still contributes to his 401(k), but he’s built up his cryptocurrency holdings, including in DeFi. He mostly buys and holds, as an investment strategy and a tax consideration to avoid higher taxes from short-term capital gains.

Looking back, the GameStop run up “was definitely the perfect gateway drug into the rest of this,” Gutierrez said, adding, “I’m in it for the long run.”