After rallying for two consecutive sessions, giving a thumbs up to Union Budget 2022, Indian equities witnessed profit booking on February 3. However, despite the weakness in domestic market, healthy buying was witnessed across the auto stocks.

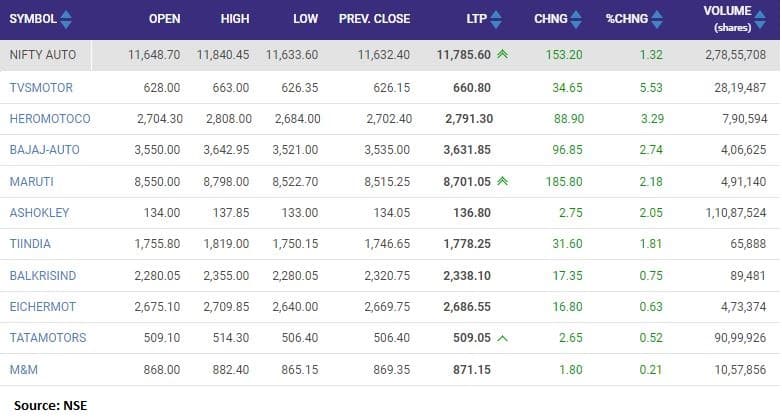

At 12:51 pm, Nifty Auto index was up 163.30 points or 1.40 percent, while the benchmark Nifty 50 index was down 96.70 points or 0.54 percent at 17,683.30. TVS Motors which jumped over 5 percent followed by Hero MotoCorp, Bajaj Auto, Maruti Suzuki and Ashok Leyland which added 2-3 percent each, were among the top gainers.

The auto sector reported mixed set of sales numbers for the month of January. Tata Motors reported 27 percent year-on-year (YoY) growth in total vehicle sales, including in the international markets, at 76,210 units in January 2022 while Mahindra & Mahindra (M&M) said its total sales increased by 19.55 percent to 46,804 units in January 2022. The company’s total sales stood at 39,149 units in January 2021.

On the other hand, the country’s largest carmaker Maruti Suzuki India reported a 3.96 percent fall in total wholesales at 1,54,379 units in January. The company had sold 1,60,752 units in January 2021, MSI said in a statement.

Bajaj Auto reported a 15 percent decline in total sales to 3,63,443 units in January 2022. The company had sold 4,25,199 units in the same month last year while TVS Motor Company reported a 13.14 percent decline in total sales to 2,66,788 units in January. The Chennai-based company had sold 3,07,149 units in the same month last year.

According to a report by Kotak Securities, auto sales continued to remain under pressure in January 2022. Wholesale volumes for passenger vehicle, 2-wheeler and tractor segments declined on a YoY basis, while CV segment continued its gradual recovery during the month. Consumer sentiment in the domestic PV segment remained strong and we expect a swift recovery once the chip shortage situation gets resolved.

Domestic 2W and tractor segments demand continued to remain under pressure. M&HCV segment volume recovery was led by pick-up in economic activity and improving fleet operator profitability, it said.

Domestic research and broking firm Motilal Oswal in its research report expects auto major Maruti Suzuki to return up to 21 percent and has set a target of Rs 10,300 per share. “Strong demand, softening commodity inflation, and the improving chip shortage situation would support margin recovery. We expect recovery in 2HCY22 in both market share and margins, led by improvement in supplies, a favorable product lifecycle, the mix, price action/cost-cutting, and operating leverage.

“The stock trades at 34.3x/22.3x FY23E/FY24E consolidated EPS. We maintain a buy rating, with target of Rs 10,300 per share (27x Mar’24E consolidated EPS),” it added.

Disclaimer: The views and investment tips expressed by experts on moneycontrol.com are their own, and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.?