Representative Image (Shutterstock)

The mega initial public offering from Life Insurance Corporation of India (LIC) is expected to be just around the corner. In what may be a unique aspect of the IPO, LIC is likely to reserve a portion of the shares for its over 250 million policyholders and may also offer them a discount. LIC has been putting out advertisements explaining how policyholders should open Demat accounts needed to trade in shares.

While policyholders may be aware of LIC’s products, as potential investors, it would be worthwhile for them to understand certain terms and the jargon associated with life insurance companies and their valuations.

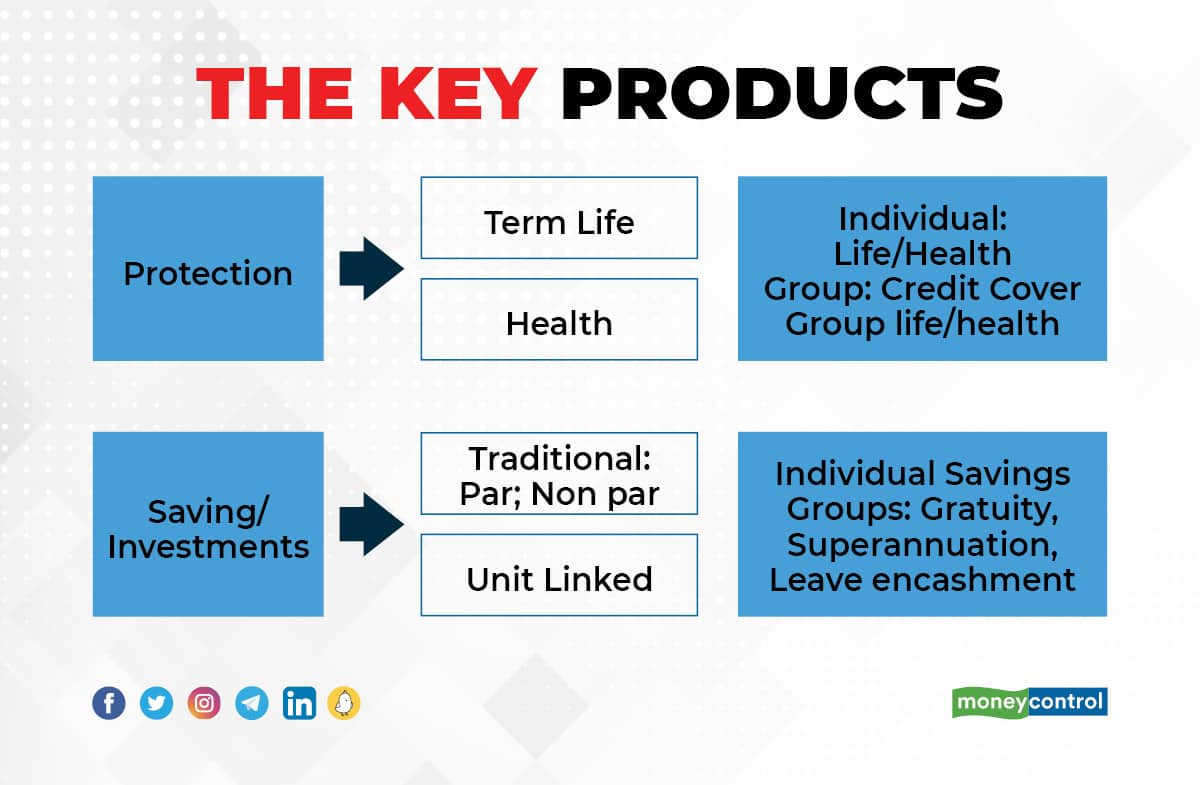

Key Products

Life insurers provide cover against mortality (death) and morbidity risks (illness), apart from savings products. The range of products includes term assurance, annuities, endowments, pension plans and unit-linked saving plans (ULIPs) to suit varying needs.

Protection business

Individual term life products cover mortality and pay only in the event of death. Typically, nothing is paid out if an insured individual survives the policy term in the case of term insurance. Group products are business-to-business dealings and include group credit-life, group-life and group health.

Savings business

In savings plans, the primary objective is long-term savings with returns on investment – there is a maturity amount along with life cover, which is relatively lower than in term insurance plans.

Savings products can be further sub-divided into traditional products – participating (par) and non-participating (non-par) – and unit-linked products.

Par products – A minimal return is guaranteed and policyholders participate in the profit of the policy. Also called with-profit policies. In India, the surplus is shared in a 90:10 ratio with 90 percent going to policyholders and 10 percent to shareholders.

Non-par products – The pay-outs are fully guaranteed at the start of the policy. Policyholders do not participate in the profit of the policy.

Unit-linked policies (ULIP) – These offer market-linked returns, where the amount accruing to policyholders depends on the fund’s performance.

Group savings products – These are fund management products where insurance companies manage funds for large business groups. Examples: gratuity, superannuation and leave encashment.

Product Mix

Product mix is an important factor to consider as it drives the margins and profitability of the insurer. Many private life insurers want to increase the share of the protection business (pure term insurance) in their product mix because it offers a relatively higher margin than ULIPs.

Product mix in life insurance sector

Chart shows product mix of all players – LIC and private companies. Private players have been active selling savings-linked insurance products that provide investment returns linked to an underlying fund like ULIP. In the past few years, private players have focused more on pure protection products (term assurance) and the annuity segment. LIC, on the other hand, is focused on traditional, non-linked products. (Chart Credit: Moneycontrol)

Chart shows product mix of all players – LIC and private companies. Private players have been active selling savings-linked insurance products that provide investment returns linked to an underlying fund like ULIP. In the past few years, private players have focused more on pure protection products (term assurance) and the annuity segment. LIC, on the other hand, is focused on traditional, non-linked products. (Chart Credit: Moneycontrol)

Channel Mix

Insurance needs strong marketing and sales teams to succeed, implying significant distribution costs in the form of commissions. Therefore, the distribution mix, or the channels for selling insurance products, is equally important and plays a decisive role in growth. Private companies typically use bancassurance – banks acting as corporate agents to sell insurance products to their customers – as their primary distributors. LIC, on the other hand, depends on an army of individual agents spread across the country to sell its policies.

Channels in life insurance industry

Chart depicts growing clout of bancassurance among private players. For the industry as a whole, agency is still the largest distributor because of LIC’s size. (Chart Credit: Moneycontrol)

Chart depicts growing clout of bancassurance among private players. For the industry as a whole, agency is still the largest distributor because of LIC’s size. (Chart Credit: Moneycontrol)

Key Ratios for Life Insurers

Annualised premium equivalent: It is the sum of the annualised first-year premiums on regular premium policies and 10 percent of single premiums from both individual and group customers.

Persistency ratio: Persistency is a measure of the policies remaining in force (not lapsed) as a proportion of policies issued in a particular period. The proportion of policies in force after the end of the first policy year is known as the 13th month persistency, while the share of those remaining in force after the second policy year is known as the 25th month persistency and so on.

High persistency means a bigger book of business and higher recurring profit from both management fees and investment income.

Solvency ratio: It is the capital required by an insurance company to run its business, taking into account the portfolio of its policies. Current regulations demand a minimum solvency ratio of 150 per cent at all times.

Embedded value: Embedded value is the present value of all future profits from existing business plus net worth. Once the embedded value is known, it is assigned a multiple to arrive at a valuation. This is the most important concept because life insurers are valued on basis of embedded value.