What started out as a lump of coal turned into a gift for bullish investors: a record for the S&P 500 index to end the week before the Christmas holiday.

But if you’ve got this market figured out, you’re among the few.

On Monday, the scene on Wall Street may have felt to many investors like how former UFC Champion Tyron Woodley’s week ended last Saturday in his contest against YouTube star-turned-prizefighter Jake Paul:

In Wall Street’s case, the omicron variant of the coronavirus, and a host of other worries, including looming monetary-policy tightening by the Federal Reserve, subbed in for Paul’s devastating sixth-round overhand blow, leveling the Dow Jones Industrial Average DJIA, +0.55%, the Nasdaq Composite Index COMP, +0.85% and the S&P 500 SPX, +0.62% in a bruising session last Monday to start the holiday-abbreviated week. U.S. markets were closed on Friday in observance of Christmas.

Read: Dow plunges and Nasdaq nears correction because stock-market investors don’t see a Christmas cavalry coming to the rescue

However, this is how some investors may feel the week ended, with spectacular aplomb from a stock market that seemed destined to get chopped down to size in the final few weeks of 2021.

On Thursday, the S&P 500 index booked its 68th record close of 2021, finishing the week up 3.6%, while the Dow Jones Industrial Average booked a 4.4% gain and the Nasdaq Composite registered a more quotidian 0.7% gain after sinking more than half way toward a correction at its lowest point during the volatile trading stretch.

Data analysts at Dow Jones said last Monday’s fall which was capped by an end of the week record for S&P 500 also happened on July 19 when the index fell 1.9% only to end the week at a record high.

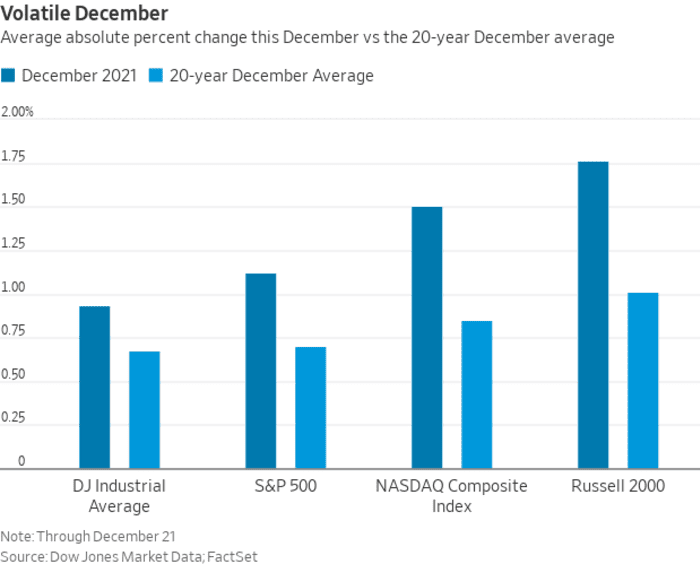

More broadly, the volatility this December so far has been stomach-churning and was the most the most choppy since 2018, the last time interest rate increases were discussed by the Federal Reserve.

Dow Jones Market Data

And the so-called Santa Claus rally, a seasonally bullish period in the last five trading sessions in a year and first two in the next year, has yet to commence. That’s if Santa deigns to dole out any additional gifts at all after the scintillation of the past three sessions.

The analysts at Leuthold Group write that since 1972, the Santa Claus rally has produced an S&P 500 average gain of 1.26%, or “60 basis points below the average for Santa Claus rallies from 1928 to 1972.”

Ryan Detrick, chief market strategist for LPL Financial, noted that the there is an overwhelming tendency for the market to rally during that period and it isn’t clear what to attribute the bullish uptrend to beyond, a gift from Old St. Nick.

But we didn’t come here to marvel at the Santa Claus rally but the indefatigability of this market.

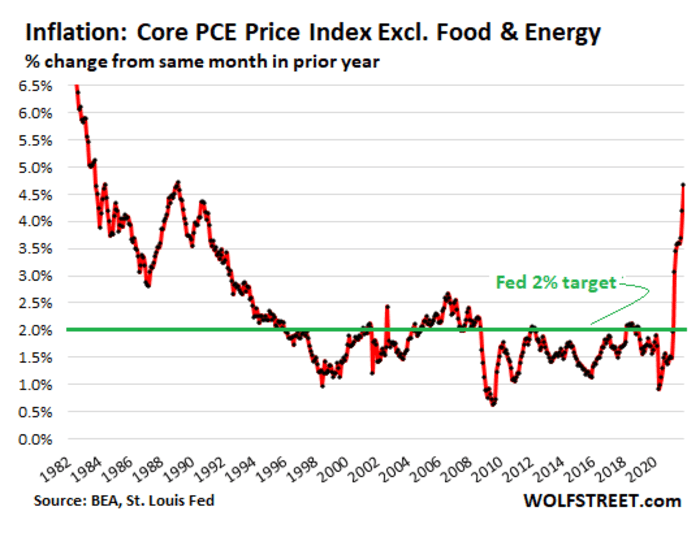

Nothing has changed about the market dynamic besides investors’ ability to fade negative headlines, including those centered on omicron and the outlook for inflation in years to come. On Thursday, data showed that the 12-month increase in the U.S. PCE index, the Federal Reserve’s preferred inflation gauge, jumped to 5.7% in November from 5% in the prior month. That’s the highest rate since 1982.

Wolf Richter of the popular Wolf Street financial blog sounded as befuddled as many have been about policy from the Federal Reserve in a recent column.

Inflation is shooting higher even as this Fed is still repressing short-term interest rates to near 0% and is still printing money hand over fist, though less than it did two months ago. And the Fed has finally backed off its ridiculous claims that this inflation, caused by enormous historic amounts of money printing and interest rate repression, is just temporary and due to bottlenecks and supply chains.

via WolfStreet.com

The Fed announced in mid December that it is cutting back on its bond buying at a faster clip, and projections from members of the central bank point to three interest-rate increases in 2022. That move was meant to deflate some of the market’s bullishness but investors continue to read the Fed’s hawkish policy pivot as dovish.

Are fears about the spread of omicron variant unwarranted because vaccines and remedies can handle it? Are people just too fatigued to consider the impact of lockdowns and mobility restrictions? Has inflation peaked or is it already priced into stocks and bonds? Who knows?

Jeremy Siegel, professor of finance at the University of Pennsylvania’s Wharton School of Business, told CNBC on Thursday that he envisioned the Fed raising rates around eight times from its current range for benchmark rates of between 0% and 0.25%.

“Believe it or not, we have to get to 2% on fed funds,” rates, Siegel speculated in conversation with the business network. The professor still saw the possibility of stocks booking low, double-digit gains, even if the Fed needs to be more aggressive.

“Stocks are still the place to be,” Siegel told the business network. The pundit said that a rotation in value is what he’s betting will play out in 2022 as investors position for higher borrowing costs against a backdrop of richly priced large-cap and growth oriented investments.

Sign up for our Market Watch Newsletters here.

What’s ahead for New Year’s week?

Monday

No U.S. economic data expected.

Tuesday

- S&P Case-Shiller U.S. home price index for October at 9 a.m. ET

Wednesday

- International trade in goods, advance report for November at 8:30 a.m. ET

- Pending home sales index for November at 10 a.m.

Thursday

- Initial jobless benefit claims for the week ended Dec. 25 at 8:30 a.m.

- Chicago PMI for December 9:45 a.m.

Friday

- No government data scheduled for New Year’s Day observed

- U.S. stock markets operate under regular hours

- U.S. bond market closes early at 2 p.m. ET

Read:Is the stock market open on Christmas Eve? New Year’s Eve? Here are the coming holiday trading hours.